Gold keeps defying gravity, is it time for a new record high?

-

Gold gains even as US dollar rallies.

-

Haven flows, inflation hedging and CB buying the main drivers.

-

Another record high may be a matter of time.

-

The outlook could change if markets start projecting rate hikes.

Gold does not surrender to strong Dollar

Gold has been one of those assets that has been trading in a unique manner recently, not following traditional correlations, and thereby making intermarket analysis difficult.

Yes, it tumbled following Trump’s election back in November, confirming its inverse correlation with the US dollar and Treasury yields, both of which rose as the election result raised concerns about a resurgence of inflation and hence a more cautious stance by the Fed on future rate cuts.

However, the metal’s last leg south was on December 18, when the Fed decided to upwardly revise its dot pot to signal that only two quarter-point reductions may be needed this year. From there onwards, gold enjoyed strong gains even as investors have been penciling in a rate path more hawkish than the Fed’s. Even after Trump’s new tariff threats to Canada, Mexico and China, the precious metal did not surrender to the dollar’s rebound and continued marching north.

Safe haven flows and inflation hedging

Perhaps the uncertainty surrounding Trump’s policies allowed more market participants to be attracted to the yellow metal for its safe haven attributes). A potentially aggressive tariff stance of the US against the rest of the world could severely impact the global economic outlook, and those kinds of concerns may have prompted some investors to hedge their risk exposure by buying more gold.

Gold is also considered an inflation hedge and fears that inflation could prove stickier than expected may have also increased demand, especially as the market is not penciling in any rate hikes for the foreseeable future and, this way, at the opportunity cost for holding the metal increases.

Central banks keep piling up reserves

Central banks around the globe have also been a quiet force behind the bullion’s uptrend. In November, global central banks collectively added 53 tons of gold to their reserves, with the National Bank of Poland emerging as the largest buyer and the People’s Bank of China resuming purchases after a six-month break.

The People’s Bank of China holds first place in terms of total reserves, as Chinese officials have decided to pile up massive volumes of gold in order to loosen their dependency on the US dollar in case tensions between the world’s two largest economies intensify. And following Trump’s election the probability of that happening seems high.

London lease rates spike

What’s more, there was a sudden spike in London lease rates last week to over 3.5%. Normally the return on a gold lease is close to zero. The last time lease rates rose 3.5% was back in 2002.

This may be another indication of investors’ unease about potential tariffs, and this time, specifically on the metal itself. The spike in London lease rates could mean that major dealers are in a frenetic rush to ship metal into the US before any tariffs are imposed, which is also a demand-positive variable.

It’s a one-way environment

But if the inverse correlation between gold and the dollar has broken down, what happens when the dollar is weakening instead of strengthening? In this case, the latest history has shown that the inverse correlation returns at some point and gold continues to trade north as the non-yielding metal becomes more attractive than assets expected to result in diminishing returns. In other words, regardless of whether the dollar goes up or down, gold is finding a way to drift higher, and it may be a matter of time before it climbs to fresh record highs.

For the metal to turn south and post a meaningful correction, Trump’s policies may need to raise fear that the potential resurgence of inflation could only be dealt with rate hikes by the Fed. Should investors start pricing in rate hikes, the opportunity cost for holding gold could increase and thus, its holders may prefer to flee to other higher-yielding assets.

Is a new all-time high a matter of time?

