GBP/USD Forecast: Pound Sterling sellers hesitate ahead of US NFP data

- GBP/USD stabilizes above 1.2400 after closing in the red on Thursday.

- The BoE cut the policy rate by 25 bps as expected but the vote-split weighed on Pound Sterling.

- January Nonfarm Payrolls data from the US could drive the USD's valuation in the American session.

GBP/USD lost its traction and dropped to a multi-day low below 1.2400 on Thursday following the Bank of England's (BoE) monetary policy announcements. After staging a rebound in the American session, the pair seems to have stabilized above 1.2400 early Friday.

British Pound PRICE This week

The table below shows the percentage change of British Pound (GBP) against listed major currencies this week. British Pound was the strongest against the US Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.21% | -0.38% | -2.12% | -2.67% | -1.24% | -1.55% | -1.06% | |

| EUR | 0.21% | 0.23% | -0.63% | -1.19% | -0.58% | -0.05% | 0.44% | |

| GBP | 0.38% | -0.23% | -1.93% | -1.41% | -0.80% | -0.27% | 0.22% | |

| JPY | 2.12% | 0.63% | 1.93% | -0.56% | 1.05% | 1.50% | 1.72% | |

| CAD | 2.67% | 1.19% | 1.41% | 0.56% | 0.37% | 1.16% | 1.66% | |

| AUD | 1.24% | 0.58% | 0.80% | -1.05% | -0.37% | 0.53% | 1.02% | |

| NZD | 1.55% | 0.05% | 0.27% | -1.50% | -1.16% | -0.53% | 0.49% | |

| CHF | 1.06% | -0.44% | -0.22% | -1.72% | -1.66% | -1.02% | -0.49% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

The BoE lowered the policy rate by 25 basis points (bps) at the February policy meeting, as widely anticipated. Two members of the Monetary Policy Committee (MPC), however, unexpectedly voted in favor of a 50 bps cut, triggering a Pound Sterling selloff with the immediate reaction.

In the post-meeting press conference, "we must judge in future meetings whether underlying inflation pressures are easing enough to allow further cuts" BoE Governor Andrew Bailey said and helped GBP/USD find a foothold.

The US Bureau of Labor Statistics will publish the employment report for January later in the day. Nonfarm Payrolls (NFP) are forecast to rise by 170,000, following the 256,000 increase recorded in December. In the same period, the Unemployment Rate is seen holding steady at 4.1%.

A positive surprise, with an NFP reading above 200,000, could boost the USD in the American session and force GBP/USD to stretch lower. On the other hand, a print below 150,000 could revive expectations for a Federal Reserve (Fed) rate cut in March and open the door for a leg higher in the pair.

