Gold bull market still technically fundamentally in place

At the start of the week, a number of clients had it pointed out to them that gold’s recent highs could be starting to look vulnerable. It is important to realise that markets don’t tend to move in straight lines. What goes up quickly can also come down quickly. This turned out to be the case with gold. Earlier this week gold saw its largest daily drop in 7 years.

Don’t panic!

The large falls in gold had some traders panicking. You may be one of them.

One area to be very careful of is not using high amounts of leverage in these kinds of markets. So, if you are sat in loss and feeling dazed this post is a reminder of the technical and fundamental picture for gold.

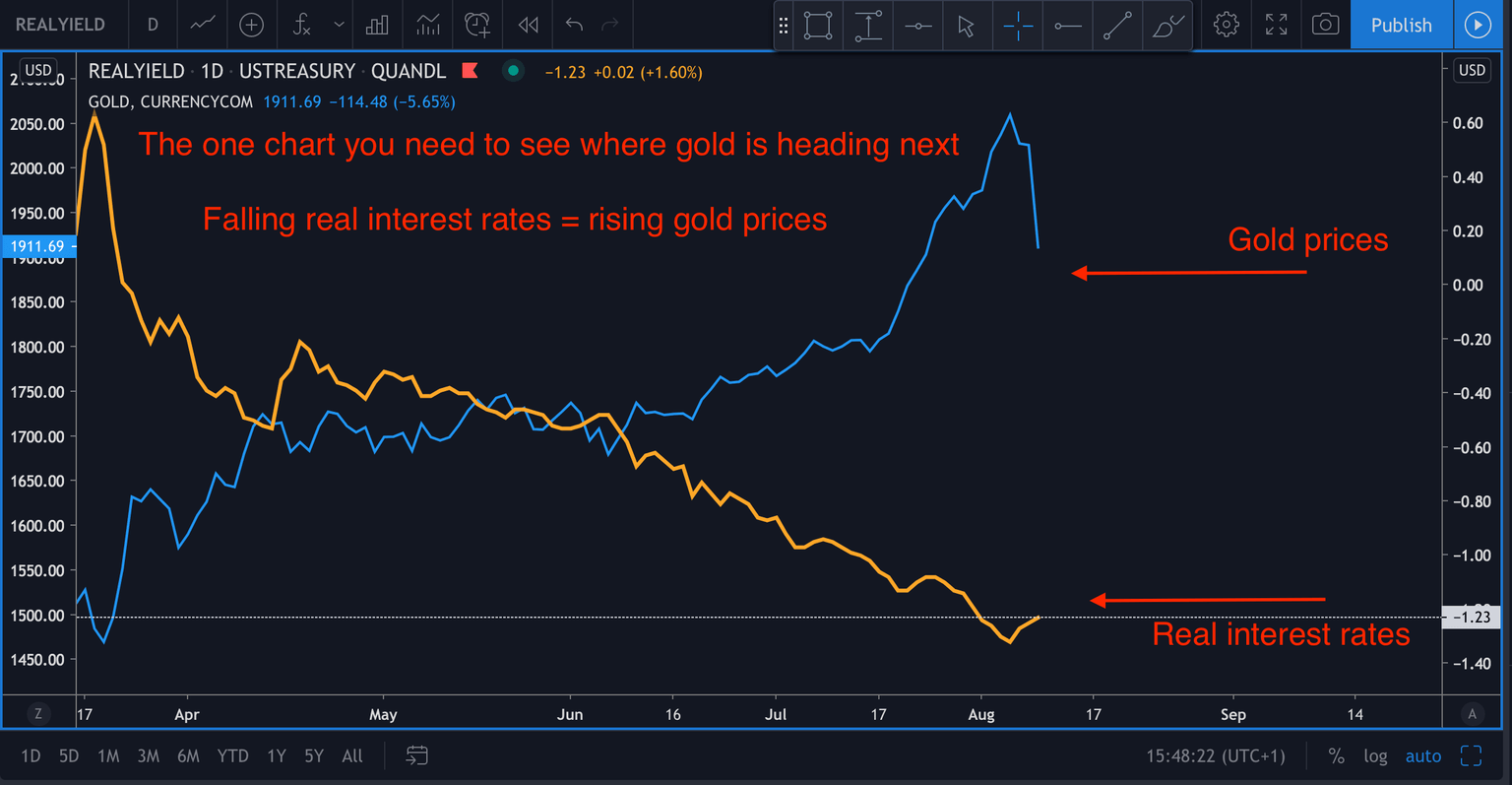

Gold’s bull market remains fundamentally in place

World interest rates are low and this supports the attractiveness of gold. Furthermore, real interest rates are negative and when/if they drop further gold prices, will also rise in tandem.

