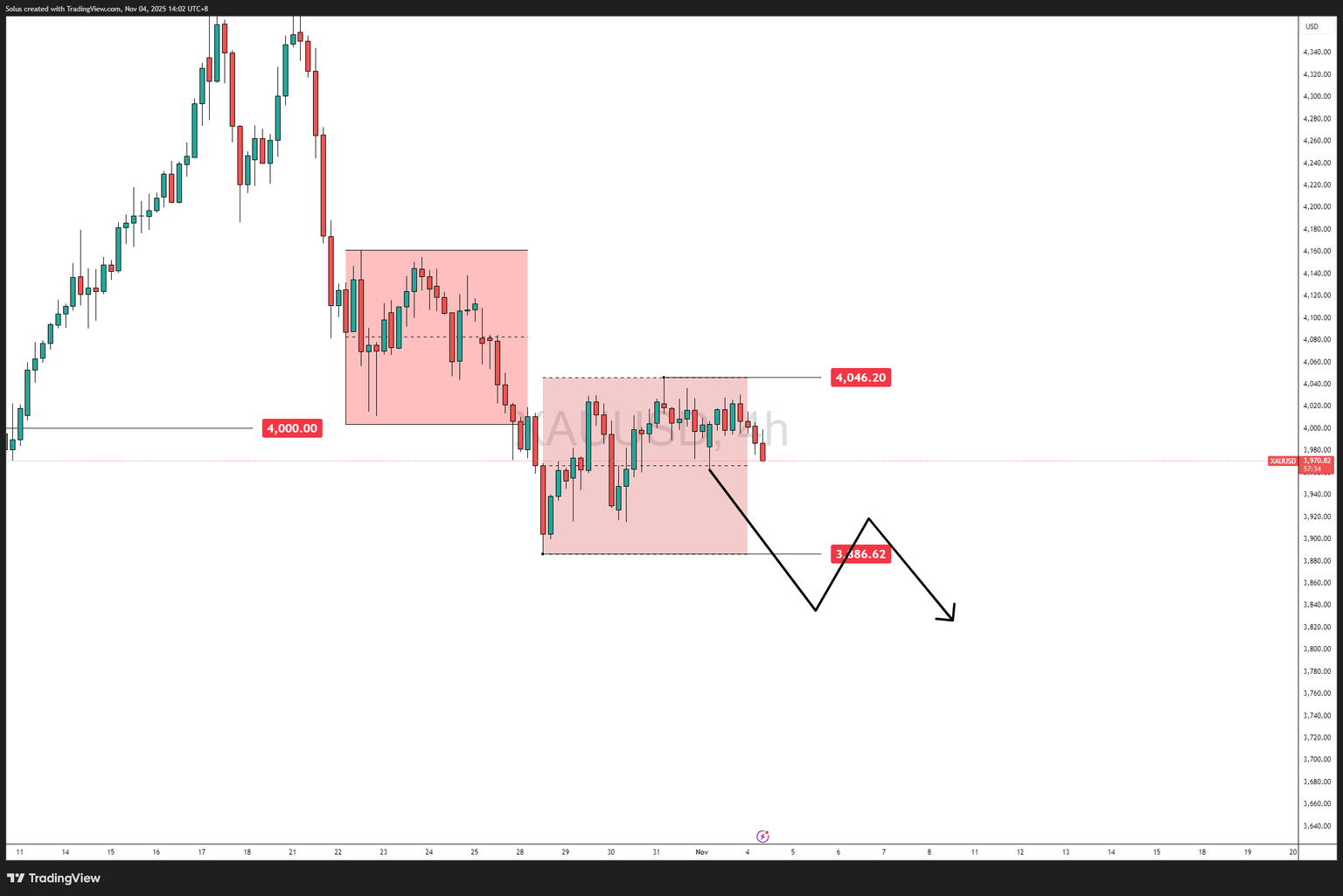

Gold consolidates at $4,000 awaiting breakout from $4,046–$3,886 range

- Gold remains trapped between $4,046.20 resistance and $3,886.62 support, as traders await fresh catalysts following the Fed’s cautious stance on December cuts.

- Powell’s tone reintroduced policy uncertainty, keeping yields firm and gold directionless ahead of key labor data and shutdown risks.

- Neutral-to-bullish bias above $3,960, but a decisive break beyond $4,046.20 or below $3,886.62 will define the next leg.

Overall narrative – Gold in a holding pattern

Gold (XAU/USD) continues to hover around the $4,000 line, caught in a tightening range following last week’s Fed rate cut. While policy easing usually benefits non-yielding assets, Powell’s cautious tone—stating that the December cut is “not assured”—has tempered bullish enthusiasm.

The result: yields remain anchored above 4%, the US dollar holds firm, and gold is consolidating rather than trending. Traders are now in wait-and-see mode, seeking confirmation from upcoming ADP, ISM Services, and NFP data—all of which could either validate or invalidate the soft-landing narrative that’s been priced into the markets.

Current price action – Consolidation between $4,046.20 and $3,886.62

On the 4H chart, gold is forming a clear consolidation box bounded by $4,046.20 (resistance) and $3,886.62 (support). The $4,000 psychological level acts as a midpoint magnet where price keeps oscillating.

This pattern reflects indecision—institutional traders are accumulating or distributing positions depending on upcoming data. Price is compressing after a steep drop from all-time highs near $4,381.38, suggesting the market is building energy for the next impulsive leg.

Here’s what we’re waiting for:

- A clean break and close above $4,046.20 → signals a short-term bullish continuation toward $4,115–$4,150, potentially reopening the path toward $4,200.

- A failure to hold $3,886.62 → validates a bearish continuation, exposing $3,835–$3,800, possibly $3,760 if risk sentiment flips.

- Until then, expect whipsaw conditions and range trading within this band.

This consolidation is typical after macro-driven volatility: traders digest the Fed’s guidance, await the next data pulse, and position accordingly.

Fundamental context – Data-dependent waiting game

The Fed’s “one and done” stance has placed gold in limbo. The cut was priced in, but the lack of clarity for December keeps markets reactive.

Key drivers now:

ADP & ISM Services (mid-week): Weak prints could reinforce dovish expectations, pressuring yields and boosting gold.

NFP & AHE (tentative): If released, a softer jobs number could confirm easing labor momentum, likely sparking a breakout above $4,046.20.

Government shutdown risk: Data delays or revisions could distort short-term volatility, keeping gold range-bound until clarity returns.

Until then, traders are monitoring the $4,000 pivot as the battleground for momentum shifts.

Technical Outlook

Bullish scenario: Breakout above $4,046.20

- Trigger: H4 or Daily close above $4,046.20.

- Confirmation: Follow-through toward $4,115–$4,150.

- Targets: $4,200, then $4,250 if momentum extends.

- Invalidation: Daily close back below $3,960.

Bearish scenario: Breakdown below $3,886.62

- Trigger: H4 close below $3,886.62.

- Confirmation: Expansion toward $3,835–$3,800 zone.

- Targets: $3,760 or deeper if NFP surprises to the upside.

- Invalidation: Swift reclaim of $3,960–$4,000.

Range bias: Neutral → bullish above $3,960; structure remains consolidative until a breakout confirms direction.

Next Catalyst Watchlist

- ADP Employment (Wed).

- ISM Services (Thu).

- NFP & AHE (Fri, tentative).

- Fed speakers and yield shifts.

Author

Jasper Osita

ACY Securities

Jasper has been in the markets since 2019 trading currencies, indices and commodities like Gold. His approach in the market is heavily accompanied by technical analysis, trading Smart Money Concepts (SMC) with fundamentals in mind.