GBP/USD outlook: Rises above psychological 1.30 barrier following better than expected UK GDP data

GBP/USD

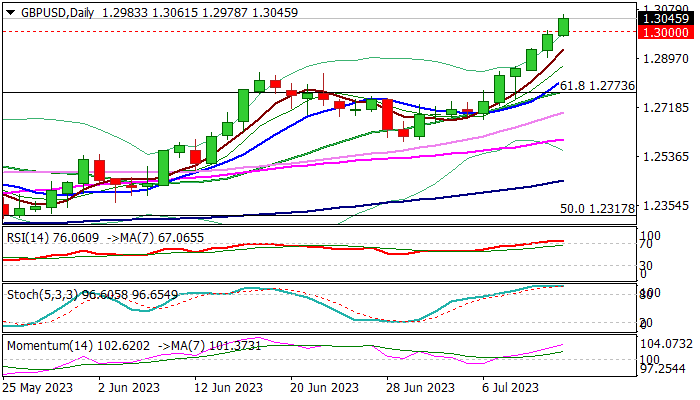

Cable surged through psychological 1.30 barrier on Thursday and hit the highest since mid-April 2022, after receiving fresh boost from better than expected UK May GDP data.

UK economy contracted by 0.1% in May, beating expectations for 0.3% contraction, adding to pound’s positive sentiment on further weakening of the US dollar, following below-forecast US June CPI.

Recent break of 200WMA (1.2882) and lift above 1.30 level, generate bullish signals which will be verified on weekly close above these levels and open way for extension through initial barrier at 1.3140 (monthly cloud) top), towards 1.3328 (Fibo 76.4% retracement of 1.4249/1.0348 downtrend).

Firmly bullish structure on daily chart could be obstructed by strongly overbought conditions, which may keep bulls on hold for price adjustment.

Dips should provide better levels to re-enter bullish market, with rising daily Tenkan-sen (1.2860) expected to hold and keep larger bulls intact.

Res: 1.3105; 1.3140; 1.3203; 1.3264.

Sup: 1.3000; 1.2932; 1.2882; 1.2860.

Interested in GBP/USD technicals? Check out the key levels

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.