GBP/USD outlook: Bulls accelerate for the second straight day and approach strong barriers

GBP/USD

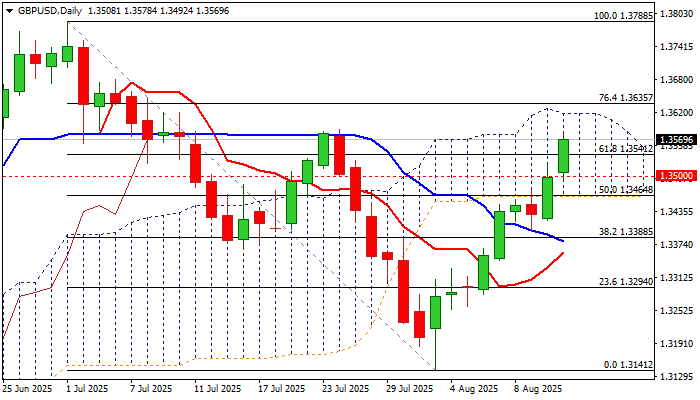

Cable continues to trend higher and nears key near-term barriers at 1.3588 (July 24 high) and 1.3618 (daily Ichimoku cloud top).

Weaker dollar on fresh signals of Fed rate cuts (the first cut to be expected in September) and latest data from UK labor sector, which do not urge BoE for immediate rate cuts, provided good support for sterling in last two sessions.

Break above psychological 1.3500 barrier (reinforced by 55DMA) and 1.3541 (Fibo 61.8% of 1.3788/1.3141) generated fresh bullish signal (to be confirmed on close above the latter).

Technical picture turned bullish on daily chart (north-heading 14-d momentum broke into positive territory / MA’s in full bullish setup, with formation of 10/100 DMA bull-cross) and support the action.

Bulls approach significant resistances (1.3588/1.3618) where increased headwinds cannot be ruled out, as Stochastic is strongly overbought.

Limited dips (ideally to be contained by 1.3500 zone ( to mark a healthy correction before bulls regain traction for final push through 1.3588/1.3618 triggers.

Firm break here to unmask key target at 1.3788 (2025 high, the highest since Oct 2021).

Res: 1.3588; 1.3618; 1.3635; 1.3700.

Sup: 1.3541; 1.3500; 1.3464; 1.3419.

Interested in GBP/USD technicals? Check out the key levels

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.