Gold holding resistance at 1904/08

Gold – Silver

Gold Spot very much remains in a sideways trend & we are just drifting without any clear direction as we test resistance at 1904/08.

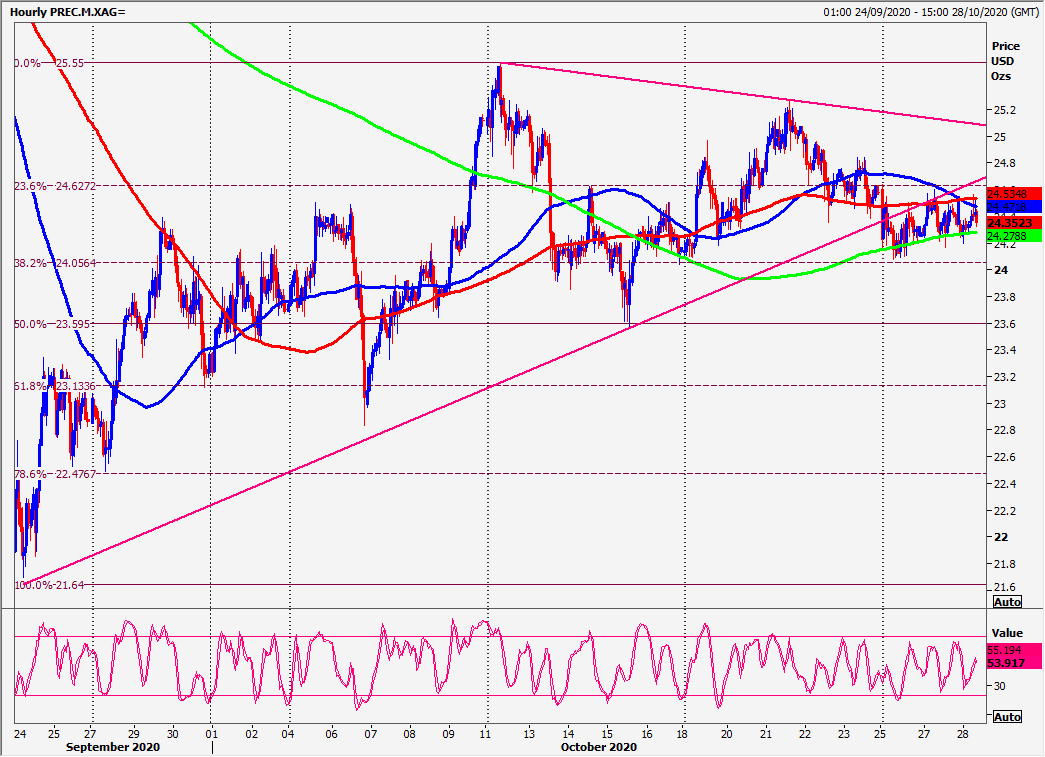

Silver Spot hits a selling opportunity at 2440/50 with stops above 2470.

Daily Analysis

Gold holding resistance at 1904/08 risks a slide to 1899 then 1896/95. Further losses target 1890 before support at the 100 day moving average at 1882/80.

First resistance at 1904/08 a break above 1912 initially targets 1917/18. Above 1920 allows a recovery to 1925 & strong resistance at 1930/32.

Silver holding strong resistance at 2440/50 initially targets 2420/10. A break lower targets 2405/00 then 2360/50. On further losses look for 2310/00.

Shorts at 2440/50 stop above 2470. A break higher is buy signal targeting 2510/20. A break above 2530 is another buy signal.

Chart

Author

Jason Sen

DayTradeIdeas.co.uk