GBP/USD Forecast: Acceptance below 1.1200 mark sets the stage for further losses

- A combination of factors drags GBP/USD to over a one-week low on Friday.

- Dismal UK data weigh on sterling and exert pressure amid fresh USD buying.

- The fundamental backdrop supports prospects for a further depreciating move.

The GBP/USD pair comes under some renewed selling pressure on Friday and drops to over a one-week low during the first half of the European session. The British pound is weighed down by the disappointing UK Retail Sales figures, which suggest that consumers are feeling the pinch of the cost-of-living crisis and high inflation. In fact, the UK Office for National Statistics reported this Friday that Retail Sales declined by 1.4% in September, missing estimates pointing to a 0.5% fall. On an annualized basis, the sales plunged -6.9% during the reported month against the 5.0% slide expected. Moreover, the core sales tumbled 6.2% YoY in September versus -4.1% anticipated and -5.3% previous. This comes on the back of the recent political turmoil in the UK and continues to undermine sterling.

Apart from this, the emergence of fresh buying around the US dollar exerts additional downward pressure on the GBP/USD pair. The continuous rise in the US Treasury bond yields, bolstered by expectations for a more aggressive policy tightening by the Federal Reserve, assists the greenback to regain some positive traction. In fact, the yield on the benchmark 10-year US government bond climbs to its highest levels since the 2008 financial crisis in reaction to hawkish remarks by Philadelphia Fed President Patrick Harker on Thursday. Harker warned that the US central bank is actively trying to slow the economy to combat stubbornly high inflation. Furthermore, growing worries about a deeper global economic downturn and the prevalent cautious mood benefit the safe-haven greenback.

This, along with diminishing odds for a full 100 bps rate increase by the Bank of England in November, suggests that the path of least resistance for the GBP/USD pair is to the downside. In fact, BoE Deputy Governor Ben Broadbent told investors on Thursday it remains to be seen whether official interest rates have to rise by quite as much as currently priced in financial markets. He added that the big increases in interest rates they had priced in would deliver a pretty material hit to the economy. In the absence of any major market-moving economic release from the US, the bearish fundamental backdrop supports prospects for a further near-term depreciating move for the GBP/USD pair.

Technical levels to watch

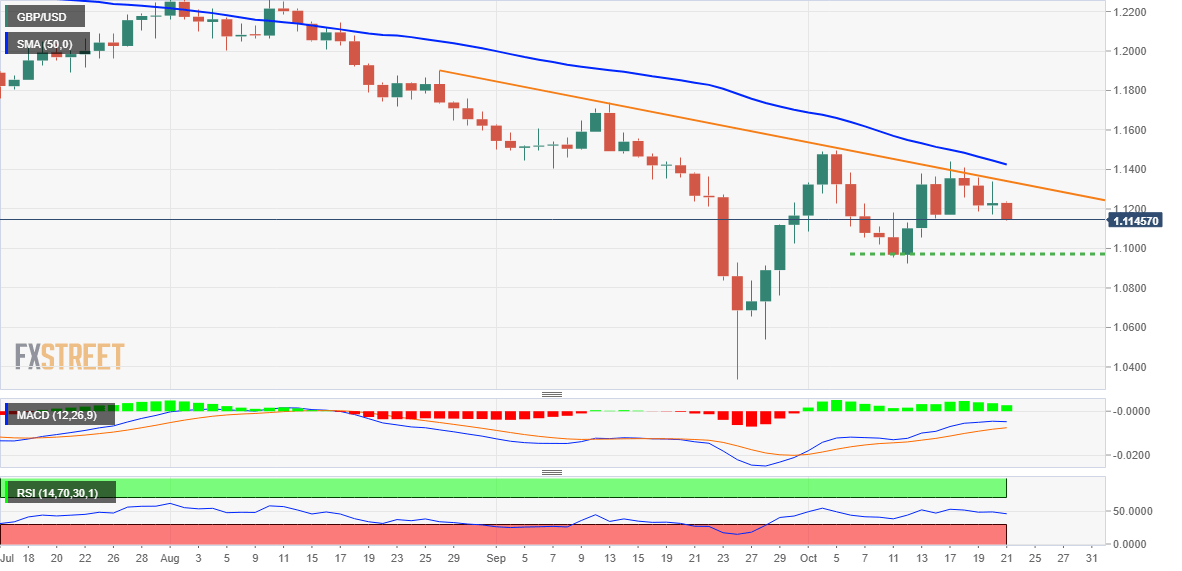

From a technical perspective, the overnight intraday uptick faltered near a downward sloping trend-line extending from late August. A subsequent fall and acceptance below the 1.1200 round-figure marks reaffirm the negative outlook. Hence, some follow-through slide towards the next relevant support, around the 1.1100 mark, remains a distinct possibility. The downward trajectory could further get extended and drag the GBP/USD pair towards the 1.1055-1.1050 intermediate support en route to the 1.1000 psychological mark.

On the flip side, momentum back above the 1.1200 mark is likely to confront stiff resistance near the 1.1250-1.1260 region. A sustained strength beyond might trigger a short-covering rally and allow the GBP/USD pair to reclaim the 1.1300 mark. Any subsequent move up, however, could meet with fresh sellers near the aforementioned trend line, which is currently pegged near the 1.1350-1.1355 region.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.