Gold Moves Slightly Bearish Expecting The US Data Employment

The futures of Gold move slightly bearish this Friday waiting for the employment data of the United States.

Gold drops 75 cents or 0.05% on Friday session, easing to $1,474.13 per ounce, while Silver stumbles 2.5 cents or 0.15%, dropping to $16.97 per ounce.

This Friday, the Bureau of Labor Statistics will release United States Non-Farm Payrolls and employment data corresponding to November.

Analysts surveyed expect the creation of 186K new jobs, representing a breakthrough on the 128K jobs created in October reported by the Bureau in early November.

Likewise, the analysts' consensus expects that the unemployment rate will remain unchanged from October at 3.6%. It should be noted that despite being 0.1% more than the yearly low that reached 3.5% in September, the unemployment rate remains at historic low levels.

In another area, this week, the yellow metal has been driven mainly by the ups and downs of trade negotiations between the United States and China.

Investors continue to watch closely the progress of the negotiations and the deadline of 15 December, when the US government plans to impose new tariffs on China.

Technical Overview

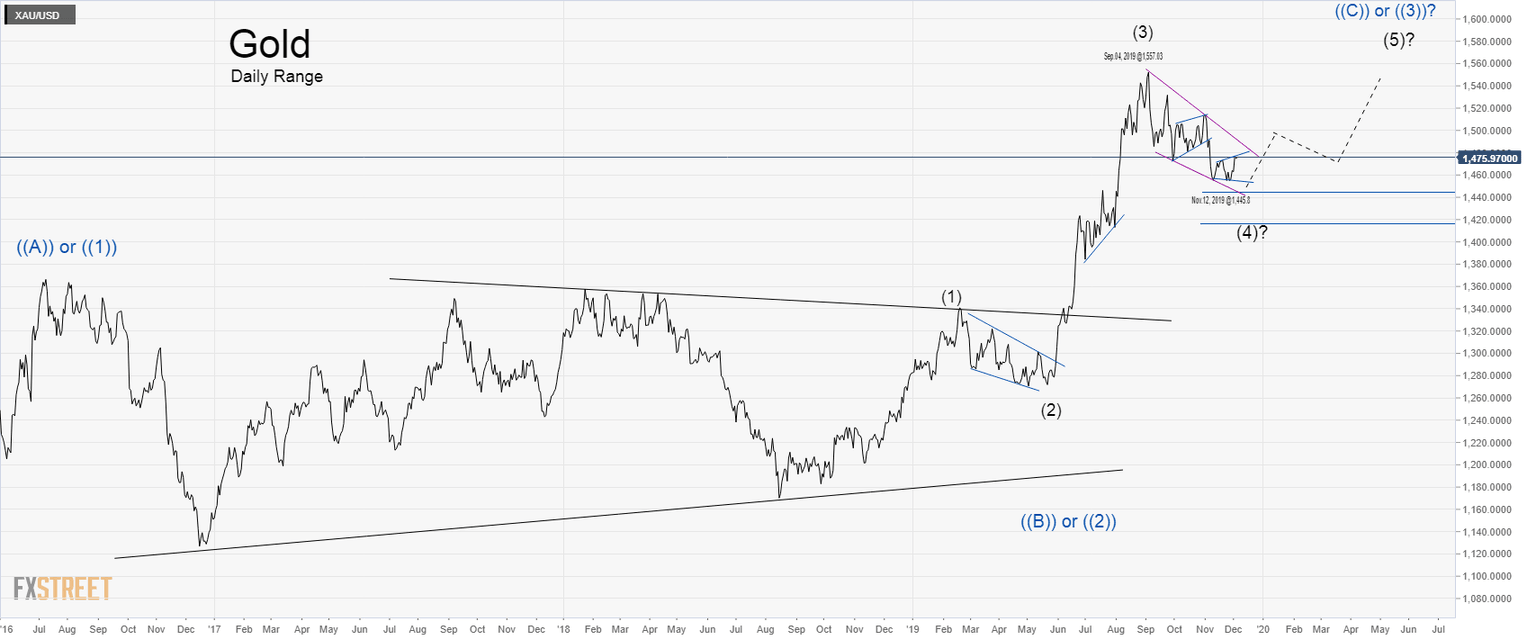

Gold, in its daily chart, shows a downward consolidation formation in progress. In the short term, the price action is developing a corrective pattern in the appearance of an expansive triangle.

