GBP/USD Forecast: Risk flows to help Pound Sterling gather further strength

- GBP/USD has managed to reclaim 1.2000 following Monday's decline.

- The pair could continue to stretch higher in case risk flows dominate the markets.

- Next key resistance is located at around 1.2100.

GBP/USD has regathered its traction and climbed above 1.2000 after having lost nearly 100 pips on Monday. In case risk flows continue to dominate the financial markets on Tuesday, the pair could continue to stretch higher. The near-term technical outlook also points to a pickup in bullish momentum.

Renewed optimism about China moving away from its zero-Covid policy seems to be helping the market mood improve early Tuesday. During the Asian trading hours, Global Times commentator Hu Xijin said, via Twitter, that China could "walk out of the shadow of Covid" sooner than expected. Additionally, in a move seen as an important step toward reopening, China's National Health Commission announced that they will strengthen vaccination for the elderly.

Mirroring the risk-positive market atmosphere, the UK's FTSE 100 Index is up nearly 1% on the day and US stock index futures are rising between 0.3% and 0.6%.

The risk perception has been having a significant impact on the US Dollar's valuation lately and a sharp increase in Wall Street's main indexes after the opening bell could put additional weight on the currency.

Later in the day, Bank of England (BOE) Governor Andrew Bailey will testify before the Lords Economic Affairs Committee.

Earlier in the month, Bailey told the UK Treasury Select Committee that they are likely to increase interest rates further. Bailey is likely to stick the narrative by noting that they will continue to hike rates but stop before reaching the 5.2% peak rate that was priced into markets. Hence, the risk sentiment is likely to continue to drive the pair's action in the second half of the day.

GBP/USD Technical Analysis

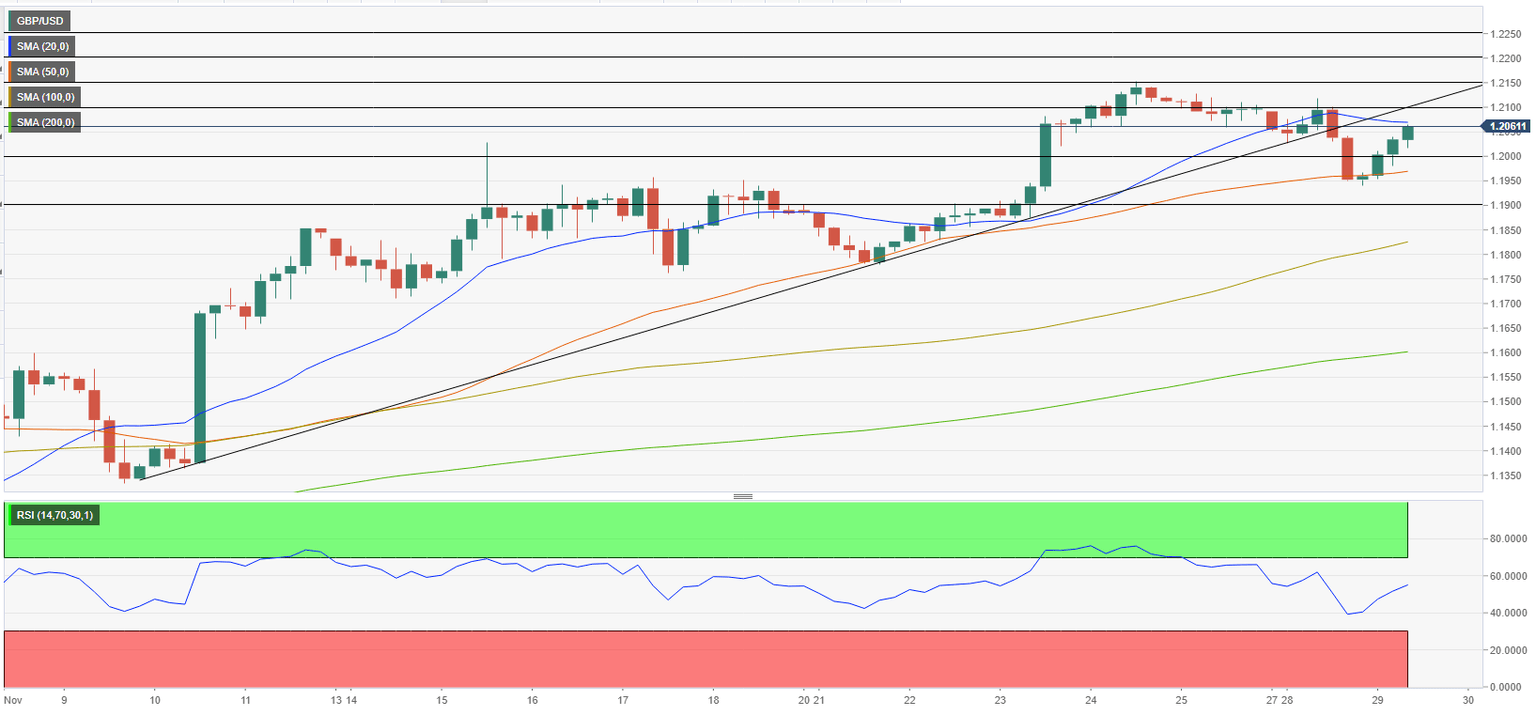

The Relative Strength Index (RSI) indicator on the four-hour chart climbed above 50 early Tuesday, suggesting that buyers remain interested in the Pound Sterling. The ascending trend line forms key resistance at 1.2100. In case the pair rises above that level and makes a four-hour close there, it could target 1.2150 (static level) and 1.2200 (psychological level)

On the downside, 1.2000 (psychological level) aligns as first support before 1.1960 (50-period Simple Moving Average (SMA)) and 1.1900 (psychological level, static level).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.