Gold and CPI anticipation: Key scenarios to watch

- Gold trades cautiously ahead of tonight’s CPI release, with markets bracing for potential volatility and trend confirmation.

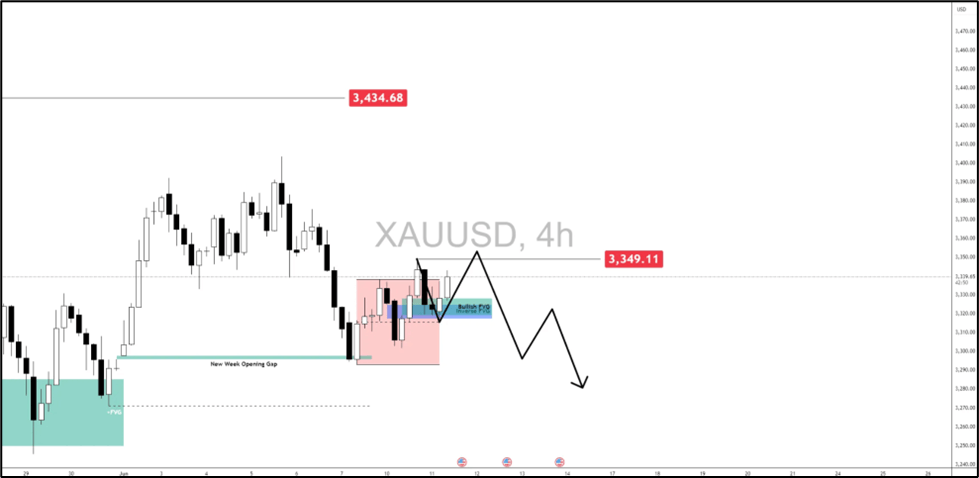

- Price continues to respect the bullish FVG and New Week Opening Gap as a launchpad for potential expansion.

- A soft CPI may ignite a breakout toward $3,434, while sticky inflation risks a breakdown toward $3,271.

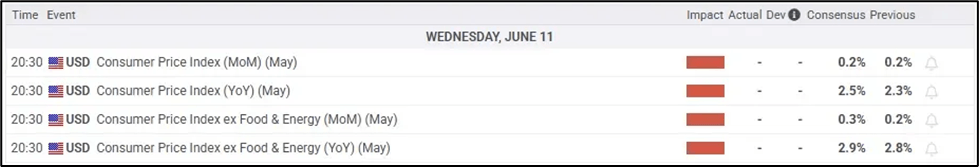

CPI Comin’ in hot

- Headline CPI YoY (May) expected at 2.5%, up from 2.3%.

- Core CPI YoY projected at 2.9%, slightly above April’s 2.8%.

- The Fed’s preferred inflation gauge remains elevated - keeping rate cut hopes in check.

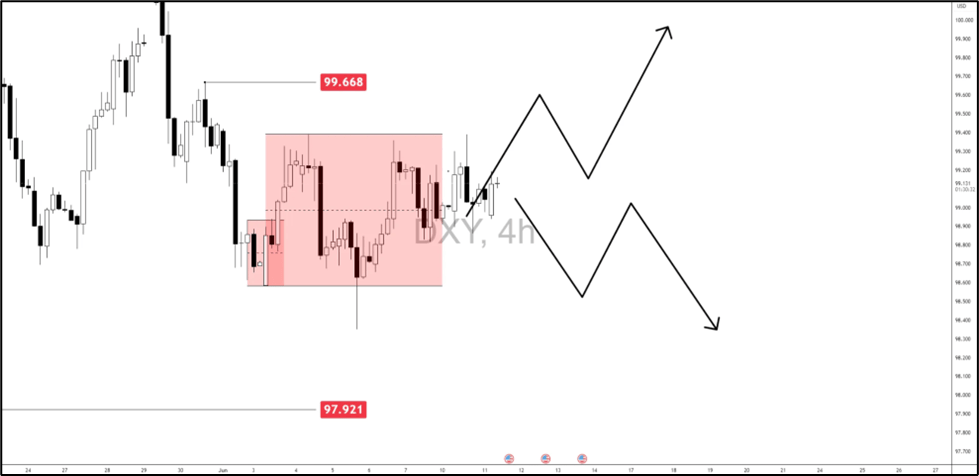

The Dollar index has struggled to find clear direction, oscillating between breakout and breakdown levels, depending on inflation expectations. This places even more importance on this CPI print as a volatility trigger that could tilt the dollar—and thus gold—into a new directional phase.

