GBP/USD Outlook: Weaker USD-inspired rally could fade rather quickly, UK/US macro data in focus

- GBP/USD attracts some buying on Monday and is supported by broad-based USD weakness.

- Bets for one more Fed rate hike in 2023 should limit the USD losses and cap gains for the pair.

- Expectations for an end of the BoE’s policy-tightening cycle might contribute to keeping a lid.

The GBP/USD pair rallies over 60 pips from the daily trough, around the 1.2465 region and maintains its bid tone near a three-day peak during the early European session on Monday. Spot prices currently trade near the 1.2525-1.2530 region, up 0.50% for the day, and for now, seems to have snapped a four-day losing streak to the lowest level since June 8 touched last week.

The intraday positive move is exclusively sponsored by a sharp US Dollar (USD) pullback from a six-month top, triggered by the hawkish Bank of Japan (BoJ)-inspired strong move up in the Japanese Yen (JPY). The USD decline could further be attributed to some repositioning trade ahead of this week's release of the US consumer inflation figures, due on Wednesday. The crucial US CPI report will play a key role in influencing market expectations about the Federal Reserve's (Fed) policy outlook, which, in turn, will determine the near-term trajectory for the USD and provide some meaningful impetus to the GBP/USD pair.

Heading into the key data risk, investors will take cues from the UK jobs report and the monthly GDP report, scheduled for release on Tuesday and Wednesday, respectively. In the meantime, the prospects for further policy tightening by the Fed should act as a tailwind for the buck and keep a lid on any meaningful upside for the GBP/USD pair. Comments by several Fed officials last week ensured that the Fed won't raise interest rates again in September. The markets, however, seem convinced that the Fed will keep interest rates higher for longer and have been pricing in the possibility of one more 25 bps lift-off by the end of this year.

The bets were reaffirmed by the upbeat US macro data released last week, which continued to point to an extremely resilient economy. Moreover, The Wall Street Journal reported that some officials still prefer to err on the side of raising rates too much, reasoning that they can cut them later. This, in turn, remains supportive of elevated US Treasury bond yields, which, along with a generally weaker tone around the equity markets, should help limit losses for the safe-haven Greenback. Apart from this, expectations that the Bank of England (BoE) is nearing the end of its policy tightening cycle might contribute to capping gains for the GBP/USD pair.

It is worth mentioning that BoE Governor Andrew Bailey warned last Wednesday that borrowing costs might still have further to rise because of stubbornly high inflation. Bailey, however, told lawmakers that the central bank is much nearer to ending its run of rate increases. This, in turn, makes it prudent to wait for strong follow-through buying before confirming that the GBP/USD pair has formed a near-term bottom and positioning for any further appreciating move. In the absence of any relevant market-moving economic data, either from the UK or the US, the USD price dynamics will continue to drive the GBP/USD pair on Monday.

Technical Outlook

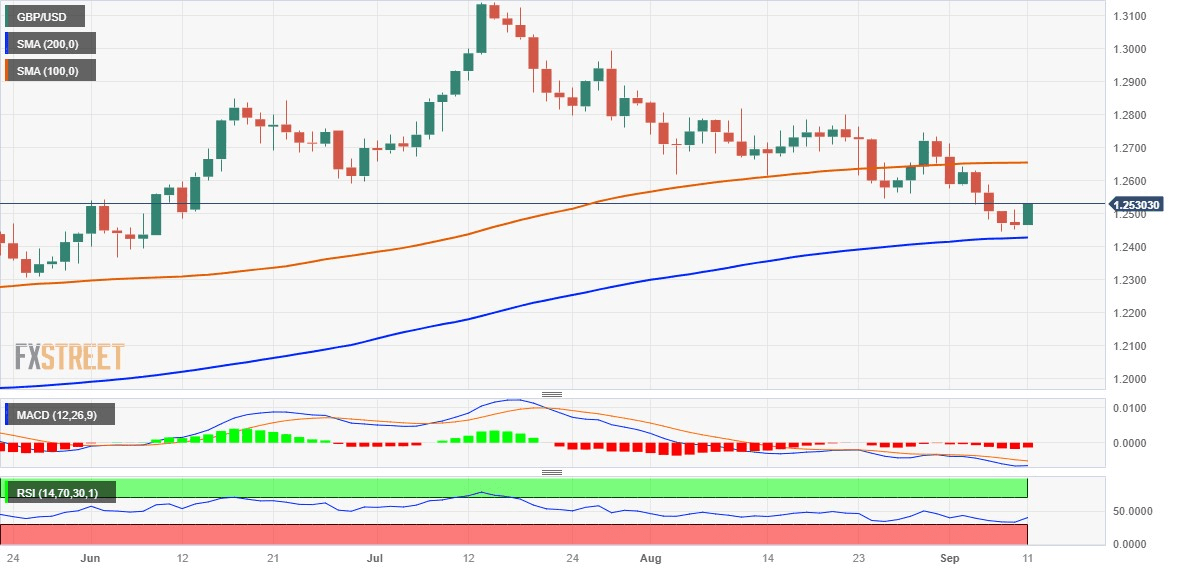

From a technical perspective, the attempted recovery move-up is more likely to confront resistance near the 1.2555-1.2560 region ahead of the 1.2600 round-figure mark. Any subsequent strength might still be seen as a selling opportunity and remain capped near the mid-1.2600s. The latter coincides with the 100-day Simple Moving Average (SMA), which if cleared decisively will suggest that the recent downward trajectory witnessed over the past two months or so has run its course and shift the near-term bias in favour of bullish traders.

On the flip side, the 1.2500 psychological mark now seems to protect the immediate downside. This is followed by the 1.2445 area, or the multi-month low touched last week, and the 200-day SMA, currently around the 1.2425 region. Some follow-through selling, leading to a break and acceptance below the 1.2400 mark will be seen as a fresh trigger for bearish traders and make the GBP/USD pair vulnerable. The subsequent downfall will expose the May monthly swing low, around the 1.2310-1.2300 area, before spot prices drop to the 1.2280-1.2275 support zone.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.