GBP/USD Forecast: Not so festive bank holiday for the pound, fundamentals and technicals point down

- GBP/USD has been unable to recover amid Sino-American tensions.

- Concerns about negative interest rates and political issues are also weighing on the pound.

- Monday's four-hour chart is pointing to losses for the currency pair.

Second, coming for sterling? Dominic Cummings, Prime Minister Boris Johnson's powerful adviser, has been under pressure to quit after a revelation that he violated the lockdown while showing symptoms of COVID-19. That scandal is dogging the government, yet there are greater issues for pound traders to ponder on.

While Brits are enjoying their spring bank holiday – albeit under lockdown restrictions – sterling may continue suffering.

Negative interest rates? Speculation remains rife that the Bank of England will set sub-zero borrowing costs. The latest BOE member was David Ramsden, who opened the door to such a move. He followed the footsteps of Governor Andrew Bailey and others. While negative interest rates have had little benefit for Japan and the eurozone, they may have an adverse effect on the exchange rate.

More: Negative Rates: Only good for downing currencies?

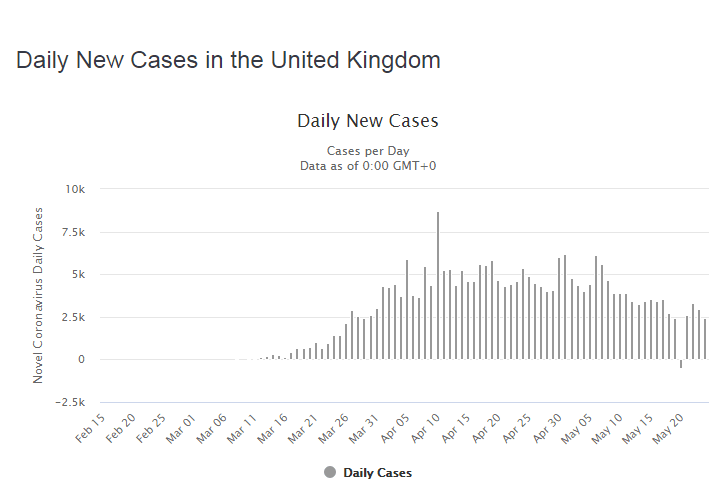

Lifting lockdown is lengthy: PM Johnson's main task is managing the coronavirus crisis. He previously announced that further easing of the shuttering will be considered in June, which is a week from now. While COVID-19 statistics continue improving, they remain stubbornly high and may require a gradual process.

Source: World Info Meters

Brexit: After a week of finger-pointing around the lack of progress in talks, negotiators will try to advance toward an accord on future EU-UK relations. Brussels wants Britain to adhere to its regulations in return for easy access to the bloc's single market – a demand London refuses. That is the main sticking point, and there is no evidence that it has changed.

Tense Sino-American relations: Weekend protests in Hong Kong – against China's suggested security law which tightens Beijing's grip on the territory– kept tensions high. The US and China also continue clashing about the origins of coronavirus, activities of Chinese firms in America, Taiwan, and more. The safe-haven dollar is in demand.

Washington's intentions of conducting a nuclear test have also caused concern, with officials in China warning of a "new cold war." The silver lining, for now, is that both countries have vowed to hold up the trade deal signed in January.

All in all, there are no reasons for sterling to spring back up – nothing has changed in this Spring Bank Holiday.

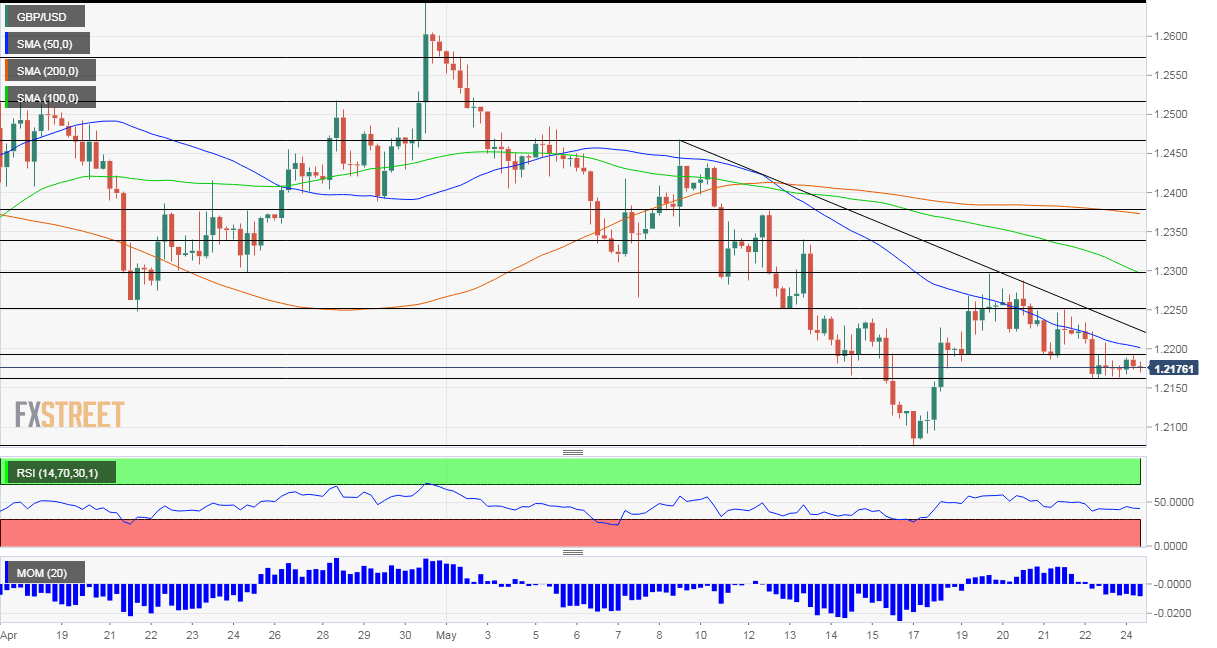

GBP/USD Technical Analysis

Pound/dollar is suffering from downside momentum on the four-hour chart and trades below the 50, 100, and 200 Simple Moving Averages – all bearish signs. Moreover, it is capped by a downtrend channel that hits the price at around 1.2220.

Support awaits at 1.2165, a former double bottom, and the daily low. It is followed by 1.2080, May's trough, and by the psychologically significant 1.20 level.

Some resistance is at 1.2190, the daily high, with the downtrend providing another cap. Next, 1.2250 was another double-bottom and 1.23 was the peak last week.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.