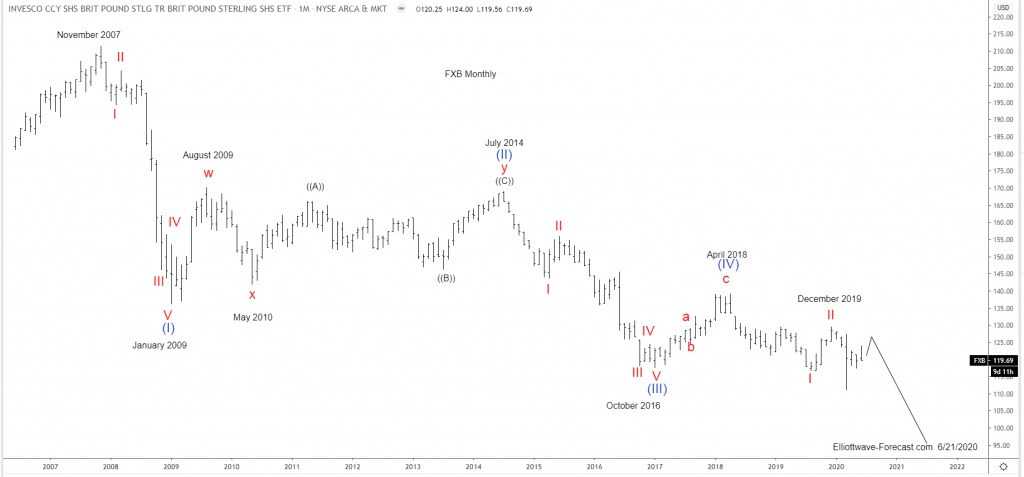

$FXB longer term bearish cycles and elliott wave

Firstly the British Pound Sterling tracking ETF fund FXB inception date was 6/21/2006. The bearish cycle lower from the November 2007 highs in FXB is the focus of this analysis. The British Pound Sterling has been the currency of the Bank of England since 1694. Considering that date was back before there was a US Dollar to compare with and data readily available suggests price was at 2.6440 in 1972 assume the trend is down & should continue. Spot price in the GBPUSD foreign exchange was 1.0520 in 1995. Price was at 2.1161 in 2007 where it peaked and turned lower. This is where we will shift the focus to the FXB highs at 211.44 in November 2007.

Secondly the bearish cycle from the November 2007 into the January 2009 lows was clearly an Elliott Wave impulse in 5 waves. From there into the July 2014 highs appeared to be a typical double three structure with an exception compared to the spot price of foreign exchange where it made a new high above the August 2009 highs in a flat wave y of (II) whereas the FXB did not. I accept this as being similar to the structures a triangle wave “Y” of any degree will not surpass the peak or low of the previous wave “W” of same degree. Also in a similar fashion in running flats the last wave “C” will not take the high or low of the initial wave “A”.

It is irrelevant as to what the structure was. The momentum indicators suggested that the July 2014 high corrected the cycle from the November 2007 highs. The analysis continues below the monthly chart.

Thirdly the turn lower from the July 2014 highs appears to be an impulse lower into the October 2016 lows. That did not hardly reach equal legs of the initial wave (I) on the monthly chart. The bounce from the October 2016 lows is a double three into the April 2018 wave (IV) highs. From there it appears a wave I & II completed.

In conclusion: The instrument is currently correcting the cycle from the December 2019 highs. While below there the instrument can see some further weakness toward the 90 area & should not be lower than 87.61 considering that would make the wave (III) shortest.

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com