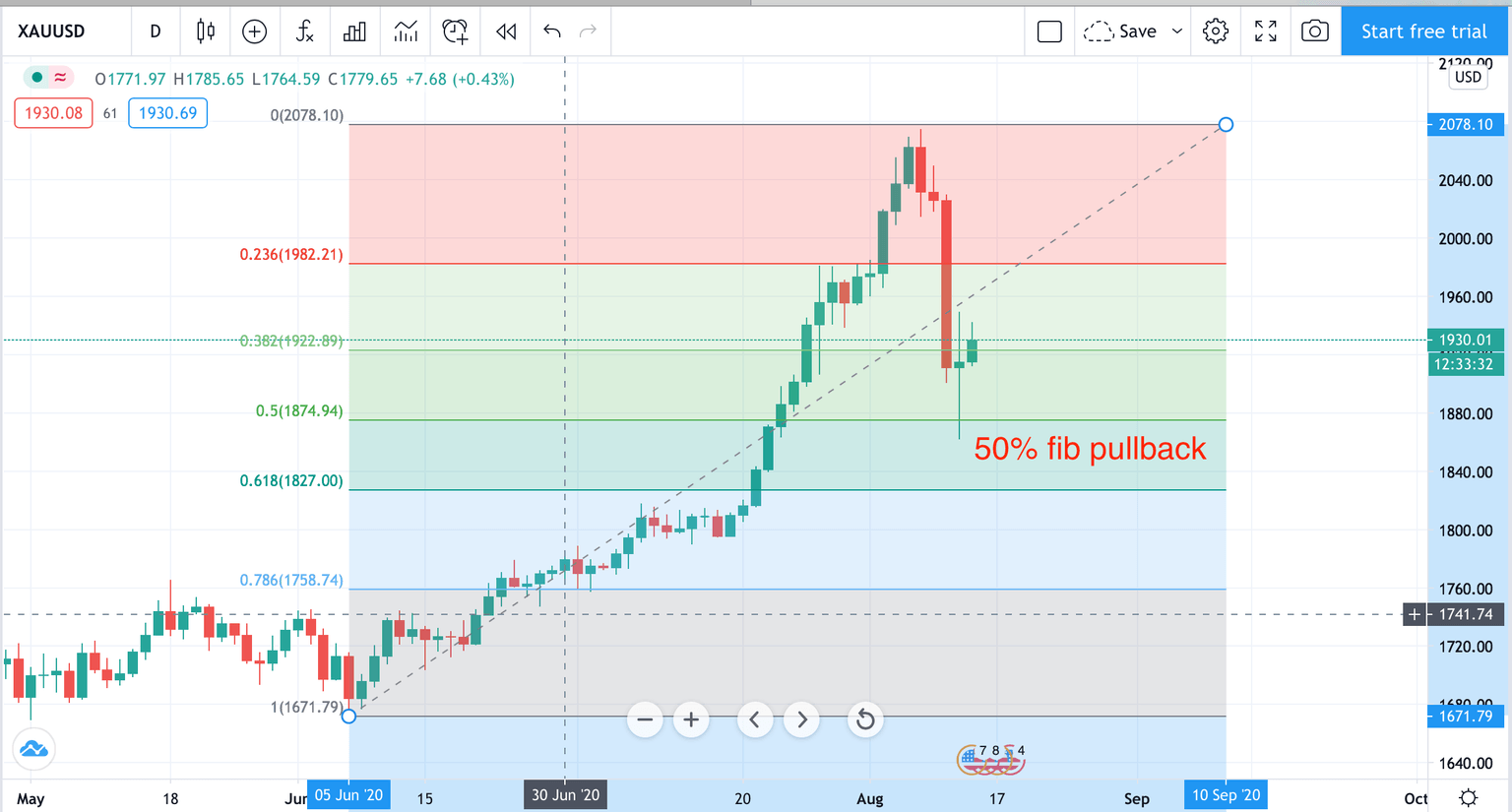

Pullbacks are the normal ebb and flow of the market

The current pullback in gold is a very ‘normal’ pullback to the 50% Fib retracement level from June’s lows.

Near term, stops will be under $1880

Near term stops under the $1880 region can be considered now that we are seeing US10Y bond yields pull back from their recent moves higher. This is a place where stops will now accumulate.

How about a re-entry price?

If you are thinking of re-entering this market look for an intraday trend line break higher as price/if price starts to consolidate from here. Finally, if you did experience a large loss by this move higher in gold use it as a learning point. Learn that violent moves higher are often accompanied by violent moves lower. The largest bear markets can happen in the strongest bull markets and vice versa, so manage risk accordingly.

Author

Giles Coghlan LLB, Lth, MA

Financial Source

Giles is the chief market analyst for Financial Source. His goal is to help you find simple, high-conviction fundamental trade opportunities. He has regular media presentations being featured in National and International Press.