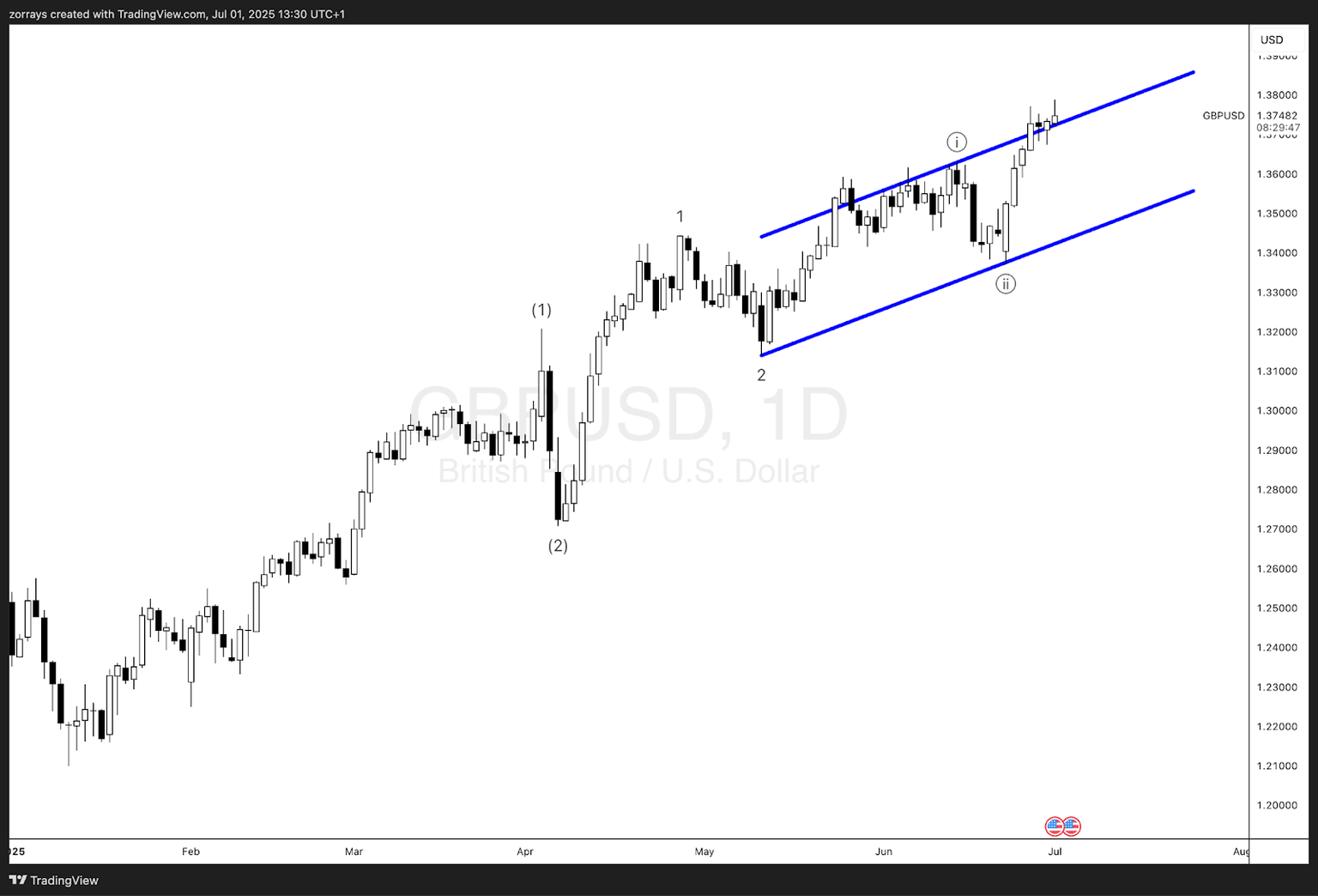

GBP/USD poised to break out: Wave ((iii)) of 3 of (3) set to accelerate beyond channel resistance

The current structure in GBP/USD (1D) suggests we are in the early stages of wave ((iii)) of 3 of (3) on a higher degree impulse cycle. The internal count from the wave (2) low clearly delineates wave (1)-(2), followed by wave 1-2 within wave (3), setting the stage for the heart of the move — wave ((iii)).

The price action has respected the boundaries of a well-defined ascending channel, with subwaves i and ii of ((iii)) already forming. The powerful rally off the wave ii low, breaking above minor wave i high with momentum, supports the view that wave ((iii)) is now underway.

Key observations

-

Wave ((ii)) retraced deep into the previous consolidation zone but respected channel support, a classic setup for a strong wave ((iii)) extension.

-

Price is pressing against the upper bound of the channel, and given the impulsive structure and wave dynamics, a channel breakout is likely imminent.

-

Wave ((iii)) tends to be the most powerful segment in an impulse — we can expect increased volume, momentum, and verticality in price action as it progresses.

-

Upon a confirmed breakout, wave 3 of (3) targets should align with Fibonacci extensions of the initial wave (1)-(2) move, potentially reaching above 1.3900–1.4000 in the coming weeks.

Outlook:

We anticipate a bullish breakout beyond the upper channel resistance as wave ((iii)) of 3 accelerates. Traders should look for confirmation through impulsive candles and higher highs with supporting internals on lower timeframes. Pullbacks will likely be shallow and bought quickly as the wave gains traction.

Author

Zorrays Junaid

Alchemy Markets

Zorrays Junaid has extensive combined experience in the financial markets as a portfolio manager and trading coach. More recently, he is an Analyst with Alchemy Markets, and has contributed to DailyFX and Elliott Wave Forecast in the past.