GBP/USD outlook: Action in early Monday lacks direction but overall picture remains bearish

GBP/USD

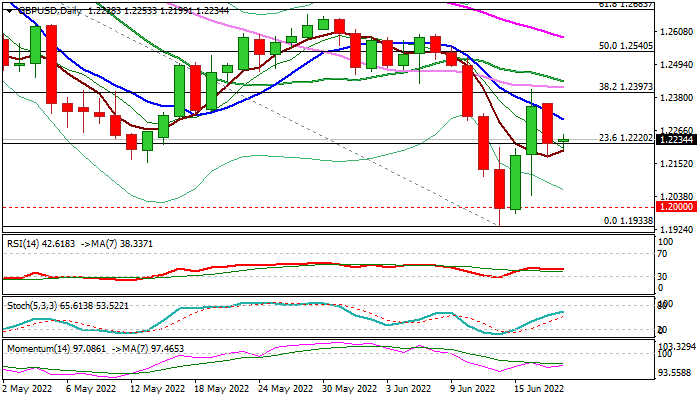

Cable is consolidation after 1.1% drop on Friday, which was contained by 5DMA, with a narrow range in early Monday suggesting a lack of direction.

Daily studies are bearishly aligned with strong negative momentum and MA’s in bearish setup that keeps the downside vulnerable.

On the other side, Friday’s hammer candle after strong rejection on probe through psychological 1.20 level, signal formation of bear-trap and generate initial signal which needs more upside action for confirmation.

Lift above 1.2397 (Fibo 38.2% of 1.3147/1.1933) would improve near-term structure and signal further recovery.

Conversely, break and close below 5DMA (1.2196) would risk retest of 1.20 pivot, loss of which would open way for fresh extension of larger downtrend.

Res: 1.2303; 1.2360; 1.2397; 1.2434.

Sup: 1.2196; 1.2155; 1.2041; 1.2000.

Interested in GBP/USD technicals? Check out the key levels

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.