GBP/USD Technical Analysis

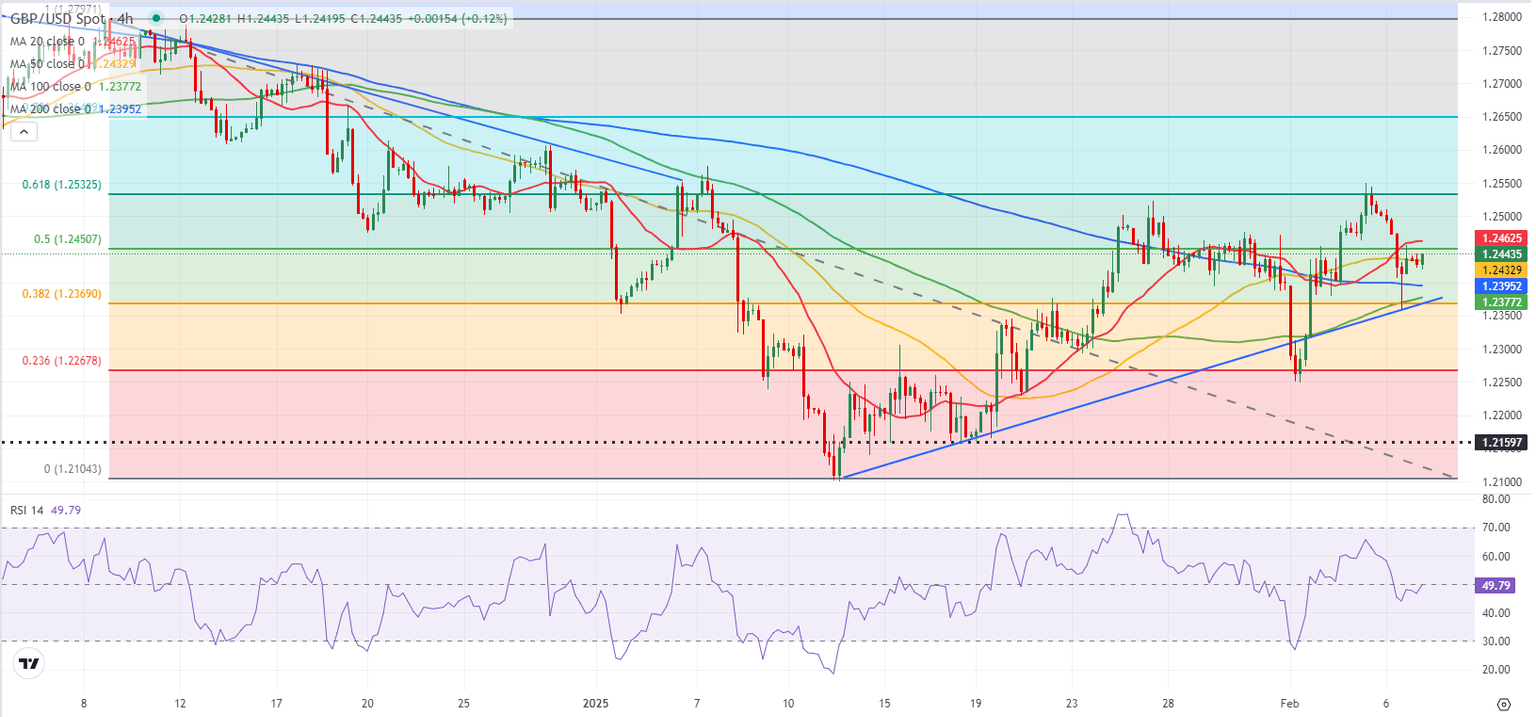

Despite Thursday's pullback, the Relative Strength Index (RSI) indicator on the 4-hour chart stays near 50 and GBP/USD holds above the ascending trend line, reflecting sellers' hesitancy.

GBP/USD could face immediate resistance at 1.2450 (Fibonacci 50% retracement of the latest downtrend) ahead of 1.2500 (static level, round level) and 1.2530 (Fibonacci 61.8% retracement). On the downside, the 200-period Simple Moving Average (SMA) could act as first support at 1.2400 before 1.2370 (Fibonacci 38.2% retracement, ascending trend line, 100-period SMA) and 1.2300 (static level, round level).

Nonfarm Payrolls FAQs

Nonfarm Payrolls (NFP) are part of the US Bureau of Labor Statistics monthly jobs report. The Nonfarm Payrolls component specifically measures the change in the number of people employed in the US during the previous month, excluding the farming industry.

The Nonfarm Payrolls figure can influence the decisions of the Federal Reserve by providing a measure of how successfully the Fed is meeting its mandate of fostering full employment and 2% inflation. A relatively high NFP figure means more people are in employment, earning more money and therefore probably spending more. A relatively low Nonfarm Payrolls’ result, on the either hand, could mean people are struggling to find work. The Fed will typically raise interest rates to combat high inflation triggered by low unemployment, and lower them to stimulate a stagnant labor market.

Nonfarm Payrolls generally have a positive correlation with the US Dollar. This means when payrolls’ figures come out higher-than-expected the USD tends to rally and vice versa when they are lower. NFPs influence the US Dollar by virtue of their impact on inflation, monetary policy expectations and interest rates. A higher NFP usually means the Federal Reserve will be more tight in its monetary policy, supporting the USD.

Nonfarm Payrolls are generally negatively-correlated with the price of Gold. This means a higher-than-expected payrolls’ figure will have a depressing effect on the Gold price and vice versa. Higher NFP generally has a positive effect on the value of the USD, and like most major commodities Gold is priced in US Dollars. If the USD gains in value, therefore, it requires less Dollars to buy an ounce of Gold. Also, higher interest rates (typically helped higher NFPs) also lessen the attractiveness of Gold as an investment compared to staying in cash, where the money will at least earn interest.

Nonfarm Payrolls is only one component within a bigger jobs report and it can be overshadowed by the other components. At times, when NFP come out higher-than-forecast, but the Average Weekly Earnings is lower than expected, the market has ignored the potentially inflationary effect of the headline result and interpreted the fall in earnings as deflationary. The Participation Rate and the Average Weekly Hours components can also influence the market reaction, but only in seldom events like the “Great Resignation” or the Global Financial Crisis.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.