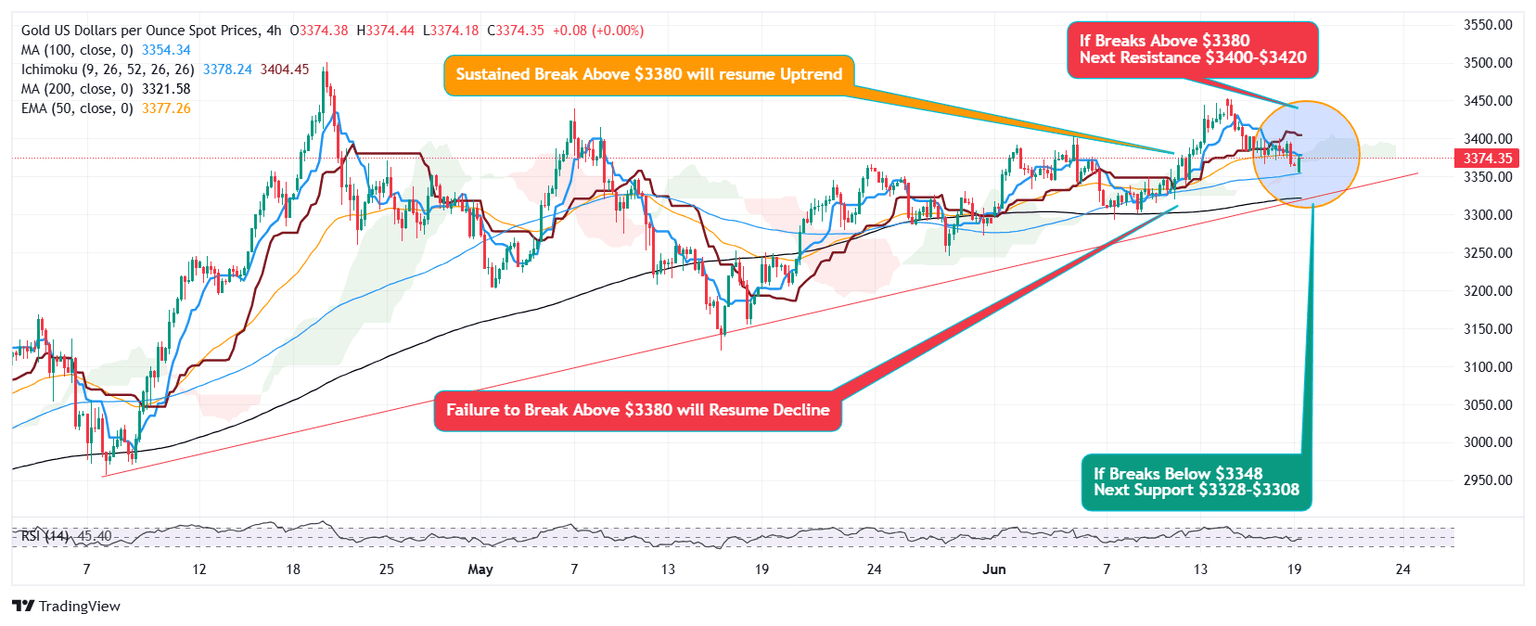

Gold down but not out yet – Bulls join in for $3,400-$3,450?

- Rejection from $3400 pushes Gold to $3348.

- Buyers resurface from the lows retest $3378.

- Next Target Eyed $3400-$3420-$3450.

- Break Below $3348 to Extend decline to $3328-$3308.

As safe haven money flow diverted to dollar rising to 99.15 Gold came under pressure caused by failure to reclaim successfully the psychological zone $3400 yesterday and prices dipped to $3347 where buyers resurfaces with a strong buying push taking the metal up for a rebound to immediate resistance $3378.

Bulls need to make a strong move breaking above this $3378 hurdle to advance further towards day high $3388 to ease the way to reclaim $3400 and extend the rally towards next leg $3420-$3450.

It is important to note that prevailing bullish momentum requires stability above $3347 failing which the metal may drop back to $3338-$3328-$3308.

Author

Sunil Kumar Dixit

SK Charting

Sunil Kumar Dixit is Chief Technical Strategist and founder of SK Charting, a research firm based in India. He tracks Precious Metals, Energy, Indices and Currency Pairs. He also participates as an expert panellist on Channel Television, Nigeria.