German ZEW Preview: Three reasons why low expectations are too optimistic, lose-lose for EUR/USD

- The German ZEW Economic Sentiment for March is projected to tumble down due to tot he coronavirus crisis.

- The rapid developments mean that expectations may already be too high.

- EUR/USD is set in a lose-lose situation with the data.

Business confidence charts are the opposite of the coronavirus infection rate – but also here, the hope is for a flatter curve. There is no doubt that ZEW's Economic Sentiment survey for March – the earliest in the continent's largest economy – is set to plunge, but the scale matters.

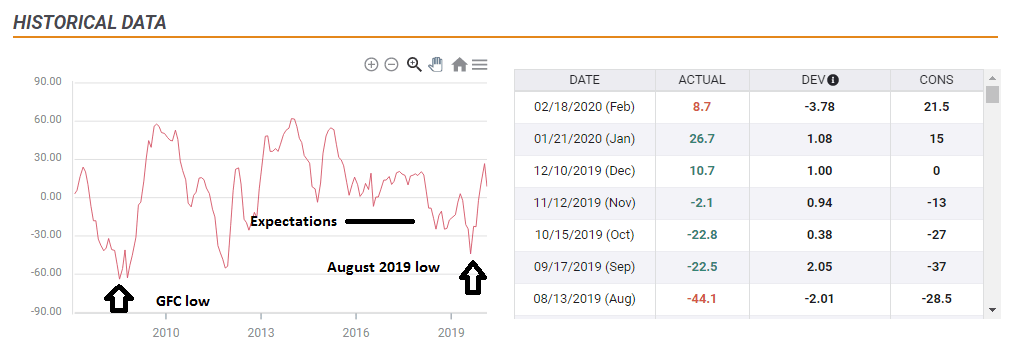

The economic calendar is pointing to a drop from +8.7 in February to -26.4 in March, which would be the worst since August 2019. That seems optimistic. There are three reasons why economists' assessment – low as it may seem – may already be too optimistic.

Three reasons why a plunge is optimistic

1) A big miss in February: The consensus for February was 21.5, but the outcome was a substantial miss at 8.7 points. Back then, cases of coronavirus in Italy were at their infancy, but China was struggling. Germany depends on exports to China, and markets underestimated the effect of the faraway disease on the local economy. That may happen again.

2) The situation is much worse: In August 2019, the ZEW Economic Sentiment fell to -44.1 amid the now-forgotten trade war between China and the US. The current crisis is far worse, closer to the 2008 Great Financial Crisis. Christine Lagarde, President of the European Central Bank, made this comparison, which does not seem so outlandish now. In October 2008, sentiment fell to -63. Such a figure may be unlikely, but expecting -26.4 seems optimistic.

3) Things are moving fast: In Italy, the movement of people is limited, and only essential services are functioning. Other European countries – including Germany – are rapidly following Italy. Airlines are ground to a halt, cultural events are canceled, and kids are at home. A deeper fall is likely.

If the figure misses expectations due to all the reasons mentioned above, EUR/USD has room to fall.

Lose-lose situation

What can be expected in the unlikely case that ZEW Economic Sentiment exceeds estimates? There is a case to see the euro suffering in this case as well. Given the current environment, with new restrictions coming every day, traders may shrug off the figures as old news.

Economic figures which carry weight – but that are from before the crisis – were mostly ignored.

All in all, it seems like a lose-lose situation for EUR/USD.

Apart from the statistics, comments from the ZEW institution will be of interest. If they reflect grave fear, the common currency could further fall. Conversely, if ZEW economists say that it is "too soon to know," perhaps the euro could stabilize.

Conclusion

There are good reasons to expect a worse outcome than what economists expect, and even a surprising beat may push the currency lower as investors may ignore it.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.