GBP/USD Forecast: Bears struggle to take control of pair's action

- GBP/USD has regained its traction following an earlier decline.

- The technical outlook shows that the bullish bias stays intact in the short term.

- Strong resistance seems to have formed at 1.2150.

GBP/USD has regained its traction and climbed toward 1.2100 after having started the new week under modest bearish pressure. Despite the negative shift witnessed in risk sentiment, the US Dollar is having a difficult time attracting investors early Monday. The near-term technical outlook suggests that Pound Sterling sellers stay on the sidelines for the time being.

Coronavirus-related news from China forced investors to adopt a cautious stance at the beginning of the week and caused GBP/USD to edge lower. China's National Health Commission reported over 40K new coronavirus cases on Sunday, reviving concerns over China's zero-Covid policy weighing on global economic activity. Investors, however, seem to be more interested in other traditional safe-haven assets than the US Dollar, such as US government bonds and the Japanese Yen, early Monday amid heightened expectations about the Fed taking its foot off the tightening pedal.

Nevertheless, in case Wall Street's main indexes fall sharply after the opening bell, the US Dollar's losses are likely to remain limited. At the time of press, US stock index futures were down between 0.4% and 0.8%.

There won't be any high-tier macroeconomic data releases featured in the economic calendar on Monday and the US Dollar's valuation is likely to continue to impact GBP/USD's movements in the second half of the day.

GBP/USD Technical Analysis

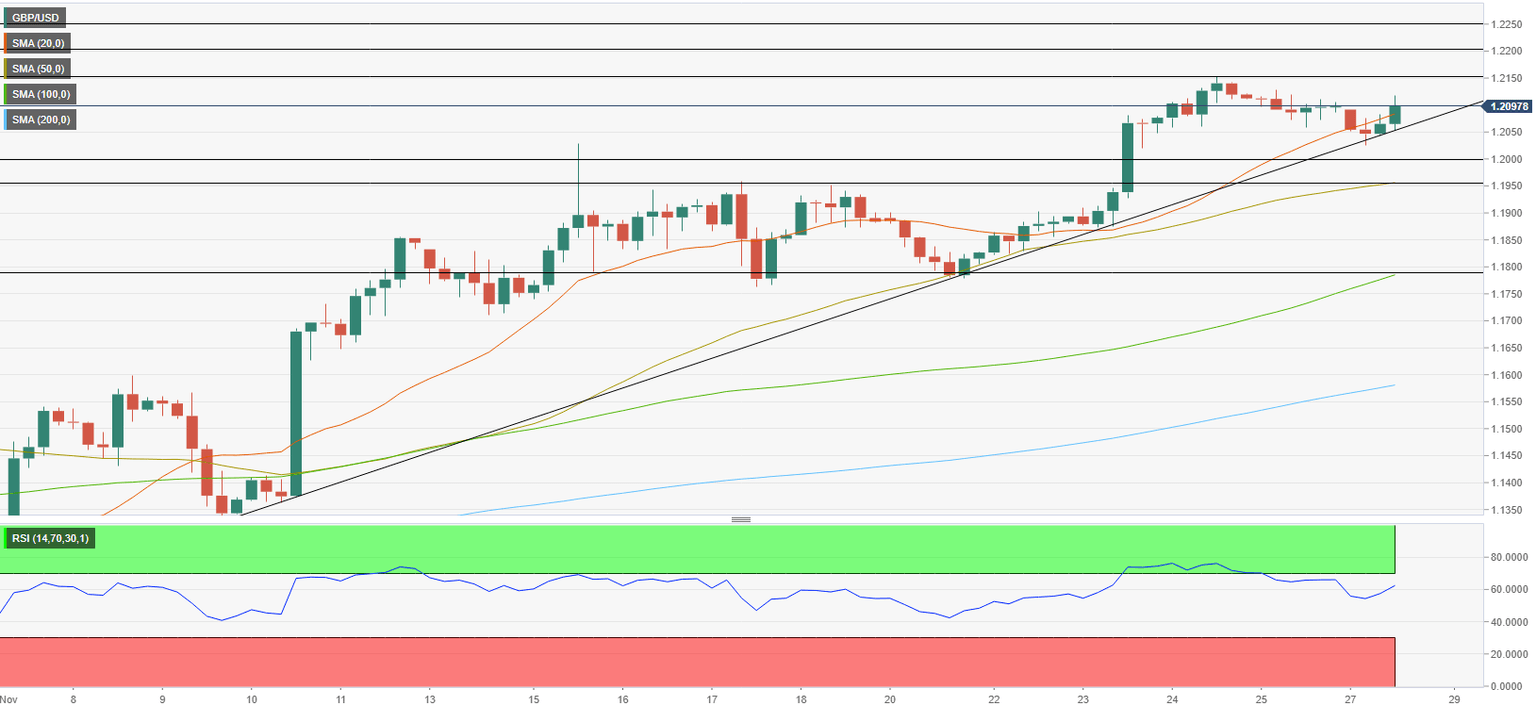

GBP/USD dropped toward the ascending trend line coming from November 9 but managed to hold above it. Additionally, the pair returned above the 20-period Simple Moving Average (SMA) after making a four-hour close below it earlier in the day, highlighting the lack of sellers' interest.

If GBP/USD stabilizes above 1.2100 (psychological level), it could target 1.2150 (static level, end-point of uptrend). With a four-hour close above the latter, additional gains toward 1.2200 (psychological level, static level) and 1.2250 (static level) could be witnessed.

On the downside, 1.2050 (ascending trend line) aligns as key support. In case GBP/USD falls below that line and starts using it as resistance, it could extend its slide toward 1.2000 (psychological level) and 1.1950 (50-period SMA).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.