GBP/USD hopes for bullish development above channel [Video]

![GBP/USD hopes for bullish development above channel [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Majors/GBPUSD/cash-345432_XtraLarge.jpg)

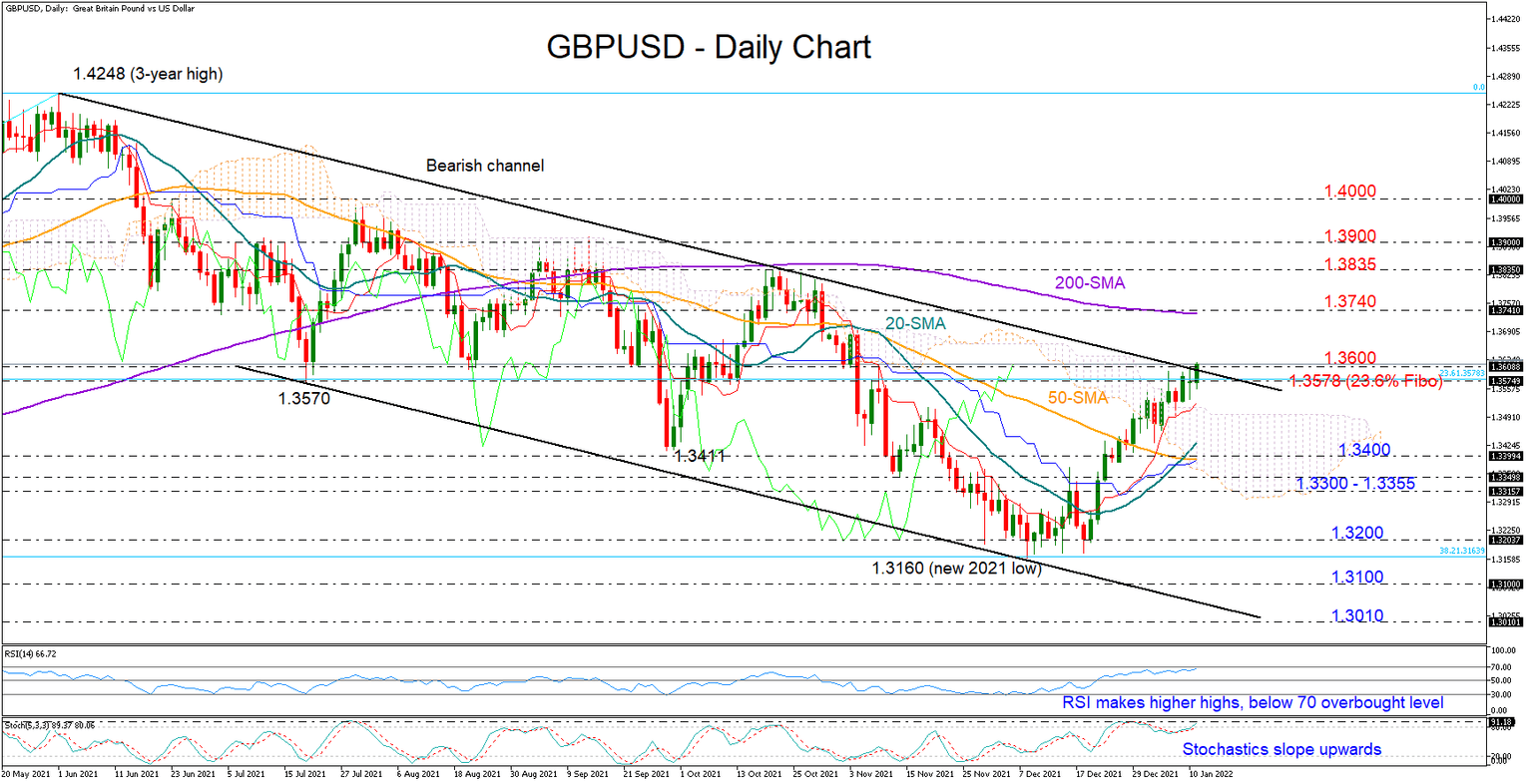

GBPUSD is currently positioned at a crucial make-or-break point, testing the top line of the seven-month-old bearish channel slightly below the 1.3600 psychological level.

A decisive close above that threshold could bring new buyers into the market, with the price likely heading straight up to the 200-day simple moving average (SMA) at 1.3740 in the aftermath, while not far above, an extension beyond the 1.3835 – 1.3900 resistance zone would finally clear the way towards the key 1.4000 mark.

The market has yet to confirm overbought conditions as the rising RSI is still some distance below 70, while the Stochastics have just pivoted to the upside to pierce the 80 level. Therefore, the base scenario is for bullish pressures to dominate in the short term.

Nevertheless, should the bears win the battle, pressing the price below the 23.6% Fibonacci retracement of the 1.1409 - 1.4248 upleg at 1.3578, the red Tenkan-sen line could immediately attempt to halt the fall around 1.3515 as it did last week. If it proves fragile, the decline could stretch towards the 1.3400 region, where the 20- and 50-day simple moving averages (SMAs) happen to be at the moment. Then, a step beneath the 1.3350 – 1.3300 region could encounter support somewhere between 1.3200 and the 2021 low of 1.3160.

Summarizing, the technical picture is favoring additional gains in the GBPUSD market, though only a sustainable move above the channel could add extra fuel to the ongoing bullish run.

Author

Christina joined the XM investment research department in May 2017. She holds a master degree in Economics and Business from the Erasmus University Rotterdam with a specialization in International economics.