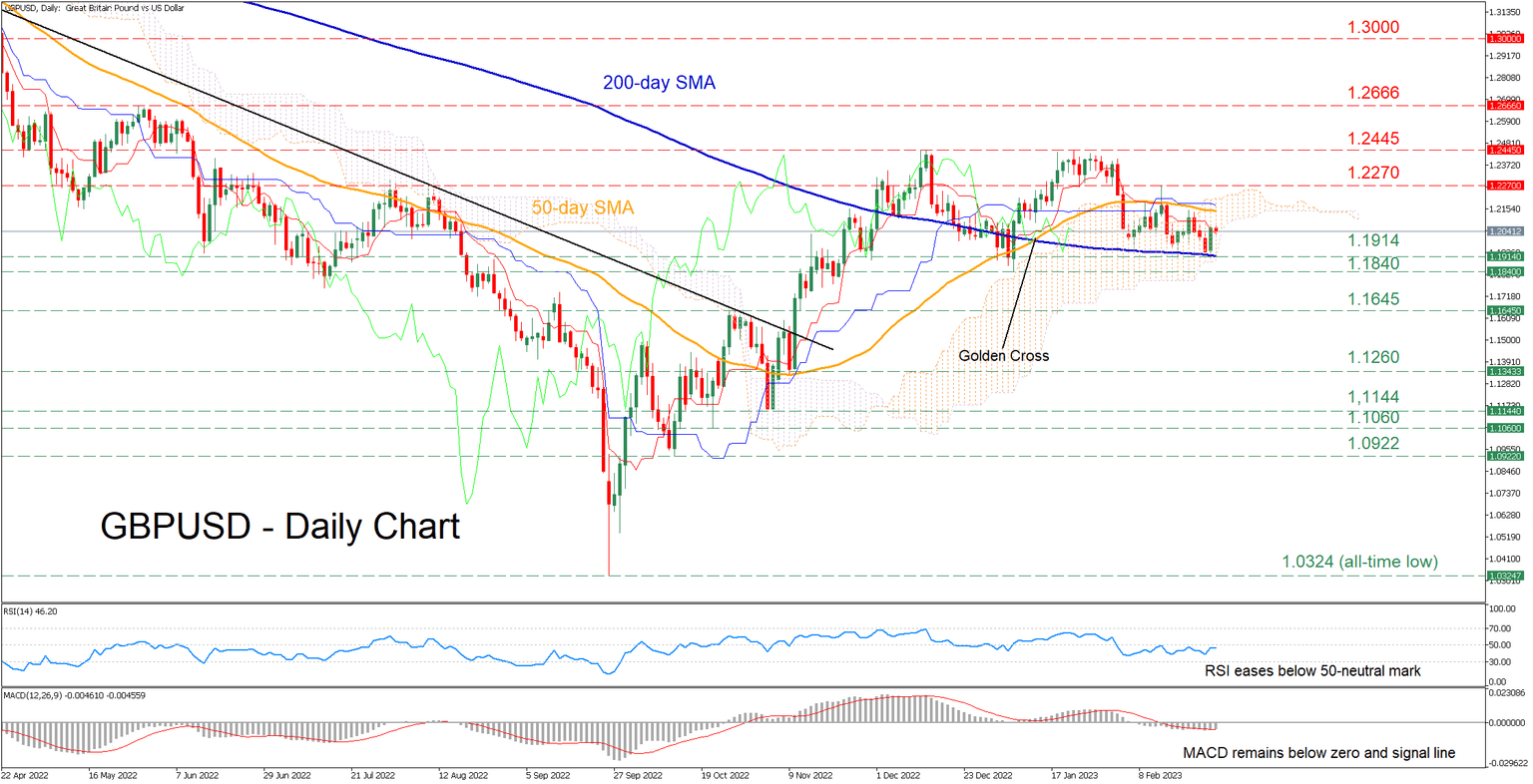

GBP/USD extends sideways pattern between SMAs

GBPUSD has been edging higher since September when it found its feet at the all-time low of 1.0324. However, this latest rebound seems to be fading after being rejected twice at the 1.2445 region, with the price remaining stuck in a tight range formed by its 50- and 200-day simple moving averages (SMAs).

Despite the pair’s rangebound pattern, the short-term oscillators are indicating that near-term risks remain tilted to the downside. Specifically, the RSI is pointing downwards after failing to cross above the 50-neutral mark, while the MACD histogram is currently below both zero and its red signal line.

To the downside, the congested region that includes the 200-day SMA and the recent low of 1.1914, which has rejected further declines three times in the past two weeks, could act as the first line of defence. Should that floor collapse, the price might test the January low of 1.1840. Even lower, further declines could cease at the October resistance of 1.1645, which could act as support in the future

Alternatively, should buyers re-emerge and push the price above its 50-day SMA, initial resistance could be found at the recent peak of 1.2270. Breaking above that zone, the price may ascend to test the crucial 1.2445 territory, which capped the pair’s upside twice in the past three months. A break above that zone could turn the spotlight to the May high of 1.2666.

In brief, GBPUSD continues to fluctuate within a tight trading zone, with its 50- and 200-day SMAs acting as an upper and a lower limit, respectively. Therefore, a break above or below this sideways pattern is likely to be followed by a significant move in the same direction.

Author

Stefanos joined XM as a Junior Investment Analyst in September 2021. He conducts daily market research on the currency, commodity and equity markets, from a fundamental and a technical perspective.