GBP/USD outlook: Key support zone remains under pressure ahead of US-UK trade deal announcement

GBP/USD

Cable holds in red on Thursday and pressuring key support zone after overnight’s 0.5% jump on news of possible US/UK trade deal, was quickly reversed.

The US President Trump is expected to announce the details of initial trade deal with Great Britain later today that would mark a foundation for further negotiations.

Meanwhile, The Bank of England’s MPC will hold their policy meeting today and widely expected to cut interest rates by 0.25%.

Overall situation looks a bit brighter, as uncertainty over US tariffs started to fade, energy prices were lower, and inflation outlook looks more optimistic that would provide more space for maneuver for the central bank.

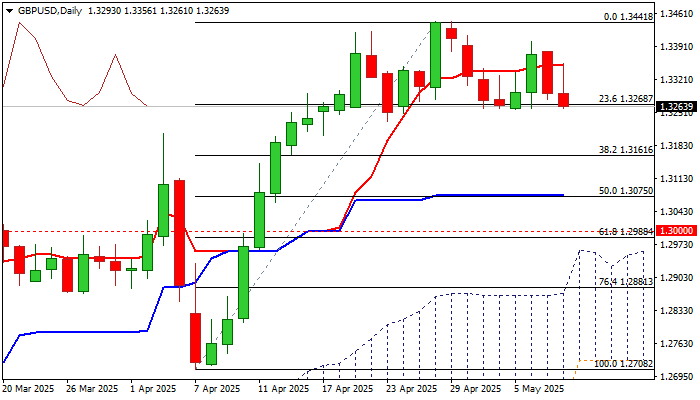

Technical picture on daily chart is expected to remain predominantly bullish while the price action holds above 1.3250 zone (floor of recent range / Fibo 23.6% retracement of 1.2708/1.3444 upleg) where several attacks were recently rejected.

However, warning signals from falling 14-d momentum which is attempting to break into negative territory, may contribute to renewed probes through key supports, with firm break of 1.3270/34 pivots to open way for deeper correction and expose immediate targets at 1.3200 (psychological) and 1.3161 (Fibo 38.2% / 30DMA).

Conversely, ability to hold above recent range floor would signal further sideways mode, though with bearish bias as long as the price stays in the lower part of the range and capped under daily Tenkan-sen (1.3351).

Res: 1.3295; 1.3351; 1.3402; 1.3444.

Sup: 1.3232; 1.3200; 1.3163; 1.3100.

Interested in GBP/USD technicals? Check out the key levels

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.