Gold downside continuation pattern [Video]

![Gold downside continuation pattern [Video]](https://editorial.fxstreet.com/images/Markets/Commodities/Metals/Gold/hand-full-of-gold-nuggets-53773200_XtraLarge.jpg)

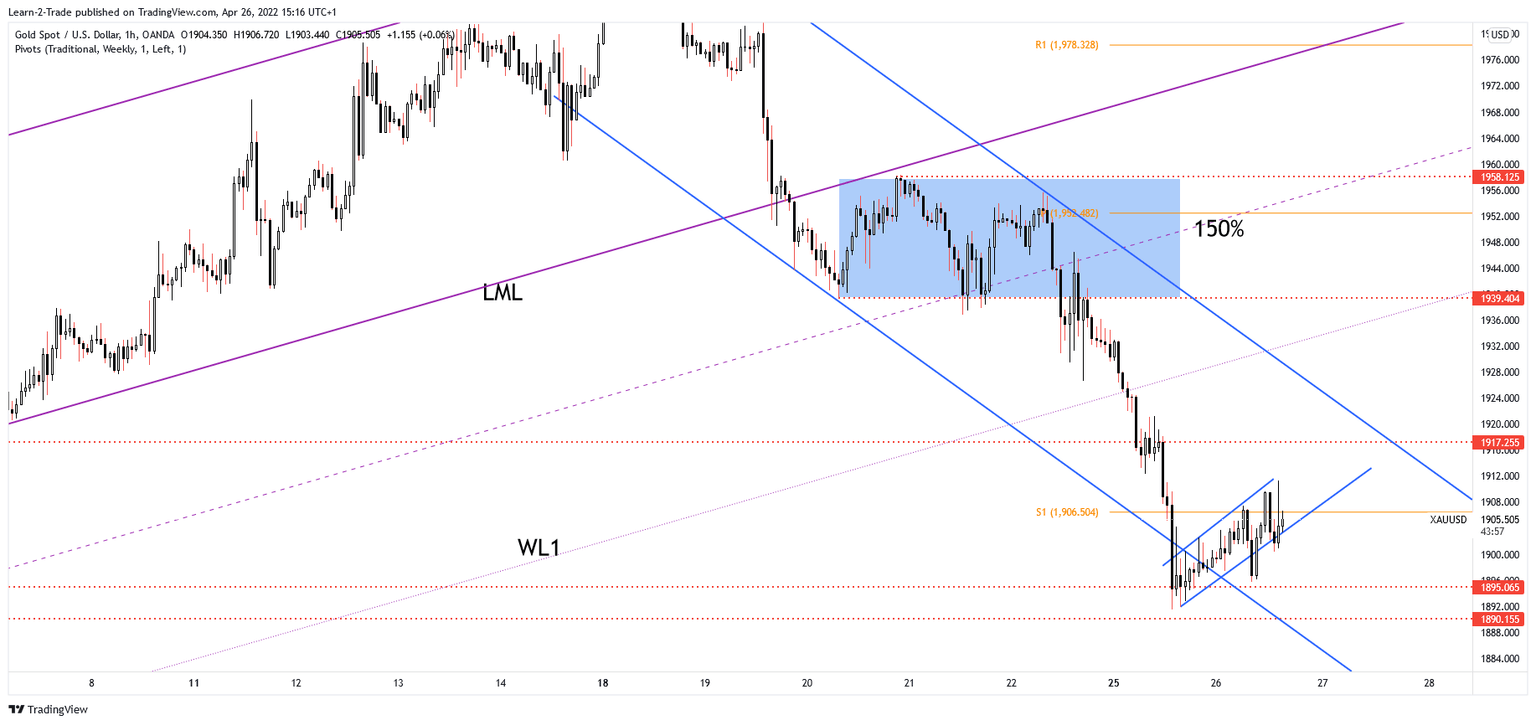

XAU/USD rebounded in the short term but the throwback could be only a temporary one. The price action developed an up channel that could represent a bearish pattern. It’s traded at 1,903.24 at the time of writing below 1,911.30 today’s high. Gold could drop deeper if the USD resumes its appreciation. Today, the US data came in mixed. CB Consumer Confidence came in at 107.3 points below 108.5 expected, Durable Goods Orders rose by 0.8% less compared to 1.0% estimates, while Core Durable Goods Orders reported a 1.1% growth exceeding the 0.5% forecasts.

Technically, the yellow metal rebounded after failing to stabilize below the down channel’s downside line and below 1,895 key support. It has developed an ascending channel but it has registered only false breakouts above the weekly S1 (1,906.50) signaling that the rebound ended and that the sellers could take the lead again. Staying below the S1 and making a valid breakdown below the minor uptrend line may signal potential drop at least towards 1,895.06 and 1,890.15 key levels.

Join Learn 2 Trade VIP Group now!

Join Learn 2 Trade VIP Group now!

Author

Olimpiu Tuns

Learn 2 Trade

Olimpiu is a seasoned Market Analyst / Trader with 11 years of experience in the financial markets having expertise in Forex, Commodities, Index, Cryptocurrencies, and Stocks.