GBP/USD Forecast: Pound Sterling needs to hold above 1.2360 for extended recovery

- GBP/USD has gone into a consolidation phase at around 1.2350 on Monday.

- The technical outlook suggests that the bearish bias stays intact.

- The pair could stage an extended rebound if it manages to flip 1.2360 into support.

GBP/USD has started the new week in a quiet manner with the Spring Bank Holiday in the UK and the Memorial Day holiday in the US causing trading volumes to remain thin. The pair's near-term technical outlook shows that buyers remain on the sidelines but an extended correction could be observed once Pound Sterling stabilizes above 1.2360.

Hawkish Federal Reserve (Fed) bets provided a boost to the US Dollar (USD) last week, causing GBP/USD to lose nearly 100 pips.

Ahead of the weekend, the US Bureau of Economic Analysis reported that the Core Personal Consumption Expenditures (PCE) Price Index, the Fed's favourite measure of inflation, inched higher to 4.7% on a yearly basis in April, compared to the market expectation of 4.6%. Further details of the publication revealed that consumer activity remained healthy with Personal Spending rising 0.8% on a monthly basis.

According to the CME Group FedWatch Tool, the odds of the Fed leaving its policy rate unchanged in June declined below 40% from nearly 75% a week ago.

In the meantime, US President Joe Biden and Republican House Speaker Kevin McCarthy reached a deal to suspend the debt limit on Sunday. In case markets turn risk-positive on this development, when bond markets and US stock index futures return to action early Tuesday, the USD could have a hard time finding demand and allow GBP/USD to gain traction.

GBP/USD Technical Analysis

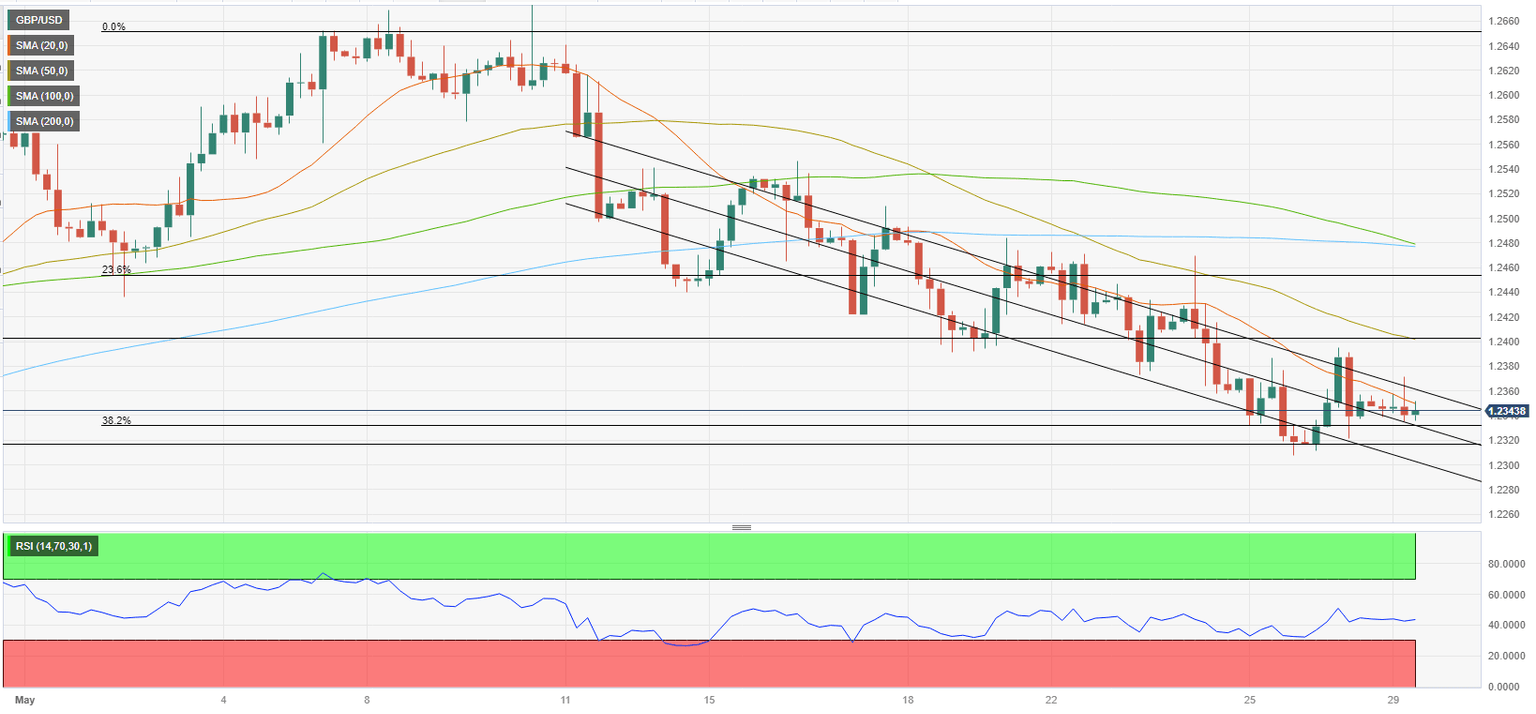

GBP/USD trades within the upper-half of the descending regression channel and the Relative Strength Index (RSI) indicator on the four-hour chart stays below 50, reflecting the bearish bias. If the pair rises above 1.2360 (upper-limit of the channel) and stabilizes there, it could target 1.2400 (50-period Simple Moving Average (SMA), psychological level) and 1.2450 (Fibonacci 23.6% retracement of the latest uptrend).

On the downside, first support is located at 1.2330 (mid-point of the channel) ahead of 1.2300 (psychological level, static level) and 1.2280 (lower-limit of the channel).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.