Forex technical analysis and forecast: Majors, equities and commodities

EUR/USD, “Euro vs US Dollar”

The currency pair has completed a corrective wave to 1.0800. Today the market continues developing a wave of decline to 1.0730. After the price reaches this level, a consolidation range could form around it. It might later extend downwards to 1.0700. Next, a corrective rise to 1.0828 could form.

GBP/USD, “Great Britain Pound vs US Dollar”

The currency pair has completed a wave of decline to 1.2355. Today the market has formed a consolidation range around this level, and an escape from it downwards suggests continuing the wave to 1.2315. After the price reaches this level, a link of correction to 1.2355 could form.

USD/JPY, “US Dollar vs Japanese Yen”

The currency pair formed a consolidation range around 138.65 and completed a structure of growth to 139.65, breaking the range upwards. Today the wave might continue to 139.85. Next, a correction could start to 138.65.

USD/CHF, “US Dollar vs Swiss Franc”

The currency pair has completed a wave of growth to 0.9062. Today the market is forming a consolidation range around this level. A link of growth to 0.9085 is not excluded. Next, a corrective decline to 0.9022 could follow. And after the correction will be over, the trend could continue to 0.9111.

AUD/USD, “Australian Dollar vs US Dollar”

The currency pair has completed a wave of decline to 0.6534. Today the market is consolidating around this level. With an escape from the range downwards, the wave could continue to 0.6480. With an escape upwards, a corrective link to 0.6571 could develop. Next, a decline to 0.6480 is expected.

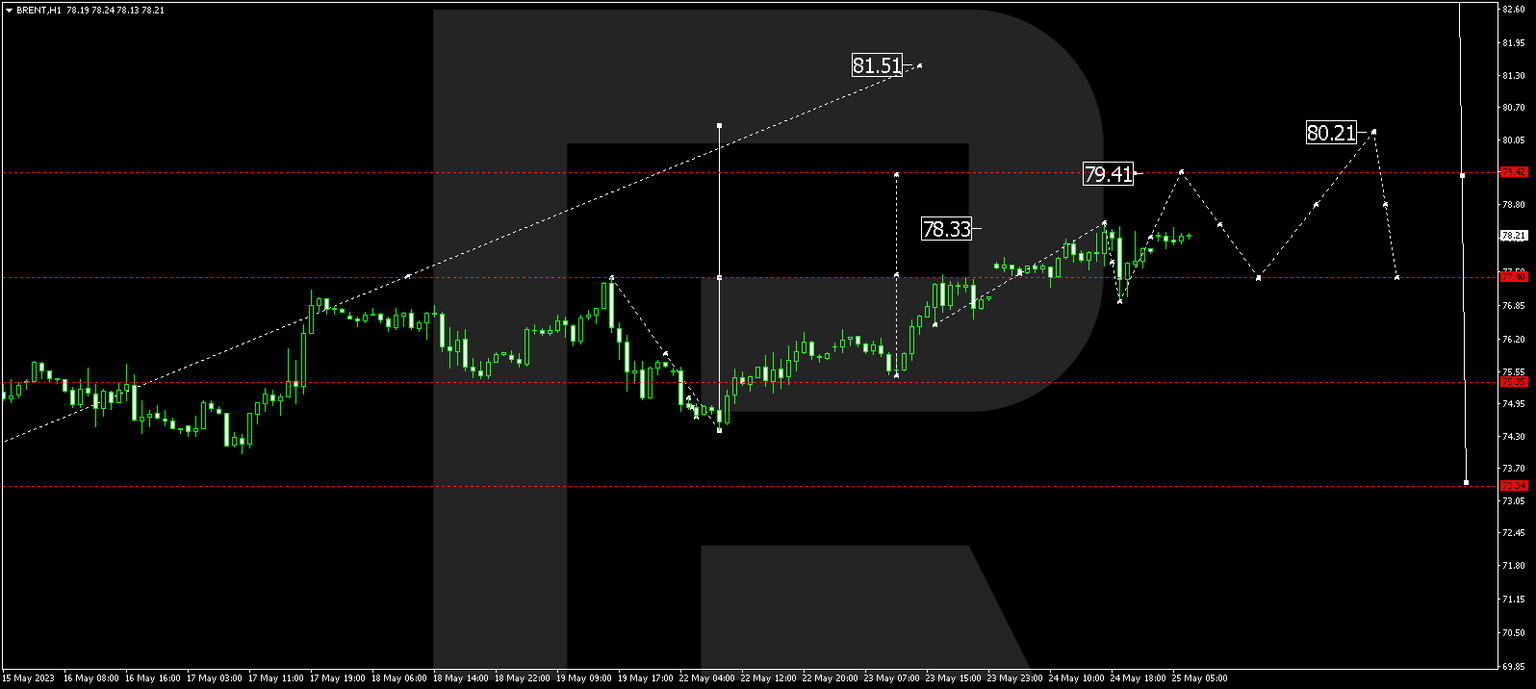

Brent

Brent has completed a wave of growth to 78.46 and a correction to 77.00. The market is forming a structure of growth to 79.40 today. This is a local target. After the price reaches this level, a correction to 77.40 could start. Next, a new wave of growth to 80.20 might begin.

XAU/USD, “Gold vs US Dollar”

Gold has completed a wave of growth to 1984.00. Today the market continues developing a new wave of decline to 1945.75. After the price reaches this level, a correction to 1964.00 could begin.

S&P 500

The stock index has completed a wave of decline to 4106.0. Today the market is forming a consolidation range above this level. With an escape from the range upwards, a link of correction to 4160.0 could develop. With an escape downwards, the wave of decline might develop to 4050.0.

Author

RoboForex Team

RoboForex

RoboForex Team is a group of professional financial experts with high experience on financial market, whose main purpose is to provide traders with quality and up-to-date market information.