GBP/USD: Brexit trade negotiations make Cable a volatile play [Video]

![GBP/USD: Brexit trade negotiations make Cable a volatile play [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Majors/GBPUSD/iStock-1178148633_XtraLarge.jpg)

GBP/USD

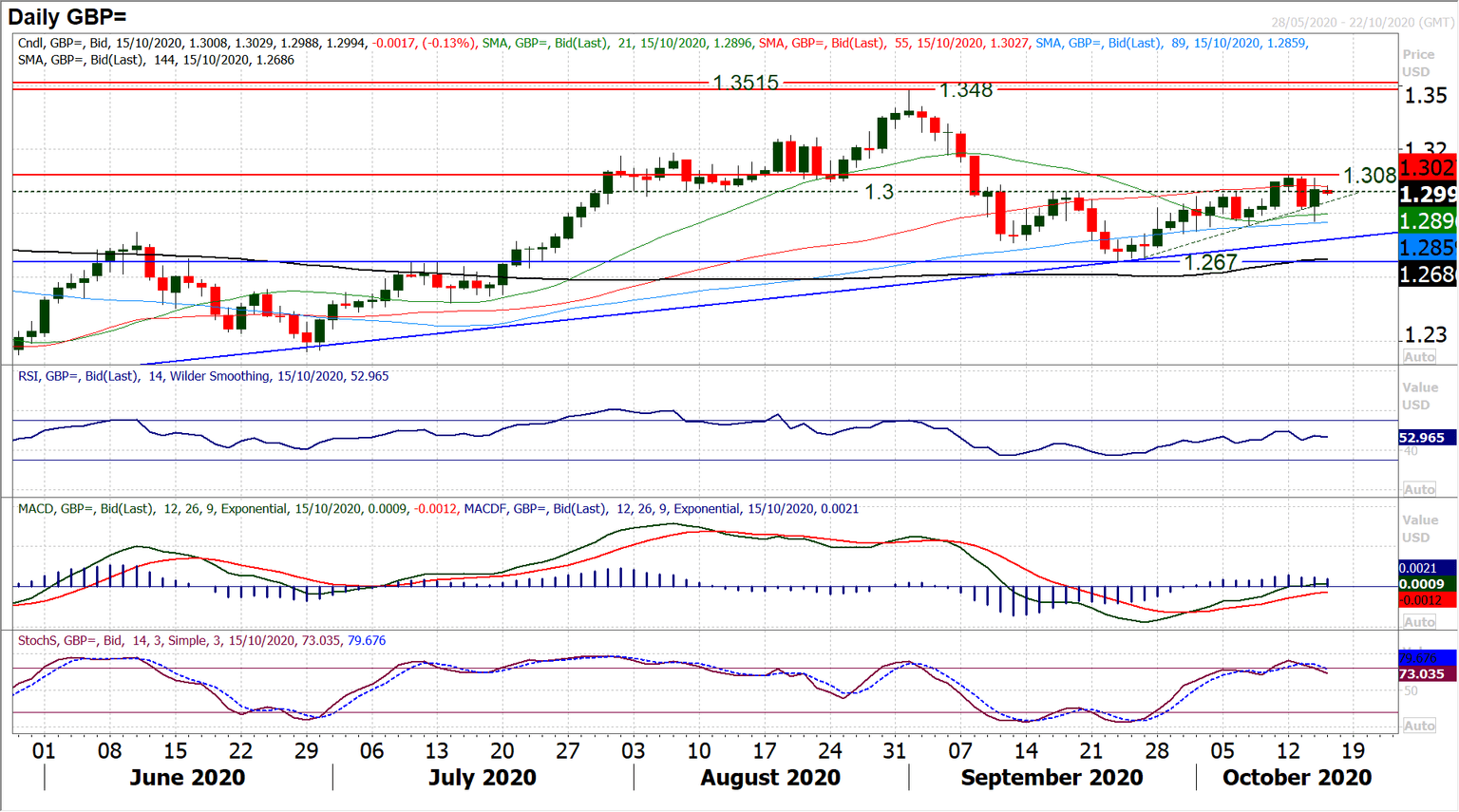

Brexit trade negotiations make sterling and in this case, Cable a volatile play right now. Sharp intraday swings in the past couple of days reflect this. A recent two week uptrend was broken yesterday, but the market then swung back higher and is again around the 1.3000 old pivot and restricted under 1.3080 resistance. Newsflow over the trade talks are a key driver here in the coming days, with support around 1.2860 (yesterday’s low) and resistance at 1.3080 near term key reference points for potential breaks. Positive news of an agreement will pull Cable above 1.3080 and open the upside once more. The two sides dragging their feet will see Cable drifting back lower again, with below 1.2860 opening 1.2670.

Author

Richard Perry

Independent Analyst