GBP/USD Outlook: Bulls could aim to retest double-top resistance near 1.2445-50 area

- GBP/USD edges lower and erodes a part of the overnight gains to a fresh multi-week top.

- A modest USD uptick is seen as a key factor exerting some downward pressure on the pair.

- The fundamental backdrop favours bullish traders and supports prospects for further gains.

The GBP/USD pair struggles to capitalize on its two-day-old uptrend to the highest level since early February and attracts some sellers in the vicinity of mid-1.2300s during the Asian session on Wednesday. The downtick is sponsored by a modest US Dollar (USD) uptick, though lacks follow-through and is more likely to remain limited. A combination of factors should hold back the USD bulls from placing aggressive bets and act as a tailwind for the major. Against the backdrop of the Federal Reserve's less hawkish stance, easing fears of a full-blown banking crisis might continue to cap any meaningful upside for the safe-haven buck.

It is worth recalling that the US central bank last week toned down its approach to reining in inflation and signalled that a pause to interest rate hikes was on the horizon. Adding to this, the takeover of Silicon Valley Bank by First Citizens Bank & Trust Company calmed market nerves about the contagion risk. Furthermore, US regulators reiterated strength in the banking system and helped reverse the recent negative sentiment in the markets. This, coupled with the lack of negative news from the banking sector over the past two weeks, boosts investors' confidence and remains supportive of a generally positive risk tone.

The British Pound, on the other hand, could draw support from the hawkish comments by the Bank of England (BoE) Governor Andrew Bailey, saying that interest rates may have to move higher if there were signs of persistent inflationary pressure. The bets were reaffirmed after the British Retail Consortium (BRC) reported that UK shop prices increased from 8.4% previously to 8.9% in the year to March. This was the highest reading on record since the survey started in 2005. Furthermore, food prices increased 15.0% over the year, also a record high, which supports prospects for some meaningful upside for the GBP/USD pair.

Going forward, there isn't any relevant macro data due for release on Wednesday from the UK, while the US economic docket features Pending Home Sales figures. This, along with the broader risk sentiment, might influence the USD price dynamics and provide some impetus to the GBP/USD pair. The focus, however, will remain glued to the final US Q4 GDP print on Thursday and the Fed's preferred inflation gauge - the Core PCE Price Index on Friday.

Technical Outlook

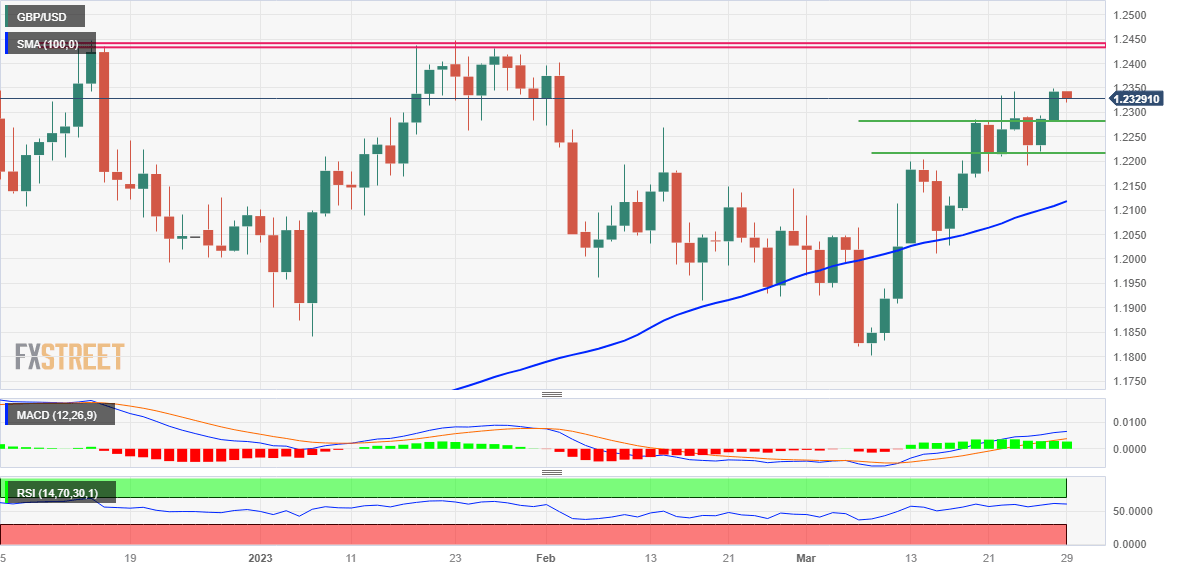

From a technical perspective, any subsequent pullback is likely to find some support near the 1.2300 mark ahead of the 1.2280 horizontal zone. A further decline might still be seen as a buying opportunity and remain limited around the 1.2220-1.2215 area, or the weekly low. This is closely followed by the 1.2200 round figure, below which the GBP/USD pair could accelerate the slide towards the 100-day Simple Moving Average (SMA), currently around the 1.2110-1.2100 region. A convincing break below the latter will negate the positive outlook and shift the near-term bias in favour of bearish traders, paving the way for deeper losses.

On the flip side, the 1.2345-1.2350 region now seems to have emerged as an immediate strong hurdle. Some follow-through buying should allow the GBP/USD pair to reclaim the 1.2400 mark. The momentum could get extended towards the double-top strong barrier, around mid-1.2400s, which if cleared decisively will mark a fresh bullish breakout and set the stage for an extension of the recent upward trajectory witnessed over the past three weeks or so.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.