GBP/USD Weekly Outlook: Pound Sterling recovery loses momentum ahead of a big week

- The Pound Sterling booked a weekly gain as the US Dollar resumed its downtrend.

- GBP/USD traders brace for a data-heavy US calendar, while trade headlines will continue to be in focus.

- Technically, the bias has turned in favor of GBP/USD sellers, with the daily RSI flipping bearish.

The Pound Sterling (GBP) staged a solid comeback from two-month lows against the US Dollar (USD) before GBP/USD buyers ran into the 1.3600 hurdle.

Pound Sterling recovery has lost traction

Despite its retracement in the second half of the week, the GBP/USD pair closed the week with gains as the USD registered its biggest weekly drop in a month.

The Greenback hit its lowest level in two weeks against major currency rivals as easing trade tensions diminished its appeal as a safe-haven asset.

Investors cheered US trade deals with Japan, Indonesia, and the Philippines while staying hopeful that an agreement between the US and the European Union (EU) will be reached soon.

Citing officials from the European Commission, the Financial Times reported on Wednesday that the EU and US are closing in trade deal that would impose 15% tariffs on European imports, while waiving duties on some items.

Progress on trade deals also raised market hopes for fresh US talks with China, especially after Treasury Secretary Scott Bessent said officials of both countries would meet in Stockholm next week to discuss an extension of the deal negotiation deadline.

Meanwhile, risk appetite also got a further boost from the record rally on Wall Street indices, following results by Google parent Alphabet, which beat estimates to kick off the "Magnificent Seven" earnings season.

The broader market optimism, combined with the USD downfall, propelled the higher-yielding Pound Sterling. This, in turn, pushed up GBP/USD to eight-day highs of 1.3584 midweek.

Subsequently, the pair embarked on a reversal mode as the US currency looked to regain lost ground amid reviving safe-haven demand in the latter part of the week.

The decade-long military conflict between Thailand and Cambodia re-ignited on Thursday, while traders turned anxious ahead of US President Donald Trump’s rare visit to the Fed headquarters.

Although markets shrugged off the presidential visit, the Asian military clash continued to weigh on risk sentiment.

The neighbours are locked in a bitter spat over an area known as the Emerald Triangle, where the borders of both countries and Laos meet, and which is home to several ancient temples.

Investors remain worried that the clash between these two countries does not translate into a wider regional conflict.

Both Asian nations requested the United Nations Security Council to convene an emergency meeting on Friday, according to China's CCTV News.

The Pound Sterling also felt the heat from a surprise slowdown in the UK services sector in July. The seasonally adjusted S&P Global/CIPS UK Services Purchasing Managers’ Index (PMI) unexpectedly dropped to 51.2 in July, versus June’s 52.8, while coming in below the anticipated 53 figure.

The Office for National Statistics (ONS) said on Friday, UK Retail Sales rebounded less than expected in June, arriving at 1.7% annually and 0.9% on the month.

The market expectations were for an increase of 1.8% and 1.2%, respectively, in the reported period. British Retail Sales data also added to the pair’s downside.

Watch out for the August 1 tariff deadline and US event risks

With the August 1 Trump tariff deadline approaching, GBP/USD traders prepare for a spate of top-tier economic events from the United States (US) in the upcoming week for fresh trading incentives.

Monday is devoid of any significant data releases from both sides of the Atlantic, and hence, eyes turn to Tuesday’s US JOLTS Job Openings Survey and the Conference Board (CB) Consumer Confidence data.

On Wednesday, the advance estimate of the second-quarter US Gross Domestic Product (GDP) will hog the limelight ahead of the July policy announcements by the Fed. The US central bank is widely anticipated to hold interest rates when it concludes its two-day policy meeting on July 30.

Friday’s US Nonfarm Payrolls (NFP) for July and the ISM Manufacturing PMI data will be on the cards. However, the focus will also be on trade developments on the tariff deadline cut-off day.

Apart from data publications, markets will scrutinize speeches from Fed policymakers on Friday as the US central bank’s ‘blackout period’ ends on Thursday.

