GBP/USD Forecast: 1.2000 comes under threat amid renewed dollar strength

- GBP/USD has turned south following Monday's choppy action.

- Safe-haven flows dominate the markets following the long weekend in the US.

- BOE noted in its latest report that the UK and global outlook deteriorated materially.

With the dollar regaining its strength following the long weekend in the US, GBP/USD has turned south during the European trading hours on Tuesday. In case safe-haven flows continue to dominate the financial markets, the pair could test 1.2000.

Following Monday's choppy action, the US Dollar Index gathered bullish momentum and climbed to its highest level in nearly two decades above 106.00. The greenback finds demand in the risk-averse market atmosphere as investors grow increasingly concerned over a global recession.

Earlier in the day, the Bank of England (BOE) noted in its latest biannual Financial Stability Report (FSR) that the global and the UK economic outlook deteriorated materially. The publication further showed that the BOE sees risky assets as being vulnerable to sharp adjustments.

In the second half of the day, May Factory Orders from the US will be looked upon for fresh impetus. Investors will keep a close eye on Wall Street as well. As of writing, US stock index futures were down between 0.5% and 0.7%. In case major equity indexes in the US suffer heavy losses after the opening bell, the greenback could continue to outperform its rivals.

Meanwhile, the S&P Global/CIPS Composite PMI for the UK improved to 53.7 in June from 53.1 in May, revealing that the business activity in the private sector expanded at a slightly stronger pace. "A slowdown in manufacturing production growth to its lowest since May 2020 (index at 50.3 in June) was offset by a modest acceleration in service sector activity (index at 54.3)," the publication read. Nevertheless, the British pound failed to capitalize on this report.

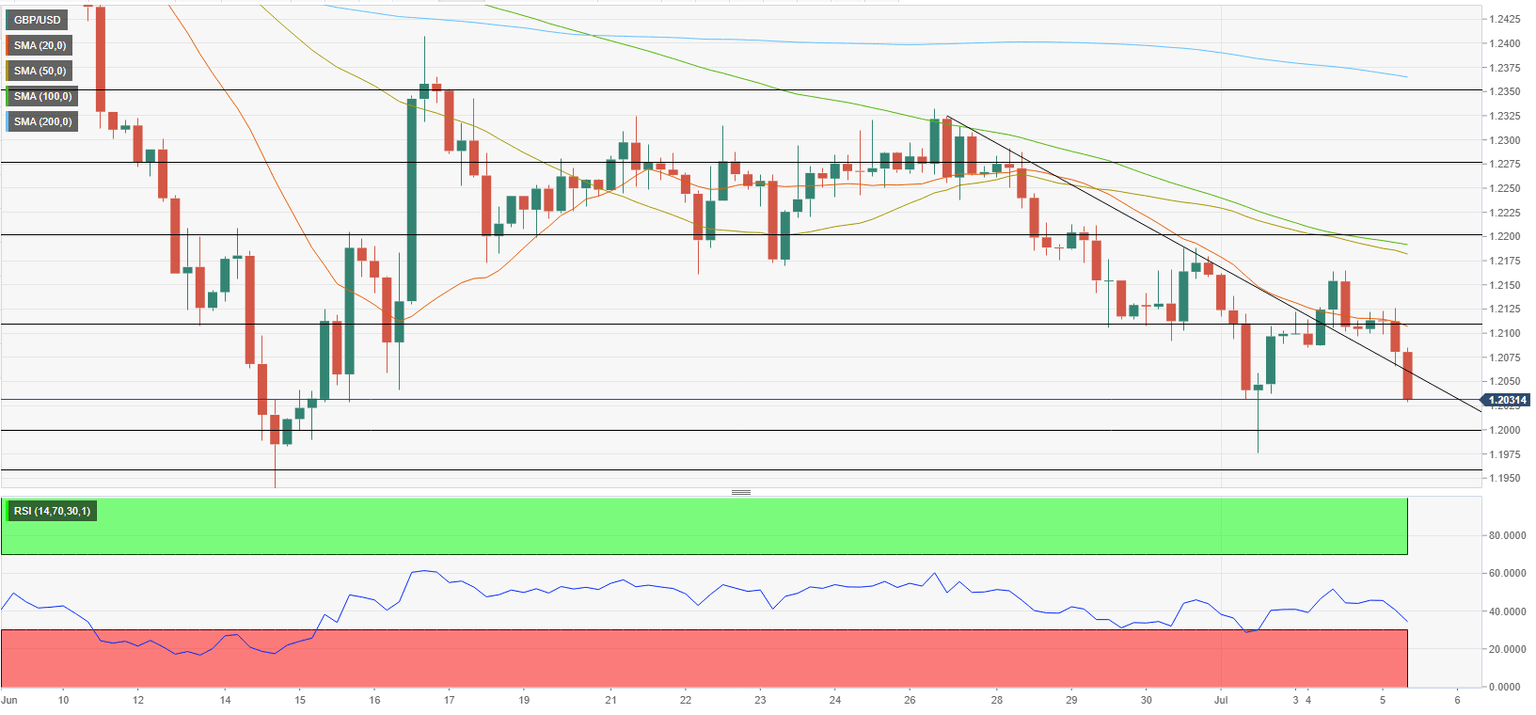

GBP/USD Technical Analysis

GBP/USD returned below the descending trend line coming from late June and the Relative Strength Index (RSI) indicator on the four-hour chart fell below 30, pointing to a buildup of bearish momentum.

On the downside, 1.2000 (psychological level) aligns as next target ahead of 1.1975 (July 1 low) and 1.1933 (June 14 low).

If the pair recovers above 1.2050 (static level, descending trend line), it could attract buyers and extend its recovery toward 1.2100 (psychological level, 20-period SMA).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.