At the same time, the yellow metal is moving at the top of this expansive triangle, which could be indicative of further falls in the precious metal. On the other hand, the US dollar index is showing signs of upward reversal, which could support to drag the price of Gold to see new lows.

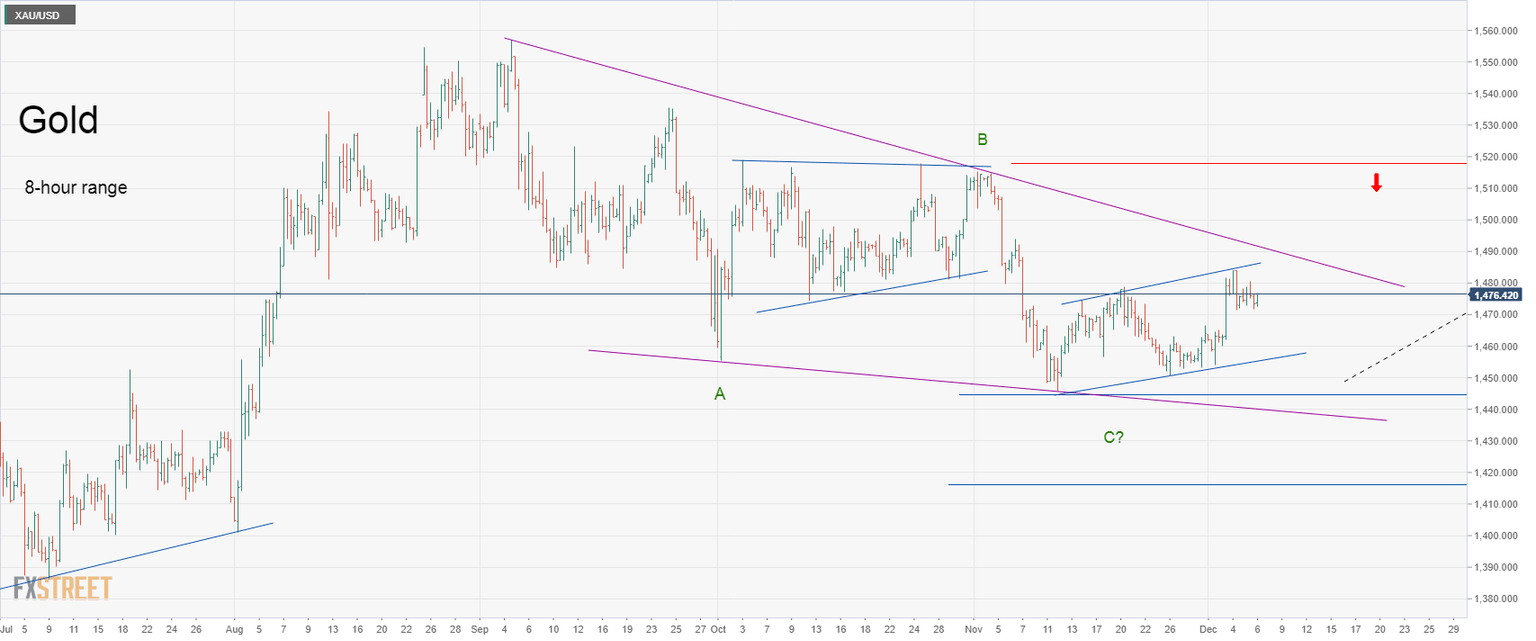

The 8-hour chart below shows the price action developing a consolidation sequence that Gold has been running after found support in the November's low at $1,445.8 per ounce.

In consequence, Gold could make a new descending movement, which at its time, should complete the corrective wave (4) labeled in black. The price of precious metal could visit and even pierce November's low. Once reached this area, Gold could find buyers looking to activate their pending long orders with the expectation of bringing the price to reach new highs.

Author

EagleFX Team

EagleFX

EagleFX Team is an international group of market analysts with skills in fundamental and technical analysis, applying several methods to assess the state and likelihood of price movements on Forex, Commodities, Indices, Metals and