Gold maintains upward bias despite hot inflation and firmer Dollar

Gold (XAUUSD) continues to show strength despite a recent pullback from record highs. Strong U.S. retail sales, firm inflation, and solid labor data have lifted the Dollar and pressured gold in the short term. However, the metal remains well supported above the $3,600 level. Its ability to stay elevated highlights ongoing macro uncertainty and steady bullish momentum. The broader technical structure also remains intact, pointing to further upside over the longer term.

Gold remains resilient despite strong Dollar and inflation surprise

Gold continues to hold firmly above the $3,600 level, showing steady bullish momentum despite stronger economic data and Dollar strength. Retail sales came in above expectations, lifting the Dollar and adding short-term pressure. Meanwhile, the Producer Price Index also exceeded forecasts, with both headline and core readings rising 3% year-over-year. The data points to firm consumer demand and persistent inflation, reducing the urgency for immediate Fed rate cuts. Yet gold’s ability to stay elevated reflects ongoing support from macro uncertainty and longer-term policy expectations.

In parallel, last week’s jobs report revealed a solid labor market. Although December’s Nonfarm Payrolls rose by just 50,000, the unemployment rate dropped to 4.4%, and wage growth accelerated to 3.8%. This combination indicates labor market strength, which may delay any aggressive policy shift by the central bank. Morgan Stanley has already pushed its rate cut forecast from Q1 to mid-year, adding to the cautious sentiment around gold.

Geopolitical tensions appear to have eased slightly, softening safe-haven demand for gold. President Trump stated that reports of executions in Iran were declining, though he did not rule out the possibility of military action. His additional warning of imposing 25% tariffs on countries engaging with Iran introduces another layer of uncertainty. However, the lack of immediate escalation has reduced urgency in the market, contributing to gold’s recent pullback.

Gold maintains bullish momentum within well-defined ascending channel

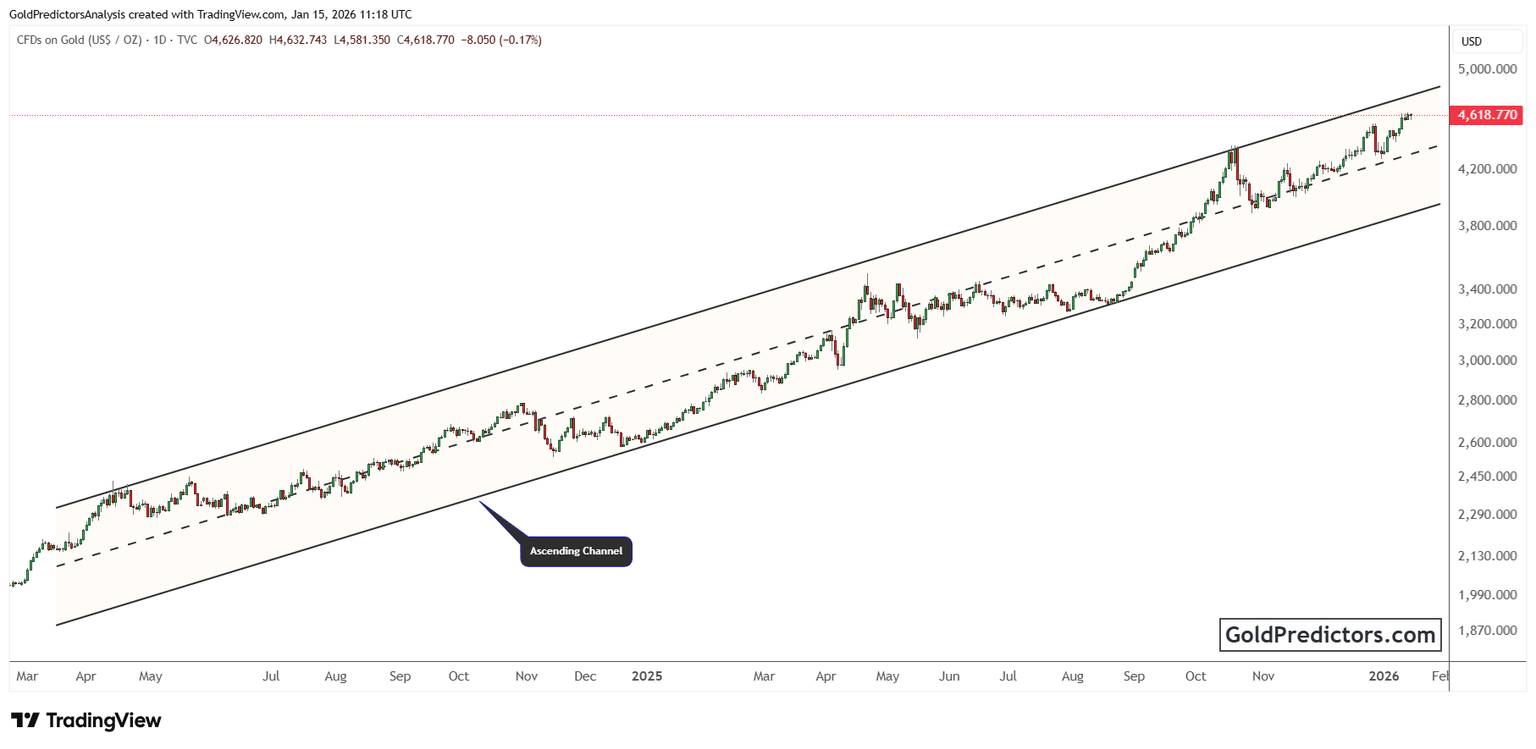

The gold chart below shows a well-defined ascending channel that has guided price action since early 2024. This structure reflects a strong and orderly uptrend, with price consistently respecting both upper resistance and lower support boundaries. The pattern signals sustained buying interest and steady accumulation, supporting the underlying bullish momentum.

After reaching a fresh record high, gold faced short-term selling pressure. Price has pulled back slightly but remains within the upper half of the channel. This suggests the trend is still strong, though short-term consolidation is likely. If gold continues to hold above mid-channel support near $4,400–$4,500, the broader bullish setup will stay intact.

Gold continues to hold within the upper half of its ascending channel, signaling strong bullish control. The upper boundary of the channel now sits just above the $4,700 mark, serving as the next key resistance. A decisive breakout above this level could trigger the next leg higher. Conversely, failure to hold the lower half of the channel may lead to a deeper pullback. Still, as long as the broader structure remains intact, any decline is likely to attract renewed buying interest.

Gold forecast: Uptrend intact despite near-term weakness

Gold remains in a healthy uptrend despite the recent pullback from record highs. Strong U.S. data and easing geopolitical tensions have reduced near-term safe-haven demand and delayed expectations for Fed rate cuts. However, the technical structure stays firmly bullish, with price action holding within the upper half of the ascending channel. As long as key support levels remain intact, the broader outlook continues to favor higher prices in the near term.

Unlock exclusive gold and silver trading signals and updates that most investors don’t see. Join our free newsletter now!

Author

Muhammad Umair, PhD

Gold Predictors

Muhammad Umair is a financial markets analyst and investor who focuses on the forex and precious metals markets.