GBP/USD Forecast: Dead cat bounce? Boris' problems and US economic strength may trigger more falls

- GBP/USD has been attempting recovery as US yields ease.

- Political uncertainty in the UK and a sizzling hot US economy may turn cable back down.

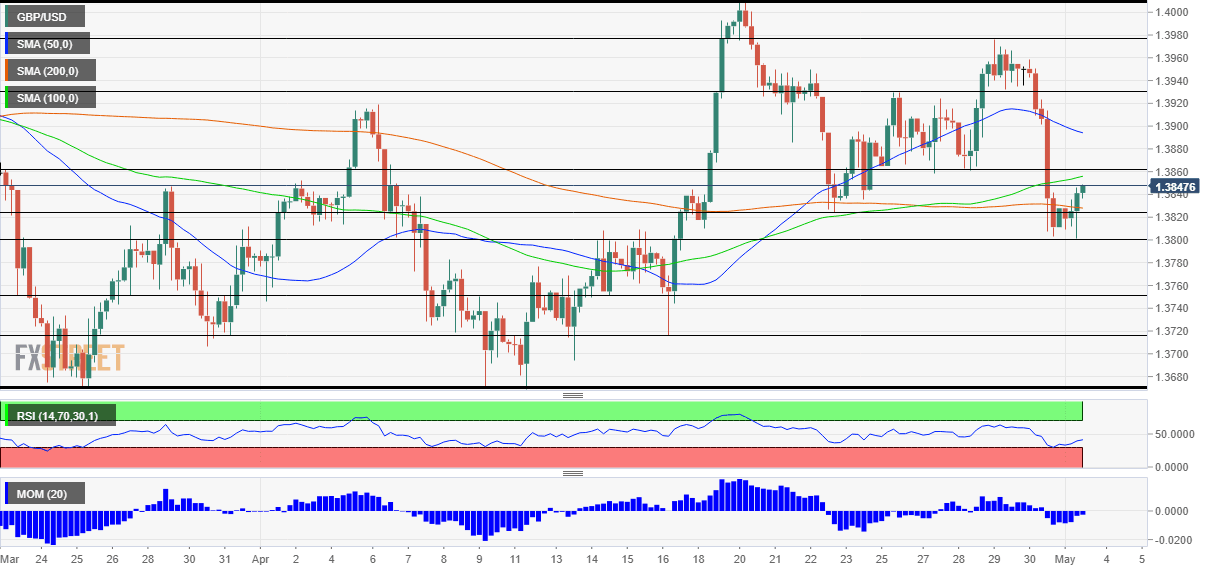

- Monday's four-hour chart is painting a growingly bearish picture.

Is this rise a GBP/USD selling opportunity? Even a dead cat bounces when it falls on the floor – and that pattern is what may be developing on the charts. US Treasury yields and especially returns on the benchmark 10-year bonds are dropping and dragging the dollar down with them. However, these falls are limited.

The greenback is backed by a robust US economy that is moving at full speed. After Thursday's Gross Domestic Product figures showed an upbeat annualized expansion rate of 6.4%, Personal Income and Personal Spending statistics from March showed a leap that beat estimates.

The next figure that awaits traders is the ISM Manufacturing Purchasing Managers' Index for April, the first hint toward Friday's Nonfarm Payrolls. Back in March, it hit 64.7 points, far above the 50-point threshold that separates expansion from contraction. Another increase is on the cards now.

US ISM Manufacturing PMI April Preview: Let the good times roll

The vaccine and stimulus recovery is causing the economy to heat up, but perhaps even to push inflation higher? While Federal Reserve Chair Jerome Powell made his best efforts to say price rises are temporary, his colleague Robert Kaplan wants the bank to signal less bond-buying in the near future. That would boost the dollar.

Can the Fed keep US rates in check?

On the other side of the pond, Britain is also benefiting from the immunization effort, but that is already priced into the pound. On the other hand, political uncertainty from several fronts weighs on sterling. Prime Minister Boris Johnson remains under pressure after reportedly asking Conservative Party donors to fund the redecoration of his Downing Street residence. That may hurt the government's ability to manage the exit from the crisis.

Moreover, the drop in support for Johnson's Tories comes ahead of local and regional elections across the UK. The most consequential vote is in Scotland, where the Scottish National Party aims to achieve an absolute majority in Hollyrood, allowing for a fresh push for independence. A fresh row within the UK would add to unresolved issues around Brexit.

All in all, the dollar has room to resume its gains while the pound will likely remain under pressure – at least until Thursday's elections.

GBP/USD Technical Analysis

Pound/dollar is suffering from downside momentum on the four-hour chart and has barely recaptured the 200 Simple Moving Average. It remains below the 50 and 100 SMAs. The Relative Strength Index (RSI) is above 30, thus outside oversold conditions.

Overall, bears are gaining ground.

Support is at 1.3820, a swing low from late April. It is followed by 1.38, and then by 1.3750 and 1.3720.

Resistance awaits at 1.3860, a cushion from last week, followed by 1.3930 and 1.3980.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.