Gold is 0.5% lower today and it remains close to yesterday’s daily low

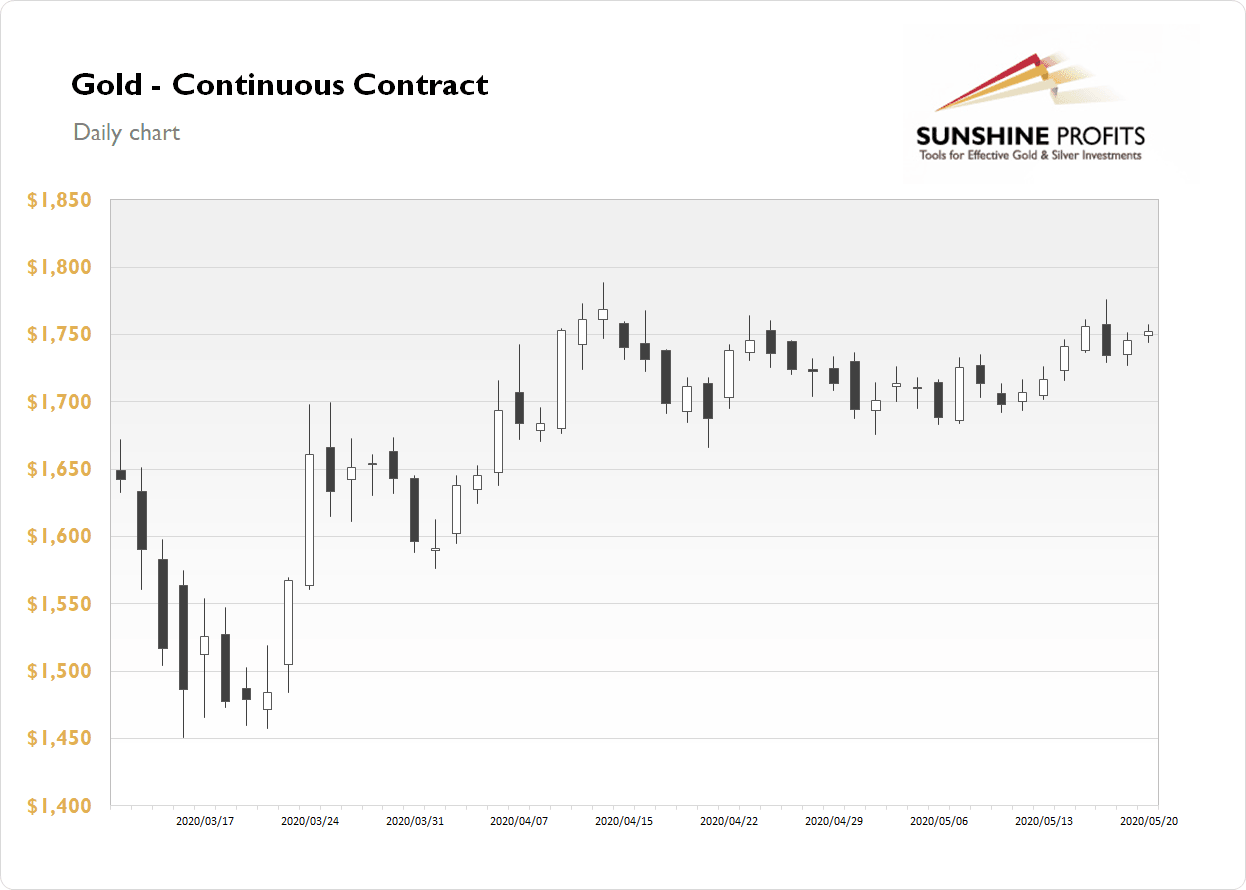

The gold futures contract gained 0.37% on Wednesday as it continued to fluctuate after reaching new monthly high of $1,775.80 on Monday. It has retraced almost all of its downward correction from April 14 high of $1,788.80. The market is extending over month-long consolidation, as we can see on the daily chart:

Gold is 0.5% lower today and it remains close to yesterday's daily low. What about the other precious metals?: Silver gained 0.73% on Wednesday and today it is 1.3% lower. Platinum gained 5.05% and today it is 1.8% lower. Palladium gained 4.08% and today it is declining by 1.86. So precious metals are trading within a short-term correction this morning.

Today's economic data releases have been as expected so far. The Philly Fed Manufacturing Index lost over 40 points and the Unemployment Claims came in at over 2.4 million. But the markets are used to bad economic numbers, as stocks are set to open relatively flat. We will also wait for the most important piece of economic data today, Flash Manufacturing and Services PMI's at 9:45 a.m. Then, the Fed Chair Powell will speak. Take a look at our Monday's Market News Report to find out about this week's economic data announements.

And here's Gold, Silver, and Mining Stocks economic news schedule for today:

-

8:30 a.m. U.S. - Philly Fed Manufacturing Index, Unemployment Claims

-

8:30 a.m. Canada - ADP Non-Farm Employment Change, NHPI m/m

-

9:45 a.m. U.S. - Flash Manufacturing PMI, Flash Services PMI

-

10:00 a.m. U.S. - CB Leading Index m/m, Existing Home Sales, FOMC Member Williams Speech

-

1:00 p.m. U.S. - FOMC Member Clarida Speech

-

2:30 p.m. U.S. - Fed Chair Powell Speech

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!

Author

Paul Rejczak

Sunshine Profits

Paul Rejczak is a stock market strategist who has been known for the quality of his technical and fundamental analysis since the late nineties.