German GDP Preview: Why expecting the worst since 2009 may be optimistic, EUR/USD implications

- Germany is expected to report a squeeze of 2.2% in economic output in the first quarter.

- Dependence on China and eurozone figures point to a more substantial drop in activity.

- EUR/USD, already falling amid dollar strength, may extend its falls.

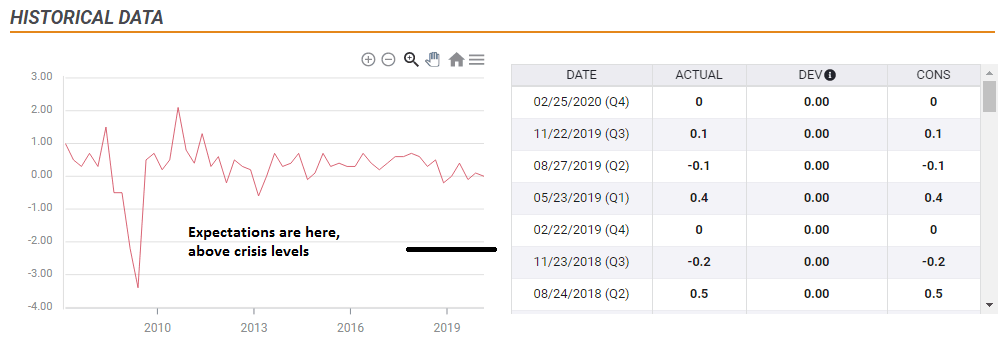

Germany is having a "good crisis" – suffering a low mortality rate in comparison to other large European countries and the rest of the world. Elevated testing capacity and sound leadership do not mean the economy has not suffered. Economists expect the old continent's largest economy to report a fall of 2.2% in Gross Domestic Product in the first quarter of 2020, the worst since Q1 2009 – the worst of the financial crisis.

However, there are several reasons to believe it could be worse. Preliminary eurozone GDP figures have shown a plunge of 3.8%

Chancellor Angela Merkel ordered schools and nurseries to close on March 13, while Italy was already in full lockdown but Spain was only on its way to doing so. It announced a national curfew on March 22, several days after France and Spain.

The small difference in days is insufficient to explain the upgraded expectations.

Another reason to project the worse outcome is Germany's dependency on exports to China. The world's largest economy hunkered down on January 23. While China's measures were not uniform across the country, business activity in Europe's "locomotive" probably suffered already suffered before March.

EUR/USD implications

Euro/dollar has been leaning lower, and this trend may extend if Germany's GDP misses expectations. Jerome Powell, Chairman of the Federal Reserve, dismissed the idea of negative interest rates, disappointing some investors that had already briefly priced in such a move.

Moreover, fears of a second wave of infections – in the US, in Germany, and elsewhere – has kept the greenback bid. The mix of weak eurozone data and a stronger dollar could push EUR/USD lower.

However, there are other scenarios to consider. If German GDP meets expectations, it would be encouraging for the euro area, as the largest country would have posted better figures than other large economies and the bloc at large. Nevertheless, USD strength will likely prevent EUR/USD from advancing.

The currency pair has room to rise only in the unlikely scenario of an upside beat, preferably contraction of less than 2%. A surprising outcome – albeit being temporary ahead of a horrible second quarter – would boost EUR/USD, at least temporarily.

Conclusion

Initial German GDP figures for the second quarter will likely show a considerable drop in output due to the coronavirus crisis. Projections seem too optimistic when looking at other European countries and China's impact. Alongside some dollar strength, the currency pair has more room to drop than rising.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.