Gold daily news: XAU/USD at $1,700 again

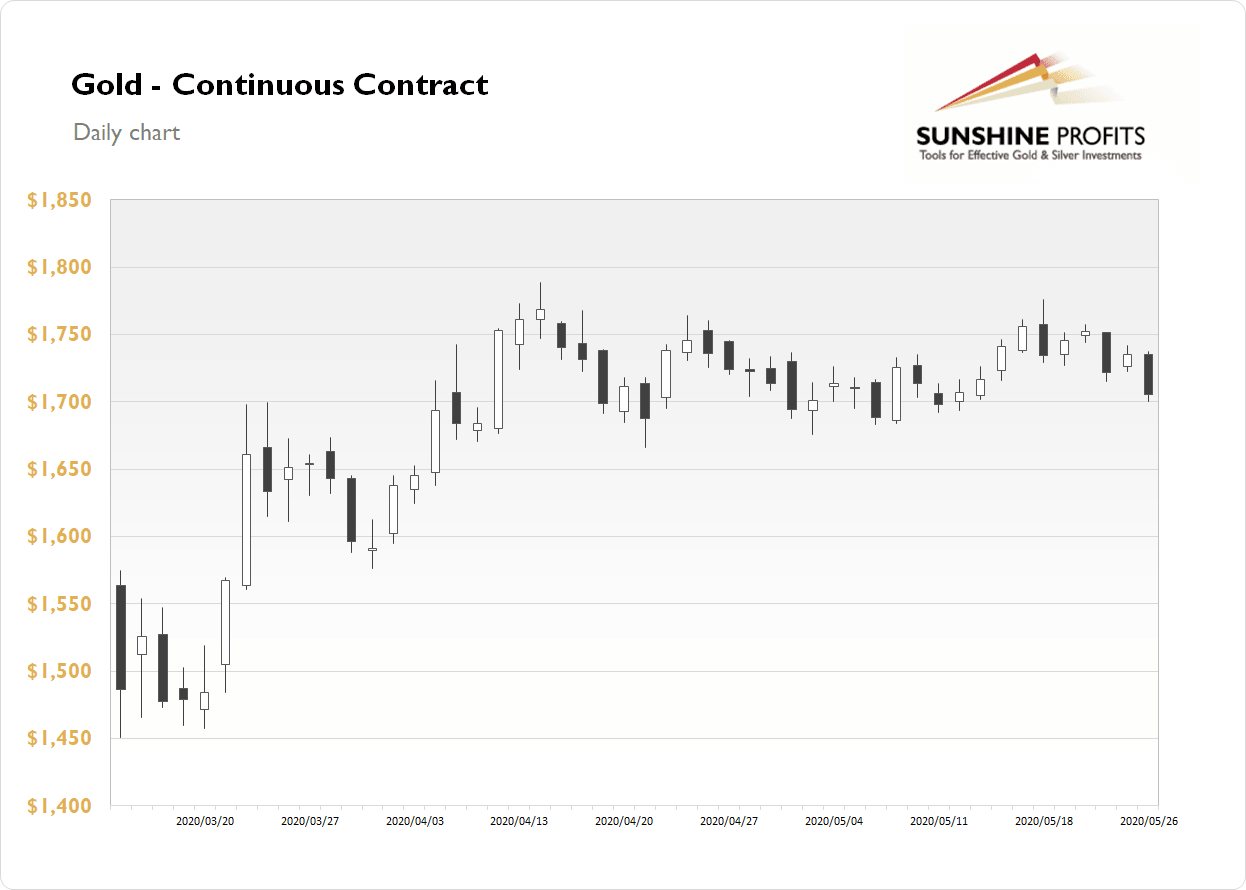

The gold futures contract lost 1.72% on Tuesday, as it extended its downward correction from last week’s Monday’s new monthly high of $1,775.80. It has retraced almost all of the decline from April 14 high of $1,788.80 before reversing downwards again. Gold price continues to trade within an over month-long consolidation, as we can see on the daily chart (updated on Friday):

Gold is 0.7% lower today, as it trading close to $1,700 mark. Financial markets are in risk-on mode, as stocks extend their uptrend. What about the other precious metals?: Silver lost 0.55% on Tuesday and today it is 1.0% lower, platinum lost 1.47% and it trades 0.3% lower this morning. Palladium gained 0.6% yesterday and today it is 0.6% lower.

The recent economic data releases have been confirming a negative coronavirus impact on global economies. Yesterday’s CB Consumer Confidence has come out below 100 level once again and the New Home Sales remained close to 600k. The markets are used to bad economic numbers, as stocks trade relatively close to their medium-term local highs following rebounding from the late March lows.

Below you will find our Gold, Silver, and Mining Stocks economic news schedule for the next two trading days. Investors will await tomorrow’s U.S. GDP number release. And today we will get the Richmond Manufacturing Index and the Beige Book:

Wednesday, May 27

3:30 a.m. Eurozone - ECB President Lagarde Speech

10:00 a.m. U.S. - Richmond Manufacturing Index

2:00 p.m. U.S. - Beige Book

Thursday, May 28

8:30 a.m. U.S. - Preliminary GDP q/q, Unemployment Claims , Durable Goods Orders m/m, Core Durable Goods Orders m/m, Preliminary GDP Price Index q/q

10:00 a.m. U.S. - Pending Home Sales m/m

11:00 a.m. U.S. - FOMC Member Williams Speech

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!

Author

Paul Rejczak

Sunshine Profits

Paul Rejczak is a stock market strategist who has been known for the quality of his technical and fundamental analysis since the late nineties.