GBP/USD: Technical Outlook

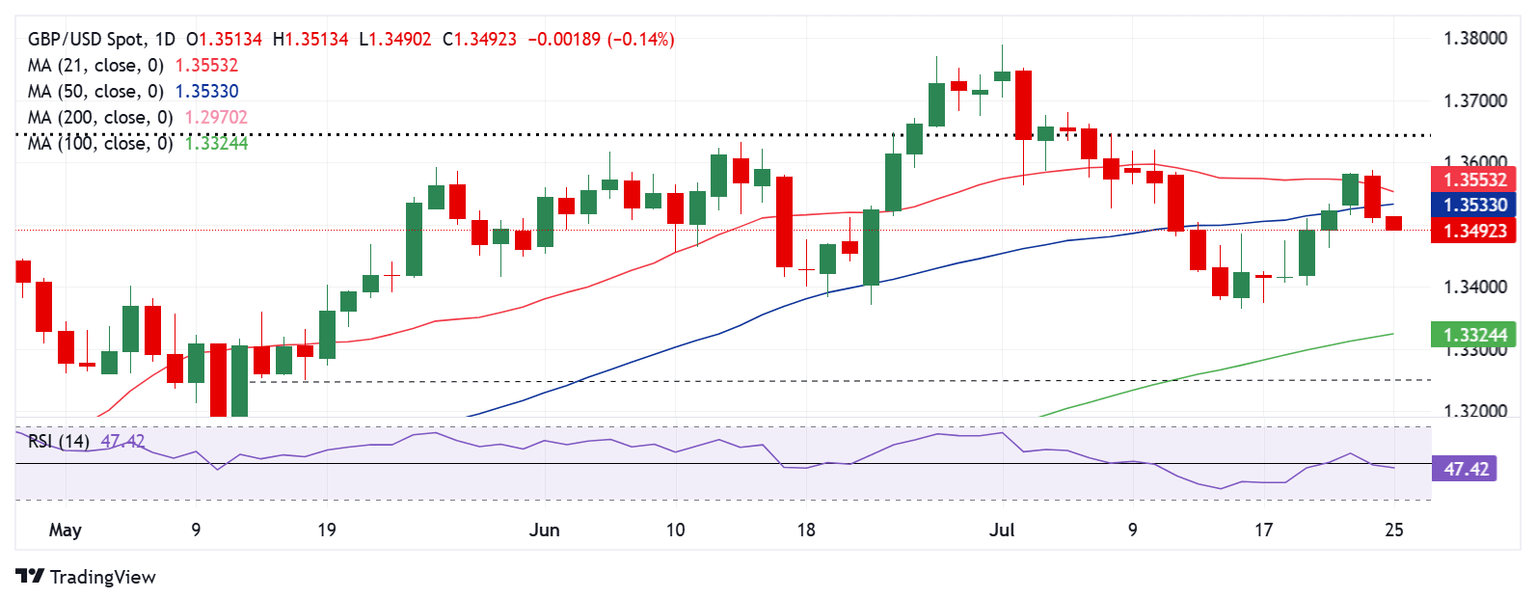

The daily chart shows that the GBP/USD pair failed to resist above the short-term 21-day Simple Moving Average (SMA), then near 1.3575, and came under intense selling pressure.

The renewed downside prompted the major to breach the 50-day SMA support at 1.3530, initiating a fresh downtrend.

The next strong support is seen at the July 16 low of 1.3365, below which the 1.3325-1.3300 demand area will be tested. That zone is the confluence of the 100-day SMA and the round level.

The mid-May low near 1.3250 could emerge as a tough nut to crack for sellers.

The 14-day Relative Strength Index (RSI) points lower below the midline, currently near 47, suggesting that sellers will likely retain control going forward.

Alternatively, strong resistance aligns near the 1.3600 threshold, above which the February 2022 high at 1.3643 must be decisively scaled.

GBP/USD breached the critical previous resistance-turned-support of the February 2022 high at 1.3643 on a sustained basis on Monday, paving the way for more bearishness.

The next topside hurdle is located at the 1.3700, followed by the 1.3750 psychological barrier.

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.