- GBP/USD has been rising amid hopes for US fiscal stimulus, but everything else is playing against the pair.

- Rising British COVID-19 cases may trigger new restrictions, weighing on the pound.

- UK GDP missed estimates, yet no new stimulus is likely.

- Brexit negotiations are unlikely to move until the last moment.

Is cable mounting its last climb? GBP/USD is trading closer to the top of the range, buoyed by hopes for US fiscal stimulus. President Donald Trump backtracked on canceling talks with Democrats after markets fell earlier in the week, and is now pushing them higher with the willingness to compromise. In turn, the safe-haven dollar is down. However, the pound has its own issues.

1) Stimulus asymmetry: While America's potential relief package is still unknown, Britain's less-generous furlough scheme is already priced into sterling. That is the first bearish factor.

Chancellor of the Exchequer Rishi Sunak is set to lay out a reduced program to aid employees who are unable to work due to the pandemic. The move was already made known a few weeks ago, and Sunak's official announcement is unlikely to help the pound. Moreover, paying only two-thirds of salaries is set to hurt consumption.

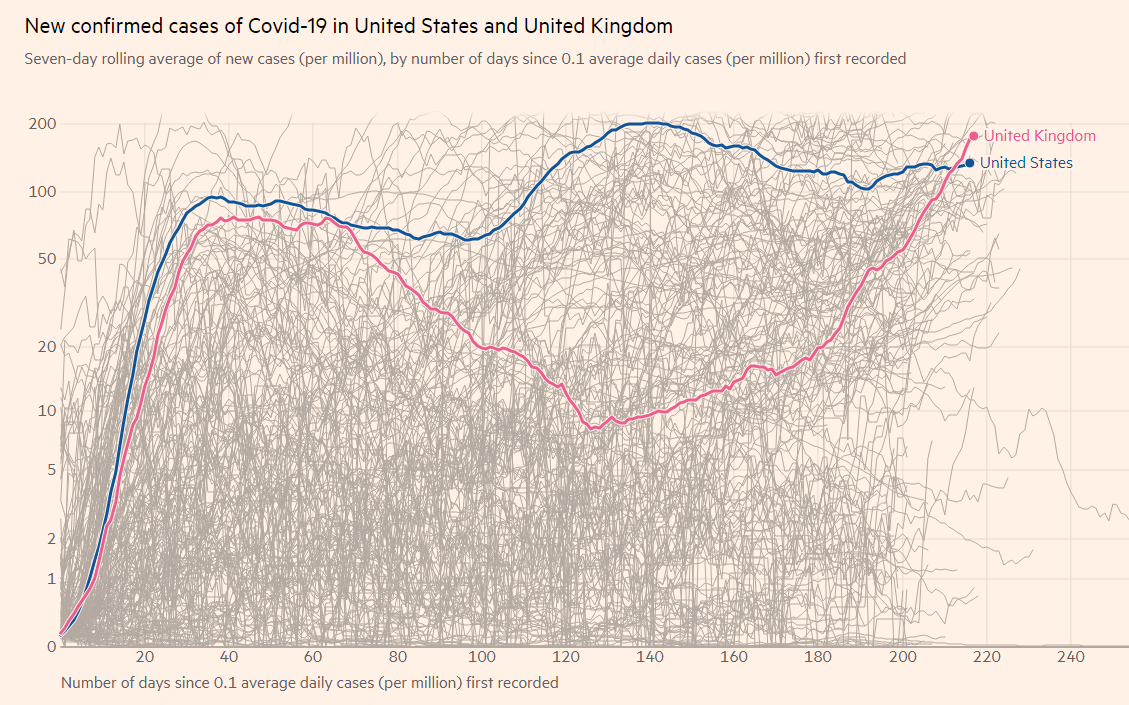

2) Rising coronavirus cases: The lower temperatures are forcing people to spend more time inside, and eroding support in the government may prompt people to flout social distancing rules. There may be other reasons for the increase in coronavirus cases, but the result is clear – rising pressure on the National Health Service.

Source: FT

The government is contemplating imposing new restrictions in the northwest, where the disease is spreading at a rapid clip. That implies reduced economic activity going forward.

3) The economy was not doing that great: Gross Domestic Product figures for August – when the mercury was higher – badly disappointed. Output grew by only 2.1%, contrary to expectations for more than double that amount. Moreover, July's GDP statistic was revised down to 6.4%.

While these figures look robust in absolute terms, they come after a devastating drop in the spring. The chances that the Bank of England sets negative interest rates is growing.

