- GBP/USD has surged to around 1.3050 as investors begin pricing in a Conservative victory.

- US data and further election developments may weigh.

- The daily chart allows for viewing the next levels.

Has Boris Johnson's campaign already succeeded? Pound bulls seem to think so, pushing GBP/USD to 1.3063 – the highest levels since May.

While Labour is narrowing the gap against the Conservatives, the roughly ten-point gap may be insurmountable with only eight days to go. Some traders may already be pricing in the ratification of the Brexit accord and market-friendly policies that the Tories promise.

Johnson avoided having his picture taken with President Donald Trump – and that may have helped as well. The US president is considered toxic in the UK, especially after he previously called for opening the National Health Service (NHS). Trump has now changed tack – seemingly trying to support the PM. He said that even if the UK would hand the NHS on a silver platter, the US would reject it.

The focus is now on the NATO Summit which Johnson is hosting and that draws attention away from the elections. However, once world leaders leave Watford and new polls are released, sterling is set to react.

Surveys that show Jeremy Corbyn's Labour Party catching up may weigh on the pound. Investors fear his murky Brexit path and radical left policies. If polls show stability, sterling may rise as markets prefer the certainty of the PM's accord and the Conservatives' market-friendly policies.

Markit´s final Services Purchasing Managers' Index for November came out at 49.3 points, better than 48.2 originally reported. That may have also had a positive effect on GBP/USD.

Trade headlines, US data

The market mood has improved after Bloomberg reported that the US and China are closer to a trade deal despite the intense rhetoric. Earlier, stocks were on the back foot amid reports that Washington is still keen on slapping tariffs on Beijing on December 15. Moreover, Trump stated that he may wait for after the November 2020 elections for striking a deal.

The president may continue making remarks throughout the day, setting the mood. Traders will also be tuned to critical US data. The ISM Non-Manufacturing PMI is set to show ongoing expansion in the services sector.

See Services PMI Preview: Manufacturing indicates lower

Earlier this week, the PMI for the manufacturing sector showed deeper contraction, sending the dollar lower.

ADP's Employment Change figure is also of interest to markets, as it serves as a hint toward the all-important Non-Farm Payrolls on Friday. America's largest payroll provider is forecast to show a faster gain in private-sector job growth.

See ADP Employment Preview: For better or worse, all roads lead to China.

Overall, a busy day awaits pound/dollar traders, amid the elections, trade, and US data.

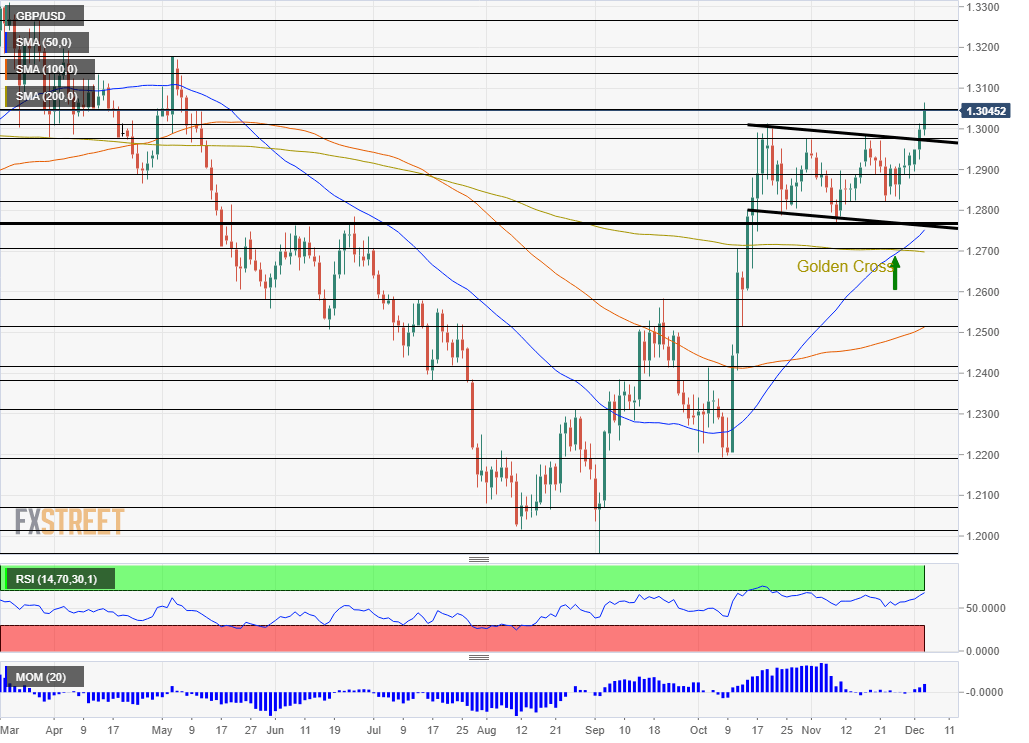

GBP/USD Daily Chart – Significant breakout

The broader daily chart comes into play and it shows a clear breakout above the downtrend channel. Cable is extending its gains after it enjoyed the Golden Cross pattern – the 50-day Simple Moving Average crossed the 200-day SMA.

Momentum is picking up and the Relative Strength Index is still below 70 – outside overbought conditions.

Resistance awaits at the daily high of 1.3063, and it is followed by 1.3135, which held sterling down in April. Next, we find the May peak of 1.3180. It is followed by 1.3275.

Support awaits at 1.3045, a high point in May. Next, we find 1.3013, which is October's high, and then by the November peak of 1.2985. Lower, we find 1.2890, which held the pound down in November.

More GBP/USD eyeing 1.3030, then 1.3118 as the next upside targets— Confluence Detector

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.