GBP/USD Forecast: Buyers could retain control while 1.2700 support stays intact

- GBP/USD advanced toward 1.2750 in the European session on Tuesday.

- The USD could struggle to find demand in case risk mood improves later in the day.

- 1.2760 aligns as immediate resistance for the pair.

GBP/USD gained traction and advanced toward 1.2750 early Tuesday after closing the first day of the week virtually unchanged. The near-term technical outlook points to a build-up of bullish momentum.

Pound Sterling price today

The table below shows the percentage change of Pound Sterling (GBP) against listed major currencies today. Pound Sterling was the strongest against the US Dollar.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | -0.24% | -0.25% | -0.06% | -0.37% | -0.45% | -0.37% | -0.22% | |

| EUR | 0.24% | -0.01% | 0.18% | -0.13% | -0.26% | -0.12% | 0.02% | |

| GBP | 0.24% | 0.01% | 0.17% | -0.14% | -0.27% | -0.12% | 0.02% | |

| CAD | 0.06% | -0.17% | -0.18% | -0.30% | -0.44% | -0.30% | -0.15% | |

| AUD | 0.37% | 0.13% | 0.10% | 0.29% | -0.13% | 0.00% | 0.15% | |

| JPY | 0.49% | 0.23% | 0.22% | 0.41% | 0.12% | 0.12% | 0.26% | |

| NZD | 0.35% | 0.13% | 0.12% | 0.30% | -0.01% | -0.15% | 0.15% | |

| CHF | 0.21% | -0.02% | -0.03% | 0.15% | -0.15% | -0.28% | -0.13% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

The upbeat market mood made it difficult for the US Dollar (USD) to gather strength early Tuesday and helped GBP/USD push higher. A Bloomberg report claiming that China was considering an equity market rescue package worth about 27 billion USD triggered a rally in Asian equity indexes and Hong Kong's Hang Seng gained nearly 3%.

Meanwhile, the decline seen in the USD/JPY pair following the Bank of Japan (BoJ) Governor Kazuo Ueda's comments in the post-meeting press conference forced the USD to stay on the back foot and further supported GBP/USD.

The UK's FTSE 100 Index opened marginally higher and US stock index futures were last seen trading little changed on the day. In the absence of high-tier data releases and fundamental drivers, a risk rally in Wall Street could put additional weight on the USD's shoulders.

On Wednesday, S&P Global will release Manufacturing and Services PMI reports for the UK and the US.

GBP/USD Technical Analysis

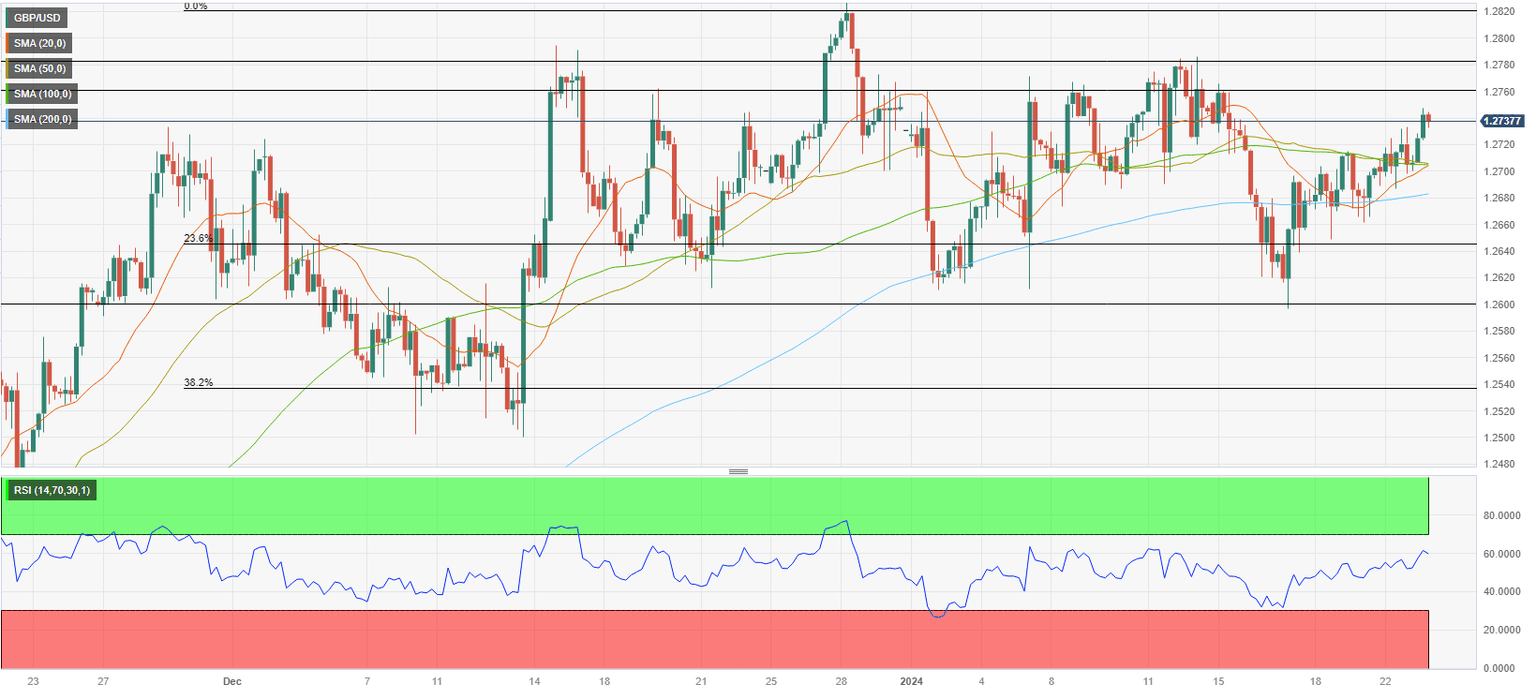

The Relative Strength Index (RSI) indicator on the 4-hour chart climbed to 60 and GBP/USD closed the last two 4-hour candles above the 100-period Simple Moving Average (SMA), highlighting a build-up of bullish momentum.

On the upside, 1.2760 (static level) aligns as immediate resistance before 1.2780 (static level) and 1.2820 (end-point of the latest uptrend).

Strong support is located at 1.2700 (100-period SMA; 50-period SMA) ahead of 1.2680 (200-period SMA) and 1.2650 (50-day SMA, Fibonacci 23.6% retracement of the latest uptrend).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.