GBP/USD: Inflation shock lifts cable past key resistance – What's next?

UK inflation surprised markets in April, jumping to 3.5%, the highest rate since January 2024. The unexpected surge was largely driven by rising household bills and sticky services inflation. This inflationary spike complicates the Bank of England's (BoE) path forward, casting doubt on the likelihood of near-term rate cuts and fueling expectations that rates may remain elevated for longer than anticipated.

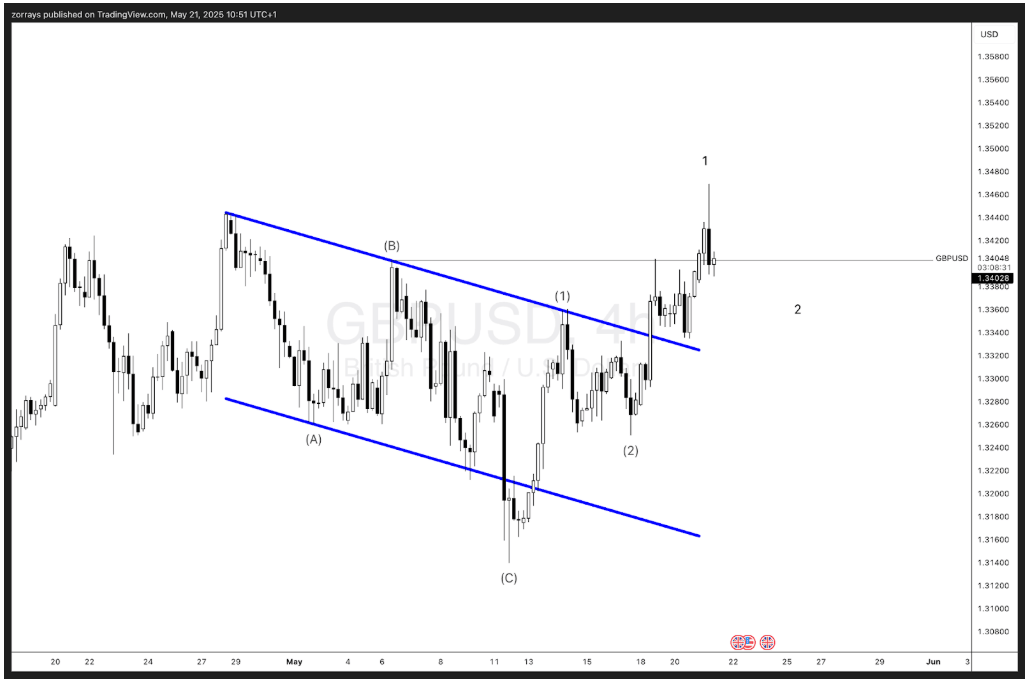

Technical breakout confirms bullish shift

From a technical standpoint, GBP/USD has broken decisively above the 1.3400 key resistance level — a major psychological and structural barrier. More significantly, price action has also taken out the Year-To-Date highs, confirming a shift in bullish momentum.

Looking at the Elliott Wave structure in the 4-hour chart, we observe the completion of a classic A-B-C corrective pattern, which was followed by an impulsive breakout. The chart appears to suggest the beginning of a wave (3) structure, with wave 1 of (3) likely completed.

What to expect next: Wave 2 pullback or continuation?

Given the sharp breakout and follow-through, we may now be entering a wave 2 corrective phase. However, if the current bullish momentum holds, this correction is unlikely to be deep. Instead, a shallow retracement towards previous resistance-turned-support (around 1.3350–1.3380) could offer a potential buy-the-dip opportunity for traders positioning for a larger wave 3 rally.

This is a make-or-break zone for GBP/USD:

- Holding above 1.3400 could validate the start of a longer-term bullish impulse.

- Failure to hold above this level might delay the bullish scenario and suggest deeper corrective potential.

In summary, macroeconomic pressures and strong technical confirmation suggest a pivotal moment for Cable. Eyes will now turn to how GBP/USD behaves in the next few sessions — whether bulls maintain control or if sellers step in for a temporary pause.

Author

Zorrays Junaid

Alchemy Markets

Zorrays Junaid has extensive combined experience in the financial markets as a portfolio manager and trading coach. More recently, he is an Analyst with Alchemy Markets, and has contributed to DailyFX and Elliott Wave Forecast in the past.