Gold builds strength ahead of US CPI inflation data

-

The upcoming CPI inflation data is expected to have a significant impact on the gold market.

-

A drop in headline inflation may signal easing inflation pressures.

-

Lower inflation increases the likelihood of the Federal Reserve cutting interest rates more aggressively.

The upcoming CPI inflation data is expected to have a significant impact on the gold market. If headline inflation drops, particularly in energy and food prices, and core CPI remains moderate, it could signal easing inflation pressures. A lower inflation environment increases the likelihood of the Federal Reserve cutting interest rates more aggressively, potentially by 50 basis points. This scenario would weaken the U.S. dollar, making gold more attractive as a hedge against currency devaluation. Additionally, with slower wage growth and a softer labor market, the lower inflation outlook could lead investors to seek the safe-haven qualities of gold amid fears of an economic downturn, similar to the deflationary pressures seen in China. On the other hand, if inflation remains elevated, the Fed may opt for a smaller rate cut, strengthening the dollar and putting downward pressure on gold prices. Ultimately, the core CPI figures and the size of the Fed’s rate cut decision will play a pivotal role in determining gold’s direction in the near term.

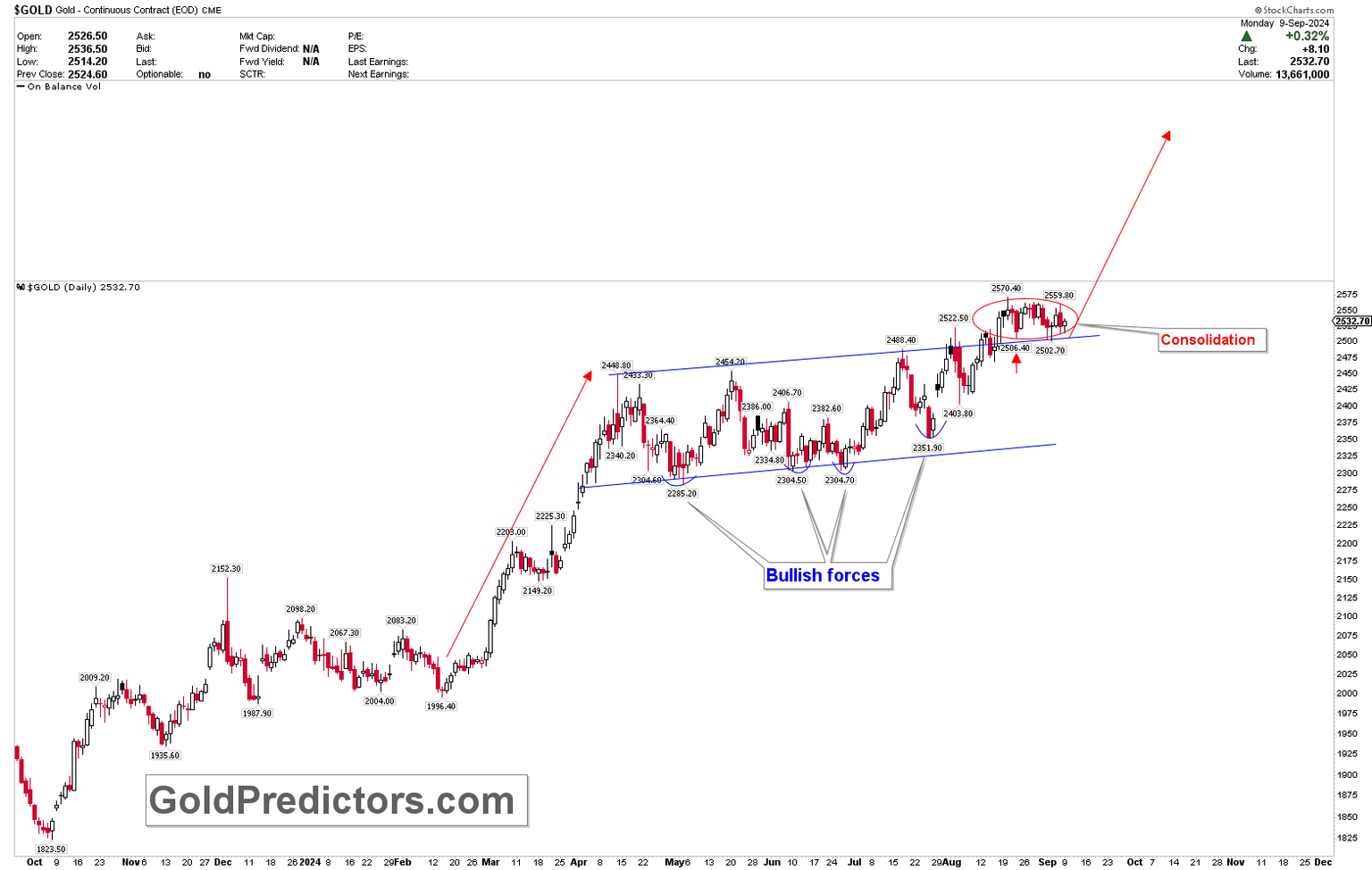

The gold daily chart below shows that gold prices are consolidating within tight ranges following the breakout of the channel. This consolidation indicates strong buying pressure in the market, suggesting that gold is likely to continue moving higher. The blue arcs on the chart show that each correction is followed by a strong rally, demonstrating gold’s resilience to major corrections. All of these factors point to the likelihood of the next breakout being to the upside. However, if prices correct lower due to strong volatility, it should be seen as a buying opportunity for traders.

Bottom line

In conclusion, the upcoming CPI inflation data and the Federal Reserve’s response will play a crucial role in shaping the gold market’s near-term outlook. Lower inflation and a more aggressive rate cut by the Fed could weaken the U.S. dollar, making gold an attractive safe-haven asset for investors. The gold market’s current consolidation and strong buying pressure suggest a likely continuation of upward momentum, with any dips seen as buying opportunities.

Unlock exclusive gold and silver trading signals and updates that most investors don’t see. Join our free newsletter now!

Unlock exclusive gold and silver trading signals and updates that most investors don’t see. Join our free newsletter now!

Author

Muhammad Umair, PhD

Gold Predictors

Muhammad Umair is a financial markets analyst and investor who focuses on the forex and precious metals markets.