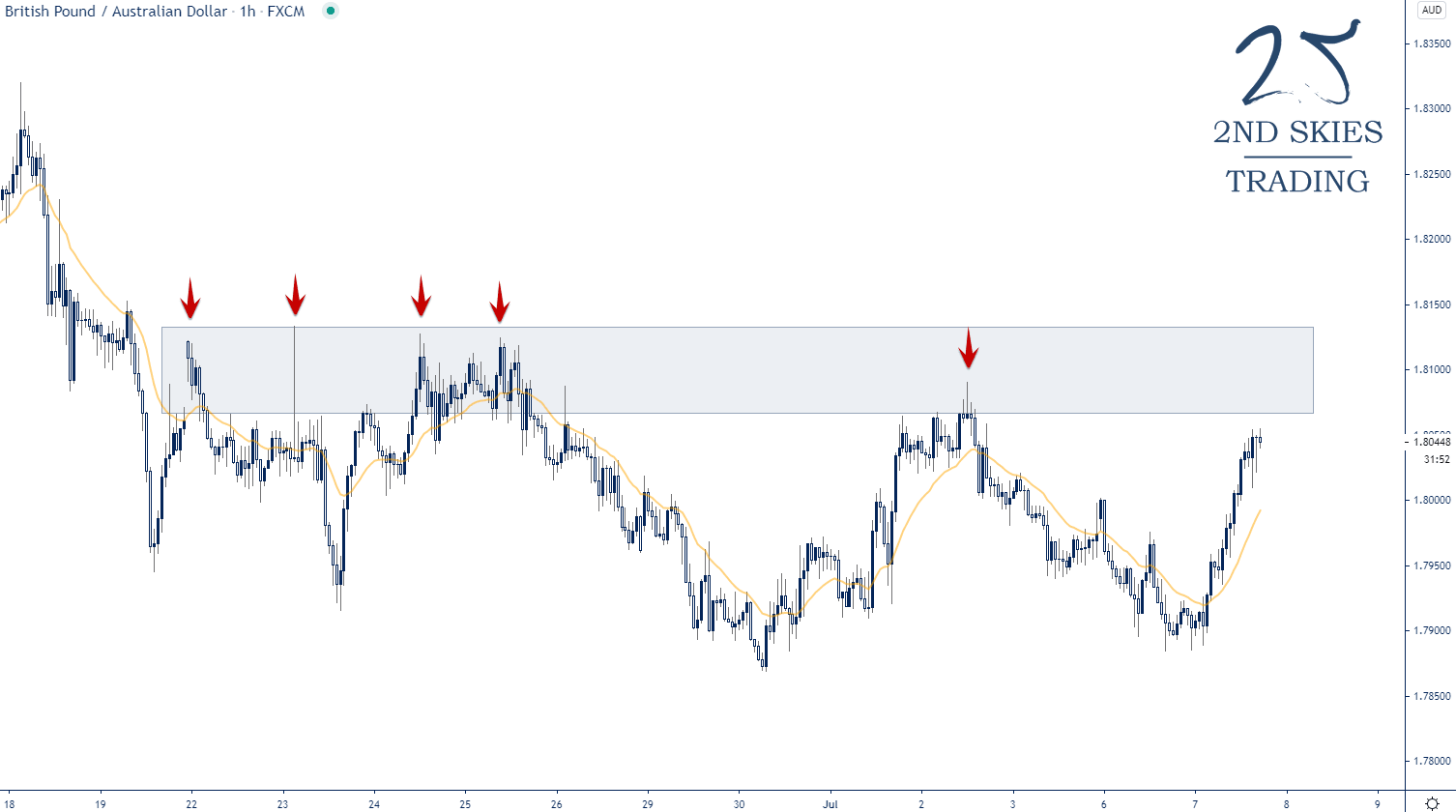

GBP/AUD – Approaching short-term key resistance

Price Action Context

Short-term, the pair is closing in on a key resistance that has held since the 22nd of June and produced multiple strong bearish rejections. The static key resistance lines up nicely with the daily dynamic resistance (20 EMA) which is closing in on price as well.

Trending Analysis

The pair has been in a strong bear trend since early April with price not being able to close above the daily 20 EMA a single time since the trend started, indicating that the order flow is heavily imbalanced towards the sell side. The current pullback into the short-term resistance and the daily dynamic resistance (EMA) can present potential shorting opportunities to those looking to short the pair.

Closest Support & Resistance Zones

Resistance: 1.8065 – 1.8130

Support: 1.7870 – 1.7900

Visit our website at 2ndSkies for more price action content, free trading lessons, strategies and videos. Find out how we can help you to change the way you think, trade and perform.

Visit our website at 2ndSkies for more price action content, free trading lessons, strategies and videos. Find out how we can help you to change the way you think, trade and perform.

Author

Chris Capre

2ndskiesforex

Chris Capre is a professional forex trader and mentor specialized in Price Action trading, and the Ichimoku Cloud.