GBP/USD Forecast: Pound Sterling could stretch higher while 1.2650-1.2660 support holds

- GBP/USD closed the previous week in positive territory.

- 1.2650-1.2660 aligns as key near-term support for the pair.

- The pair's upside could remain limited in case market mood sours.

GBP/USD took advantage of the broad-based selling pressure surrounding the US Dollar (USD) and registered weekly gains for the first time since early January. The pair holds steady above 1.2650 early Monday, while the technical picture suggests that additional gains are likely in the near term.

Pound Sterling price today

The table below shows the percentage change of Pound Sterling (GBP) against listed major currencies today. Pound Sterling was the strongest against the New Zealand Dollar.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | -0.08% | 0.01% | 0.01% | 0.13% | -0.06% | 0.30% | -0.03% | |

| EUR | 0.08% | 0.09% | 0.09% | 0.21% | 0.02% | 0.38% | 0.05% | |

| GBP | -0.01% | -0.09% | 0.00% | 0.12% | -0.07% | 0.29% | -0.04% | |

| CAD | -0.02% | -0.10% | -0.01% | 0.13% | -0.08% | 0.28% | -0.05% | |

| AUD | -0.14% | -0.21% | -0.12% | -0.12% | -0.19% | 0.17% | -0.16% | |

| JPY | 0.05% | -0.01% | 0.11% | 0.07% | 0.19% | 0.35% | 0.01% | |

| NZD | -0.30% | -0.37% | -0.28% | -0.28% | -0.16% | -0.34% | -0.33% | |

| CHF | 0.03% | -0.05% | 0.04% | 0.05% | 0.20% | -0.02% | 0.33% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

Retreating US Treasury bond yields didn't allow the USD to gather strength against its rivals ahead of the weekend. In the European morning on Monday, the benchmark 10-year US Treasury bond yield continues to push lower toward 4.2% and helps GBP/USD holds its ground, by making it difficult for the USD to find demand.

Meanwhile, the UK's FTSE 100 futures trade flat ahead of the opening and US stock index futures lose between 0.1% and 0.3%.

In the absence of high-tier data releases, a negative shift in risk mood, with Wall Street's main indexes opening in negative territory, could help the USD stay resilient against its rivals in the second half of the day.

January New Home Sales will be the only data featured in the economic calendar on Monday. In December, New Home Sales rose by 8%. A similar monthly increase could provide a boost to the USD with the immediate reaction and weigh on GBP/USD. On the other hand, a negative print could support the pair.

On Tuesday, January Durable Goods Orders and Conference Board's Consumer Confidence Index for February from the US will be watched closely by market participants.

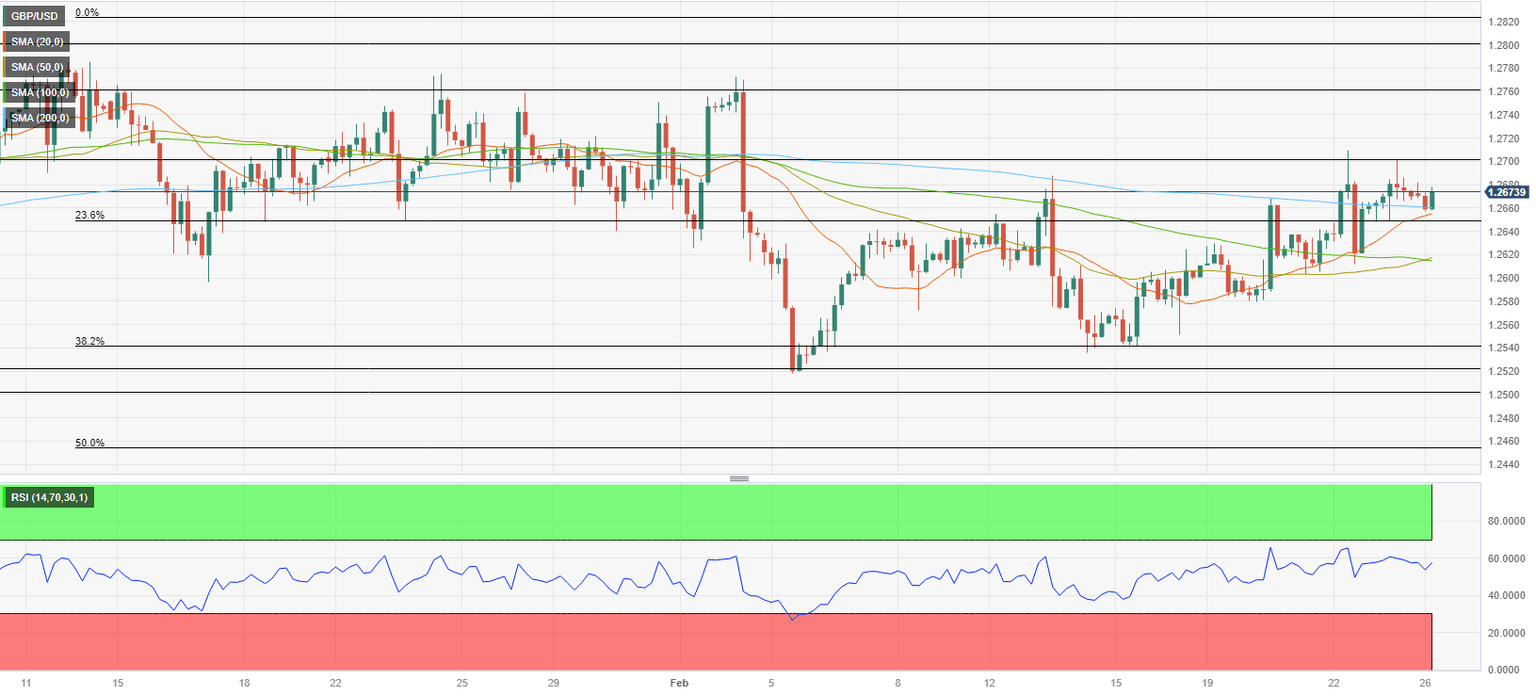

GBP/USD Technical Analysis

GBP/USD holds above 1.2660-1.2650, where the 200-period Simple Moving Average (SMA) on the 4-hour chart and the Fibonacci 23.6% retracement level of the long-term uptrend align. In the meantime, the Relative Strength Index (RSI) rises toward 60, reflecting a buildup of bullish momentum.

On the upside, 1.2700 (psychological level, static level) could be seen as next hurdle before 1.2760 (static level) and 1.2800 (psychological level, static level).

If GBP/USD returns below 1.2660-1.2650 area and starts using it as resistance, additional losses toward 1.2620 (100-period SMA, 50-period SMA) and 1.2600 (psychological level) could be seen.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.