Gold maintains strength on policy easing hopes and global risk factors

Gold is holding firm as markets brace for the Federal Reserve’s policy decision. A 25 basis point rate cut is widely expected. Attention now turns to Powell’s remarks and the Fed’s updated projections, which could shape expectations for further easing in 2026. Meanwhile, the US Dollar remains under pressure, while geopolitical tensions and mixed economic data continue to support safe-haven demand. This backdrop has kept gold supported, with tight price action reflecting broader caution ahead of fresh policy guidance.

Gold remains supported by Fed easing bets, Dollar weakness, and global tensions

Gold is holding steady just below the $4,200 level as markets await new signals from the Federal Reserve. Price action remains tight, reflecting broader caution ahead of the central bank's key policy decision. The Fed is widely expected to cut interest rates by 25 basis points. However, the updated projections and Powell’s remarks will carry more weight than the rate cut itself. Market participants are looking for concrete signals about the timing and scale of further rate cuts in 2026. This guidance could significantly impact both the US Dollar and gold’s short-term path.

Meanwhile, recent data reveals both strength and weakness, complicating the central bank’s decisions. The PCE Price Index released last Friday showed persistent price pressures. Despite this, the Fed has pointed to signs of cooling in the broader economy. Slower job growth, weak wage gains, and modest GDP expansion have contributed to growing expectations for policy easing. These factors support the case for continued rate cuts into the new year.

Additionally, a steady labor market and ongoing global tensions are helping gold maintain support. Tuesday’s JOLTS report showed job openings holding above 7.6 million, reflecting ongoing demand for workers. While this highlights continued strength in hiring, market attention stays fixed on the Fed’s forward guidance. At the same time, geopolitical tensions persist, with Ukraine’s President Zelenskyy reaffirming that no land concessions will be made to Russia. This continues to support safe-haven demand for gold. With the US Dollar under pressure, gold continues to draw support from macro uncertainty and growing expectations of monetary easing.

Gold coils beneath resistance in ascending triangle formation

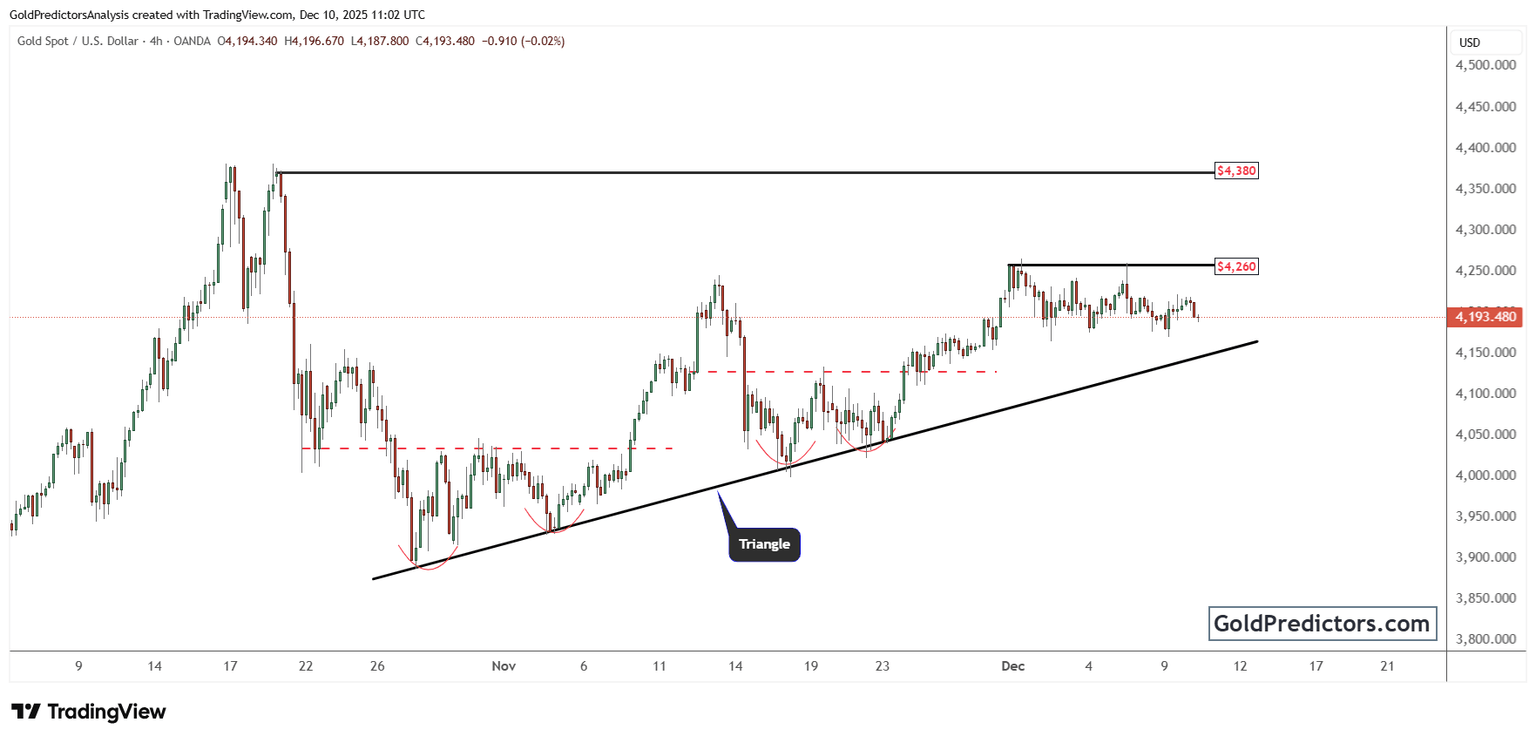

The gold chart below shows a well-formed ascending triangle pattern. A series of higher lows is building support near the $4,150–$4,160 range. Price action remains compressed between the rising trendline and horizontal resistance near $4,260. A breakout above this resistance would validate the pattern and point to a continuation of the uptrend.

Additionally, the chart shows rounded bottoms that established a firm foundation for the ongoing trend. These formations helped initiate the current upward move. Each breakout from prior consolidation zones resulted in a measured climb, highlighting the trend’s underlying strength. The current setup, positioned just below key resistance, closely resembles earlier patterns that preceded sharp bullish moves.

If gold clears the $4,260 barrier, the next upside target lies near $4,380. That level represents a previous high and would confirm continuation of the broader uptrend. On the downside, the ascending trendline must hold to maintain the bullish structure. A breakdown below this support would raise concerns about a potential shift in trend direction. For now, the chart favors a bullish outcome, especially if the Fed signals dovish intent.

Gold outlook: Bullish setup holds as Fed guidance takes center stage

Gold remains stable as markets await the Fed’s next move and broader macro clarity. Price continues to trade just below key resistance, supported by geopolitical risks, Dollar softness, and expectations of easing policy. The technical setup points to continued upside, with the ascending triangle pattern showing growing pressure toward a breakout. If the Fed delivers a dovish message, gold could break above $4,260 and extend its uptrend. Until then, the market stays range-bound, with short-term direction likely shaped by the Fed’s guidance and broader macro developments.

Unlock exclusive gold and silver trading signals and updates that most investors don’t see. Join our free newsletter now!

Author

Muhammad Umair, PhD

Gold Predictors

Muhammad Umair is a financial markets analyst and investor who focuses on the forex and precious metals markets.