GBP/USD: far more settled as the UK political risk for a no-deal Brexit has reduced [Video]

![GBP/USD: far more settled as the UK political risk for a no-deal Brexit has reduced [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Majors/GBPUSD/iStock-689067954_XtraLarge.jpg)

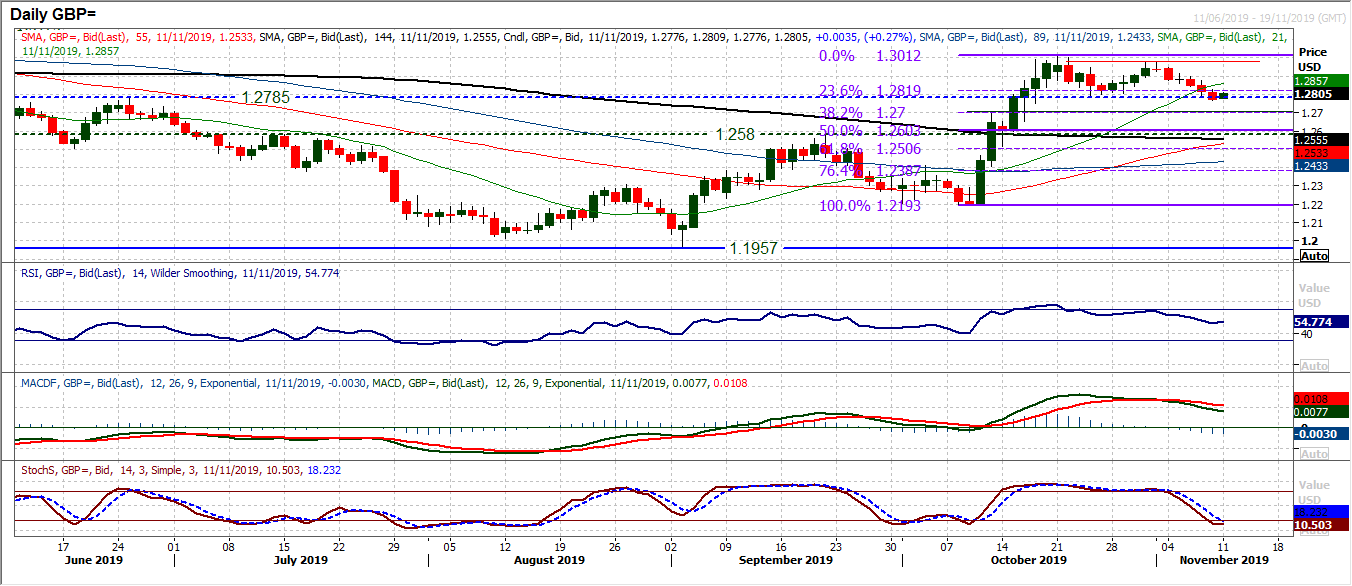

GBP/USD

Cable has slide back in the past week in a move to test the $1.2785 medium term pivot level. We have recently been discussing that there is a far more settled outlook that has taken over in recent weeks, as the UK political risk for a no deal Brexit has reduced. We see that the election uncertainty will induce a negative drift on Cable in the coming weeks and the last few sessions have played into this. The market has left a lower high at $1.2975 (under the $1.3010 key October high) before forming a run of negative closes to test $1.2785. There is a far more stable nature to the slide on Cable (compared to EUR/USD) and this is allowing a simple unwind on momentum rather than anything more decisively bearish. The RSI has slipped back towards 50 whilst MACD lines are drifting lower. There has been an opening rebound today and it will be interesting to see how the market responds. The market has sold into intraday rebounds on each of the past five sessions and another today for a close back under $1,2785 would open for a deeper correction back towards the next band of breakout support $1.2580. The hourly chart shows initial resistance $1.2835 needs to be breached to re-engage the bulls within what is still essentially a three week trading range. Further resistance at $1.2875.

Author

Richard Perry

Independent Analyst