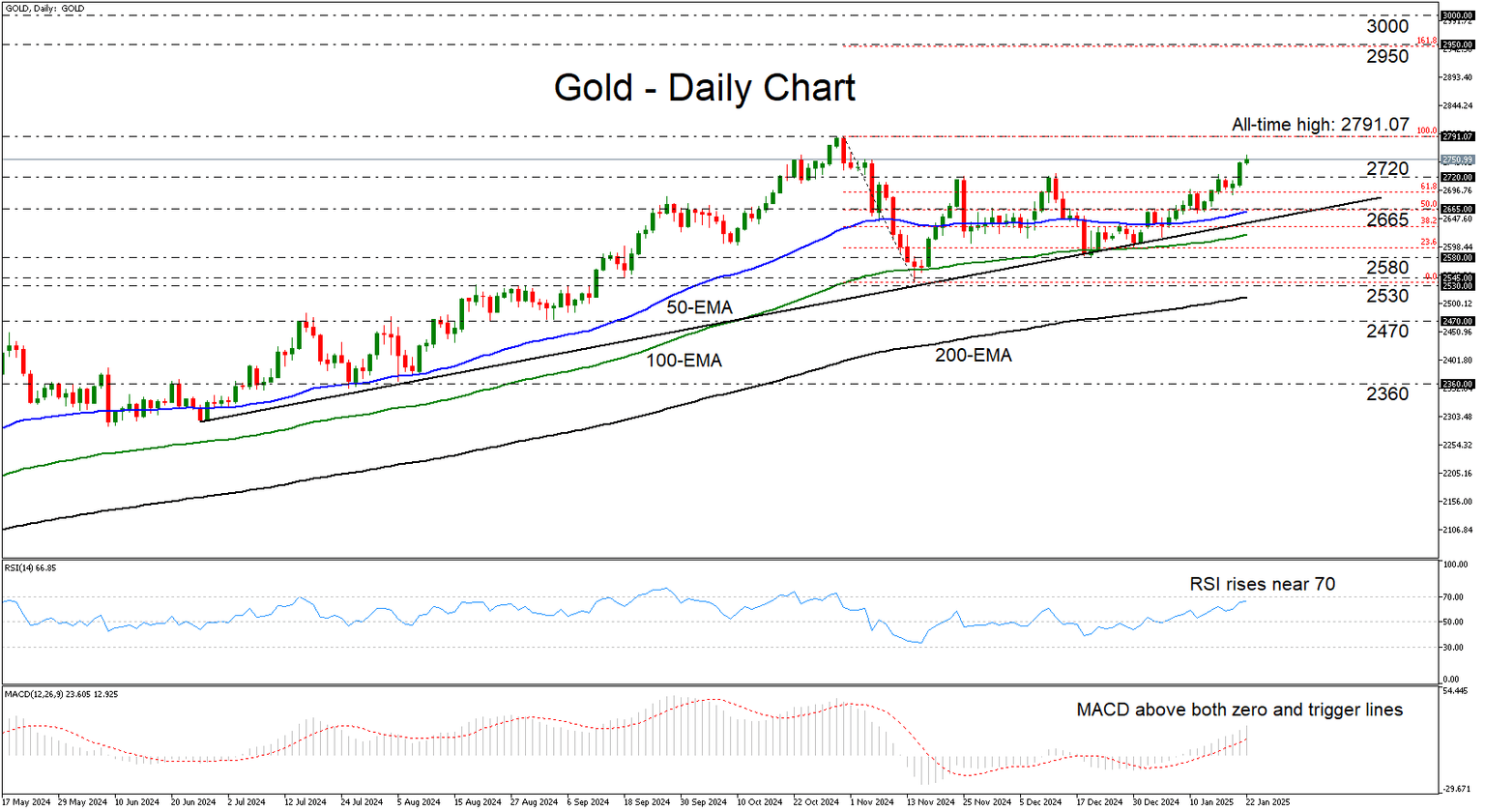

From a technical standpoint, gold emerged above the key resistance (now turned into support) zone of $2,720 and looks to be headed for a test of its all-time high of $2,791.07, hit on October 31. As long as the price continues to trade above the uptrend line drawn from the low of June 26, the outlook remains positive.

If the bulls are strong enough to reach and breach the record of $2,791.07, they may feel confident to continue marching north and perhaps aim for the 161.8% Fibonacci extension level of the October 31 – November 13 downleg. For the outlook to start darkening, a dip below the $2,580 zone may be needed, as such a move will not only solidify the break below the aforementioned uptrend line, but also a forthcoming lower low in the daily chart.

Author

Charalampos joined the XM Investment Research department in August 2022 as a senior investment analyst.