Gold and bonds: The new safe-haven tug of war

Two havens, one uncertainty

Markets once followed a simple rule: when yields rise, gold retreats, and when bonds rally, the metal shines.

That logic no longer applies.

In late 2025, U.S. Treasury yields hover around 4,0–4,1 %, yet gold trades steadily above 4,000 $, maintaining one of its strongest performances of the decade.

Investors are no longer choosing between yield and safety, they are learning to balance both.

Bonds protect against cyclical weakness, Gold shields against institutional doubt.

Together, they form a new equation of risk management in a world where no single asset offers full protection.

Fed fatigue and fading confidence

The U.S. economy continues to show uneven momentum.

Manufacturing and housing indicators have softened, while job creation has slowed enough to question the sustainability of tight monetary policy.

The Federal Reserve’s “higher for longer” stance is losing credibility, and markets are now betting on the first rate cuts in early 2026.

The 10-year Treasury yield has eased to near 4,0 %, confirming that inflation fears have given way to growth concerns.

Yet demand for Treasuries remains cautious, constrained by record government issuance and rising fiscal worries.

Bonds still offer income, but they no longer offer unquestioned safety.

Gold, instead, is gaining precisely because it does not rely on trust in policy.

Central banks in China, India, and Turkey continue to accumulate reserves, and ETF inflows have turned positive after months of redemptions.

In a system crowded with promises, investors are returning to assets that stand outside it.

A structural shift in haven dynamics

The historical inverse link between gold and yields has weakened sharply.

The 90-day rolling correlation between the two now fluctuates around –0,25, compared with –0,7 a decade ago.

Gold and bonds are no longer rivals for safe-haven flows, they now complement each other: one hedges economic weakness, the other hedges confidence risk.

This transition reflects a deeper truth.

Investors are adapting to structural instability — fiscal, geopolitical, and monetary.

The new reality is that both assets can rise together when the market no longer trusts policy consistency.

Technical view: Renko Gold (XAU/USD)

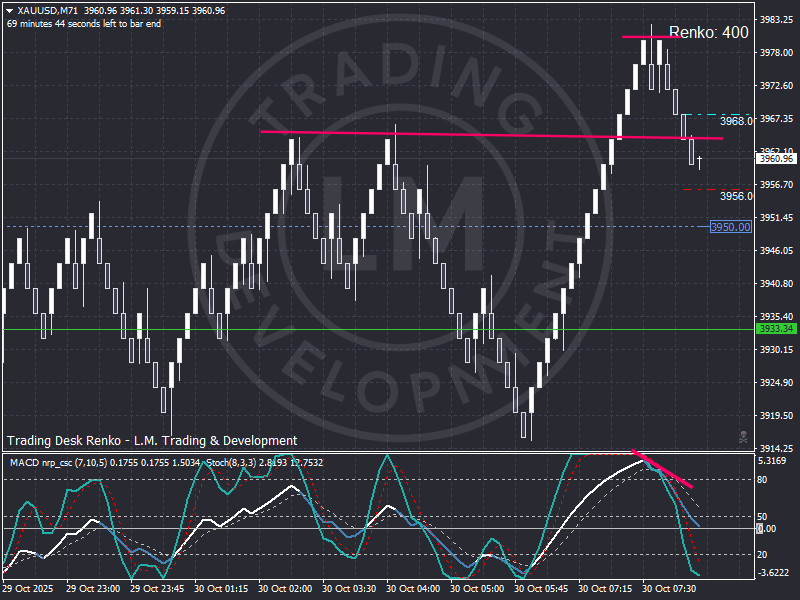

On the Renko Gold (XAU/USD) chart, momentum remains well supported.

After a steady ascent from 3,933 $, the metal registered a rejection near 3,981 $, then advanced beyond 4,000 $ with controlled energy.

XAUUSD Renko, breakout above 4 000 $, support around 3 950 $, structure shows controlled rotation between gold and bonds as investors seek stability.

Support rests around 3,950 $, while new resistance appears between 4,040 $ and 4,060 $.

As long as prices hold above 3,950 $, the structure signals continuation, not exhaustion.

The stochastic oscillator is cooling from mid-range, the MACD histogram remains slightly positive, and price action keeps building higher lows — all signs of strength without euphoria.

The Renko pattern shows methodical white bricks, not emotional spikes, confirming that institutional accumulation remains in control.

The macro layer

Gold’s strength runs parallel to the dollar’s fatigue.

The greenback still trades firm, but its correlation with yields is softening, revealing doubts about the Fed’s ability to maintain restrictive policy into 2026.

Meanwhile, bond investors face a challenge of supply and conviction: the more Treasuries the government issues, the less confidence investors have in their long-term value.

That dynamic is not a paradox, it is the natural consequence of debt saturation.

Central banks are quietly diversifying away from the dollar, not abandoning it but diluting exposure.

Gold sits at the centre of this process, offering neutrality between competing currencies and policy regimes.

Global interplay

Across Asia and the Middle East, physical demand for gold remains robust.

In Western markets, portfolio managers are rebuilding mixed allocations — Treasuries for liquidity, gold for credibility.

Volatility metrics confirm this divergence: the MOVE index for bonds remains elevated, while gold’s implied volatility stays near its 2023 average.

Calm in gold no longer signals calm in markets; it signals trust in something other than policy.

Outlook: Coexistence, not competition

Into the final months of 2025, both gold and bonds are expected to coexist as twin hedges.If yields drift lower on weaker data, gold could extend toward 4 100–4 150 $.

If yields rebound modestly, a retracement toward 3 950 $ is possible, yet strong physical demand should limit losses.

Bonds may stabilise near current levels, with any rally capped by heavy issuance and cautious demand.

The key story is not which haven outperforms, but how both now share the defensive role once dominated by Treasuries alone.

Personal take

Gold above 4 000 $ is more than a technical achievement, it is a symbol of a changing financial order.

Investors are learning that policy guidance can fade, but tangible value endures.

Bonds still matter, but their dominance as the world’s single safe asset is gone.

The new equation of safety combines yield, liquidity, and credibility — all in uneasy balance.

And on the Renko chart, that evolution is visible: each new brick adds structure to confidence, not speculation.

Author

Luca Mattei

LM Trading & Development

Luca Mattei is a market analyst focusing on FX, metals, and macroeconomic trends. He develops trading tools for retail and professional traders, coding indicators and EAs for MT4/MT5 and strategies in Pine Script for TradingView.