GBP/USD Forecast: Pound Sterling could have a hard time finding direction

- GBP/USD went into a consolidation phase above 1.2700.

- The pair could gain traction in case risk flows drive the action in financial markets.

- Buyers could be discouraged in case GBP/USD returns below 1.2700.

GBP/USD started to move sideways slightly above 1.2700 in the last week of 2023 after failing to capitalize on the broad US Dollar (USD) weakness in the previous week. The pair could have a difficult time making a decisive move in either direction ahead of the New Year's holiday.

Although the USD Index fell nearly 1% last week, GBP/USD closed virtually unchanged. Latest macroeconomic data releases from the UK showed that inflation continued to soften at a faster pace than expected while the economic activity continued to lose momentum.

The monthly Consumer Price Index in the UK declined by 0.2% in November. In the meantime, the Office for National Statistics (ONS) revised down the third-quarter Gross Domestic Product (GDP) reading to unveil a 0.1% contraction on a quarterly basis.

In case there is a positive shift in market mood later in the day, the USD could come under renewed bearish pressure. Investors, however, could refrain from betting on persistent Pound Sterling strength.

GBP/USD Technical Analysis

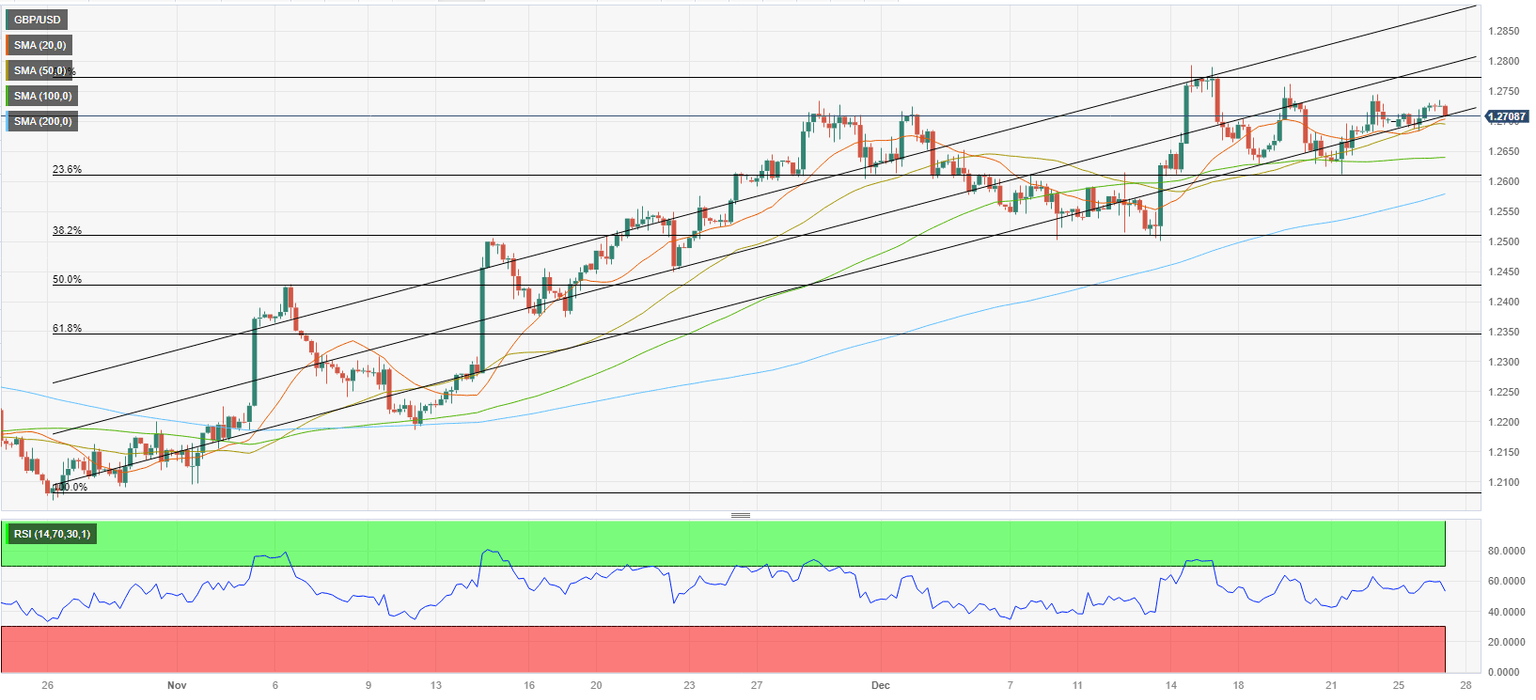

GBP/USD stays within a touching distance of 1.2700, where the lower limit of the ascending regression channel is reinforced by the 20-period and the 50-period Simple Moving Averages (SMA) on the 4-hour chart. In case this support fails and it's confirmed as resistance, 1.2650 (100-period SMA) and 1.2600 (psychological level, Fibonacci 23.6% retracement of the latest uptrend) could be set as next bearish targets.

On the upside, 1.2750 (static level) aligns as first resistance before 1.2770 (static level) and 1.2800 (mid-point of the ascending channel).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.