Gold builds strength on geopolitical risk and labour market weakness

Gold (XAUUSD) is gaining momentum as rising economic and geopolitical risks push demand toward defensive assets. Weak U.S. labour data has raised concerns about the economy and reduced the Federal Reserve’s room to keep rates high. At the same time, geopolitical tensions are intensifying, with ongoing conflict in Eastern Europe and uncertain peace efforts. These developments have heightened market anxiety and kept gold supported.

Gold climbs on weak US jobs data and rising global tensions

Gold is regaining momentum as macro uncertainty continues to build. Fresh concerns about the U.S. economy have emerged following weaker labour data. Unemployment claims are rising, and job creation is slowing, pointing to a softening employment landscape. These developments may reduce the Federal Reserve’s flexibility to maintain higher rates. In this environment, gold remains supported as a defensive asset and long-term store of value.

At the same time, geopolitical developments are fueling safe-haven flows. Ukraine's military action within Russian territory and the upcoming peace discussions in Turkey have kept tensions high. While Ukrainian officials are engaging in diplomatic efforts, Russia’s refusal to participate in the talks leaves uncertainty unresolved. These events have added to market anxiety, further strengthening gold's appeal.

Still, the direction of the U.S. Dollar remains a key factor for gold. Federal Reserve officials have delivered mixed signals in recent days. Some emphasize the need for caution, while others acknowledge the case for rate cuts amid signs of labor market weakness. Investors now await the FOMC minutes and the delayed Nonfarm Payrolls report for further guidance. These releases could significantly influence expectations around the Fed’s December decision. In the meantime, gold is likely to stay responsive to shifts in Dollar strength and evolving policy signals.

Gold breaks above ascending channel to start steeper bullish trend

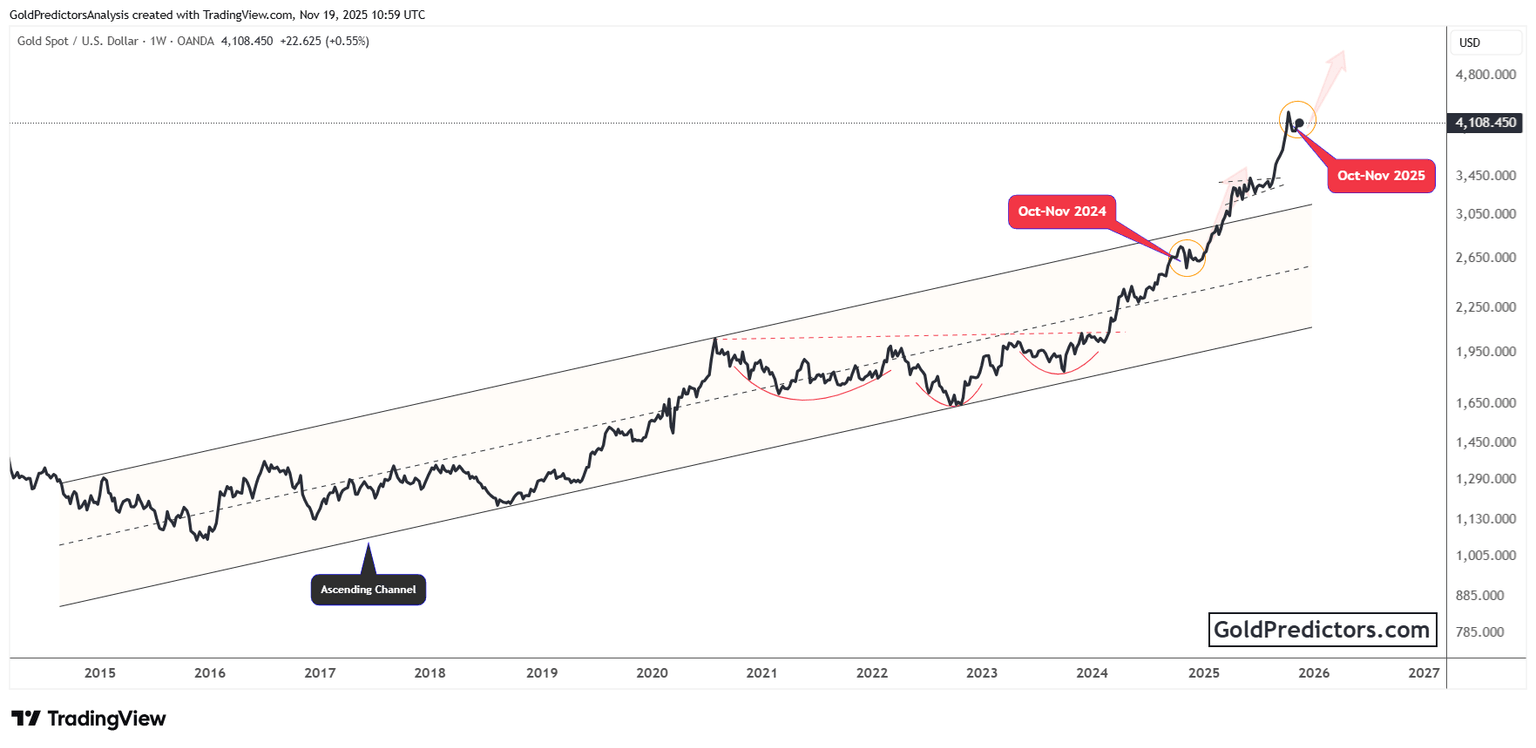

The gold chart below shows a decisive breakout from a well-defined ascending channel. Price action moved steadily within this structure, forming a consistent pattern of higher highs and higher lows. The channel provided a strong technical foundation for gold’s long-term uptrend, holding firm through periods of volatility. Its eventual breakout signals a shift in momentum and the potential for a steeper phase of advance.

Furthermore, this breakout marked the beginning of a sustained directional shift in gold’s performance. It followed an extended consolidation phase that developed over several years. The move transitioned gold from steady gains to a sharper upward phase, with the price surging beyond key resistance levels. Notably, the breakout confirmed the resolution of an inverse head-and-shoulders pattern. It signaled the beginning of a more powerful phase in gold’s long-term uptrend.

Gold recently advanced toward the $4,400 zone before encountering short-term resistance. The pullback that followed appears to be a standard correction after a strong rally. Despite the pause, the broader trend remains firmly intact. Chart projections indicate the potential for another leg higher once the current consolidation resolves. The breakout from the established channel suggests that gold is now forming a stronger and more accelerated upward trend.

Gold outlook: Bullish trend supported by market uncertainty and technical breakout

Gold continues to hold its rebound as macro uncertainty drives demand for defensive assets. Softer U.S. labor data, geopolitical tensions, and mixed Fed signals are fueling flows into safe-haven assets. This shift has kept gold in demand while the Dollar struggles to extend gains. Short-term resistance near $4,400 has triggered a brief pause in momentum. Still, the broader structure remains bullish following the breakout from the long-standing ascending channel. Gold may stay responsive to Dollar moves, labour data, and global tensions. This reaction could continue until upcoming economic reports offer clearer policy direction.

Unlock exclusive gold and silver trading signals and updates that most investors don’t see. Join our free newsletter now!

Author

Muhammad Umair, PhD

Gold Predictors

Muhammad Umair is a financial markets analyst and investor who focuses on the forex and precious metals markets.