4) Brexit: The saga continues with ups and downs – and Friday will likely be a down day. Chief EU Negotiator Michel Barnier tends to release updates on the talks at the end of the working week and he almost always downbeat. In any case, no breakthrough is likely before the EU Summit next week. London and Brussels remain at odds over state aid and fisheries.

Overall, optimism about the US stimulus is unlikely to keep cable afloat.

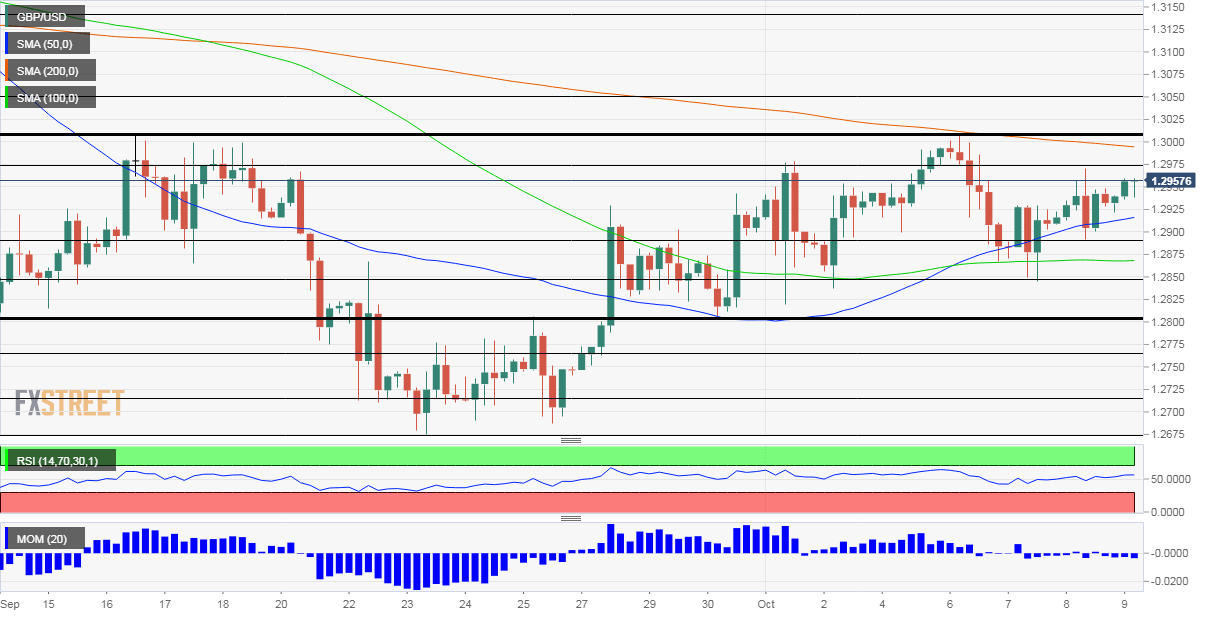

GBP/USD Technical Analysis

Pound/dollar is trading above the 50 and 100 Simple Moving Averages but suffers from downside momentum. The recent range trading has balanced the technical picture.

Support awaits at 1.2885, which was a low point on Thursday, and it is followed by 1.2850 and 1.28.

Resistance is at 1.2975, Thursday's high, followed by the all-important 1.30 level. The next line to watch is 1.3050.

More: State of the race: Where do Trump and Biden stand after the first debates, fast news

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

GBP/USD remains on the defensive below 1.2450 ahead of UK Retail Sales data

GBP/USD remains on the defensive near 1.2430 during the early Asian session on Friday. The downtick of the major pair is backed by the stronger US Dollar as the strong US economic data and hawkish remarks from the Fed officials have triggered the speculation that the US central bank will delay interest rate cuts to September.

EUR/USD extends its downside below 1.0650 on hawkish Fed remarks

The EUR/USD extends its downside around 1.0640 after retreating from weekly peaks of 1.0690 on Friday. The hawkish comments from Federal Reserve officials provide some support to the US Dollar.

Gold: Middle East war fears spark fresh XAU/USD rally, will it sustain?

Gold price is trading close to $2,400 early Friday, reversing from a fresh five-day high reached at $2,418 earlier in the Asian session. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row.

Bitcoin Price Outlook: All eyes on BTC as CNN calls halving the ‘World Cup for Bitcoin’

Bitcoin price remains the focus of traders and investors ahead of the halving, which is an important event expected to kick off the next bull market. Amid conflicting forecasts from analysts, an international media site has lauded the halving and what it means for the industry.

Israel vs. Iran: Fear of escalation grips risk markets

Recent reports of an Israeli aerial bombardment targeting a key nuclear facility in central Isfahan have sparked a significant shift out of risk assets and into safe-haven investments.