GBP/USD Outlook: Move beyond 1.3900 mark should pave the way for additional gains

- GBP/USD gained traction for the sixth consecutive session on Monday and shot to two-week tops.

- Reduced Fed rate hike bets, sliding US bond yields undermined the USD and remained supportive.

- The set-up favours bullish traders and supports prospects for a move beyond the 1.3900 mark.

The GBP/USD pair witnessed a dramatic turnaround on Friday and rallied over 125 pips from intraday swing lows, around the 1.3715 region. A strong pickup in the US Treasury bond yields extended some support to the US dollar, which, in turn, was seen as a key factor that exerted some downward pressure on the major. However, diminishing odds for an earlier than anticipated Fed lift-off kept a lid on any meaningful gains for the USD and helped limit any further losses, rather assisted the pair to attract some dip-buying at lower levels.

Despite the incoming strong US economic data, investors seem convinced that any spike in inflation was likely to be transitory and that the Fed will keep interest rates near zero levels for a longer period. On the economic data front, slightly better US housing market data for March – Building Permits and Housing Starts – was overshadowed by softer Michigan Consumer Sentiment Index and failed to provide any respite to the USD bulls. Apart from this, the underlying bullish tone in the financial markets further undermined the safe-haven USD.

Bulls seemed rather unaffected by concerns about a link between the AstraZeneca COVID-19 vaccine and a rare blood clot, instead took cues from the recent easing of lockdown restrictions in the UK. It is worth reporting that the UK's medical regulator had issued a temporary ban on the jab for the below 30 age group, which fueled speculations about a possible delay in the UK government's plan to reopen the economy. Nevertheless, the pair ended near the top end of its daily trading range and gained traction for the sixth consecutive session on Monday.

The momentum pushed the pair beyond mid-1.3800s, or near two-week tops during the Asian session. There isn't any major market-moving economic data due for release on Monday, either from the UK or the US, leaving the pair at the mercy of the USD price dynamics. Meanwhile, fears about another dangerous wave of coronavirus infections globally weighed on investors' sentiment. This might extend some support to the safe-haven USD and keep a lid on any meaningful upside for the major, at least for the time being.

Short-term technical outlook

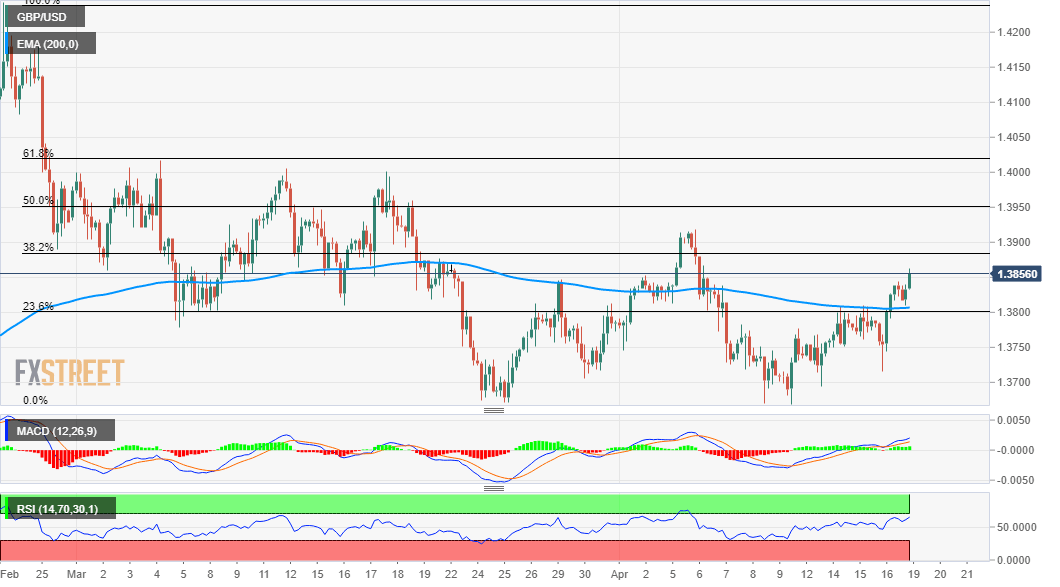

From a technical perspective, Friday’s convincing break through the 23.6% Fibonacci level of the 1.4243-1.3669 corrective slide remained supportive of the follow-through positive move. Given bullish technical indicators on 4-hour/daily charts, a subsequent move towards the 38.2% Fibo. level, around the 1.3890-1.3900 region, now looks a distinct possibility. Some follow-through buying should negate any near-term negative bias and push the pair further towards the 50% Fibo. level, around mid-1.3900s, above which bulls are likely to aim back to reclaim the key 1.4000 psychological mark.

On the flip side, the 23.6% Fibo. level, around the 1.3800 mark, coinciding with 200-period EMA on the 4-hour chart, should now act as strong support. Sustained weakness below might prompt some technical selling and drag the pair back towards the 1.3755 intermediate support. Failure to defend the mentioned support levels might turn the pair vulnerable to slide back to the 1.3700 mark en-route multi-week lows, around the 1.3670-65 support zone.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.