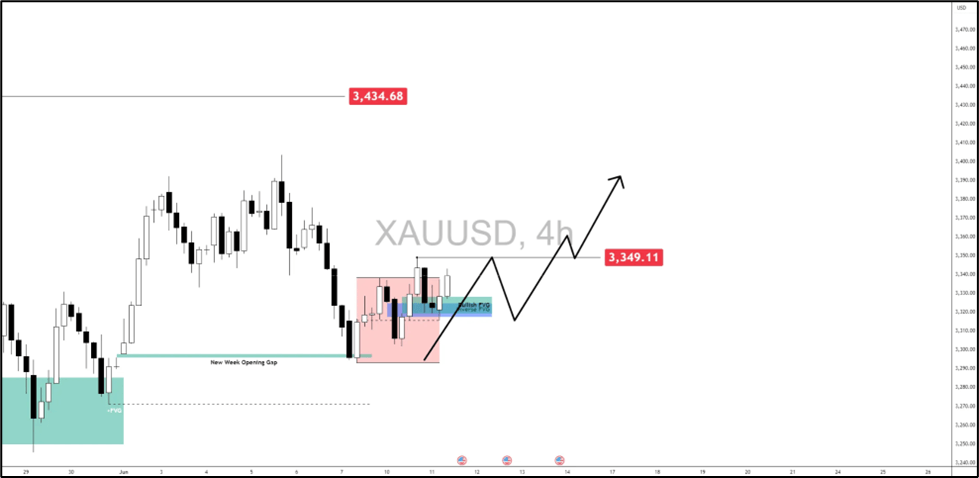

Gold gearing for the next leg: Up or down?

Gold has stabilized after last week’s volatility and is on a “stabilized” or “calm” price action at the beginning of this week, but that calm may be short-lived or may be not. Markets are now bracing for the next macro catalyst later on today.

Gold has been supported by central bank demand, global geopolitical tensions, and expectations of a peak Fed rate, but today’s CPI print could challenge or strengthen that view. If inflation proves stickier than expected, it could reinforce the Fed’s cautious stance and support the U.S. dollar, pressuring gold. If CPI surprises to the downside, it could ignite bullish momentum on gold, especially with a weak dollar narrative building.

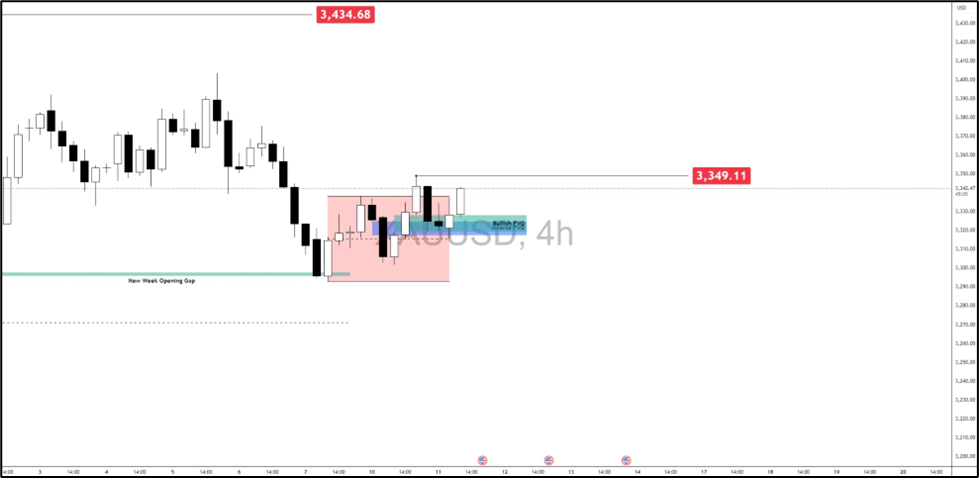

Gold respecting $3,320-$3,340 level

Gold is currently consolidating in a tight range, as shown in the chart below:

Previously, I have mentioned in Gold outlook: Why macro bulls are still in control that overall, bullish scenario is still intact since we haven’t tested yet the $3,271.18 level.

After consolidating for quite some time since Monday and testing out the New Week Opening Gap created last week, we are now gearing up towards the $3,350 level unless other scenarios plays out post-CPI.

Key levels to watch and CPI price action scenarios

Bullish scenario: Soft CPI surprise

If CPI comes in below expectations

- Dollar weakens, Fed rate cut bets increase.

- Gold clears $3,350 resistance.

- $3,320-$3,340 FVG level holds.

This FVG level can be a low-risk area for potential long setups if price confirms with CPI volatility. However, a deeper sweep of the $3,300–$3,280 liquidity pocket is also possible before expansion.

Bearish scenario: Sticky inflation

If CPI surprises to the upside

- Dollar strengthens sharply.

- Gold breaks below New week opening gap, targets $3,295.79–$3,298.03.

- Break of $3,320-$3,340 FVG level.

- Test of $3,271.18.

Author

Jasper Osita

ACY Securities

Jasper has been in the markets since 2019 trading currencies, indices and commodities like Gold. His approach in the market is heavily accompanied by technical analysis, trading Smart Money Concepts (SMC) with fundamentals in mind.