GBP/USD Price Forecast: Awaits BoE decision before the next leg up amid dovish Fed

- GBP/USD reverses an intraday dip amid the emergence of fresh selling around the USD.

- The Fed’s dovish signal caps the attempted USD recovery move from a multi-year low.

- Traders now look to the BoE policy decision for a fresh impetus ahead of the US data.

The GBP/USD pair attracts some buyers near the 1.3585 region on Thursday, and for now, it seems to have stalled the post-FOMC retracement slide from its highest level since early July, which it touched the previous day. The US Federal Reserve (Fed), as was widely anticipated, lowered borrowing costs for the first time since December 2024, by 25 basis points, putting the overnight funds rate in a range between 4.00%-4.25%. Moreover, the central bank indicated the need for two more interest rate cuts by the end of this year amid worries about a softening US labor market. The initial market reaction, however, turned out to be short-lived following Fed Chair Jerome Powell's remarks during the post-meeting press conference.

Powell told reporters that risks to inflation are tilted to the upside, and the move to lower interest rates was a risk management cut. Powell added that he doesn't feel the need to move quickly on rates and that the Fed is in a meeting-by-meeting situation regarding the outlook for interest rates. The US Dollar (USD) witnessed a dramatic intraday turnaround from its lowest level since February 2022, touched in reaction to the FOMC rate decision, and exerted pressure on the GBP/USD pair during the latter part of the US trading session on Wednesday. The USD bulls, however, struggle to capitalize on the subsequent move up, which, in turn, assists the GBP/USD pair to reverse an intraday slide on Thursday.

The British Pound (GBP), on the other hand, draws support from diminishing odds for an immediate rate cut by the Bank of England (BoE). The BoE will announce its decision later today and is expected to keep the benchmark interest rate unchanged amid concerns about sticky inflation. The Office for National Statistics (ONS) reported on Wednesday that the headline UK Consumer Price Index (CPI) rose 3.8% over the year in August, marking the highest level since January 2024. That said, signs of a cooling labour market keep the door open for further policy easing by the UK central bank. Nevertheless, this still marks a significant divergence in comparison to the Fed's dovish outlook and supports the GBP/USD pair.

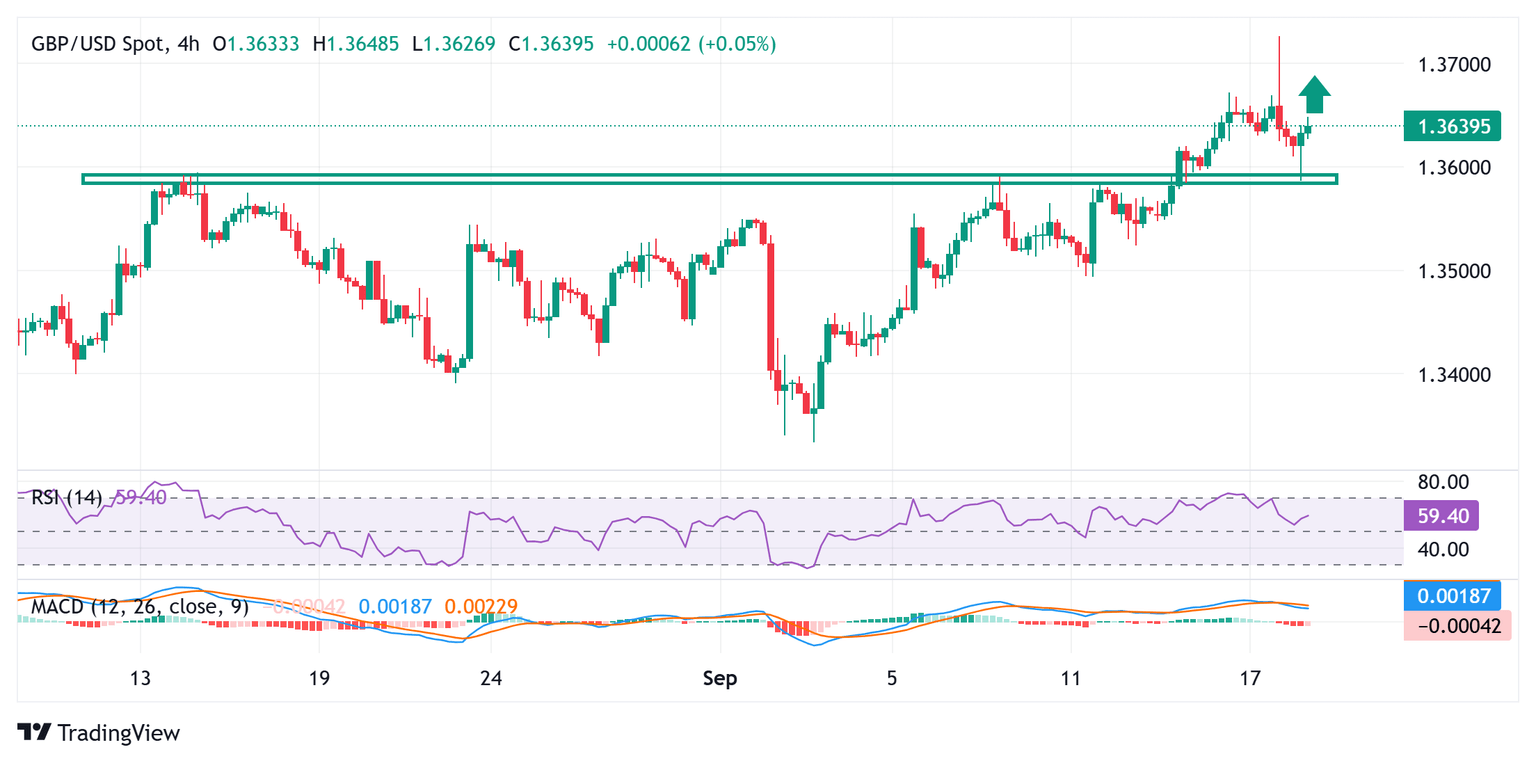

GBP/USD 4-hour chart

Technical outlook

This week's breakout through a strong horizontal barrier near the 1.3600 mark and the emergence of dip-buying on Thursday favor the GBP/USD bulls. Moreover, oscillators on the daily chart have been gaining positive traction and are still away from being in the overbought zone. This, in turn, suggests that the path of least resistance for spot prices remains to the upside and backs the case for additional gains towards reclaiming the 1.3700 round figure. The latter is closely followed by the overnight swing high, around the 1.3725 region, above which the pair could accelerate the momentum towards the 1.3745 intermediate hurdle en route to the 1.3800 neighborhood, or the year-to-date high touched in July.

On the flip side, the intraday low, around the 1.3585 region, which coincides with the aforementioned resistance breakpoint, might continue to protect the immediate downside. Any further slide is more likely to attract fresh buyers and remain limited near the 1.3555-1.3550 area. The latter should act as a strong support, which, if broken decisively, could prompt some technical selling and drag the GBP/USD pair to the 1.3500 psychological mark. The corrective decline could extend further towards the 1.3435-1.3430 support en route to the 1.3400 round figure.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.