Forex technical analysis and forecast: Majors, equities and commodities

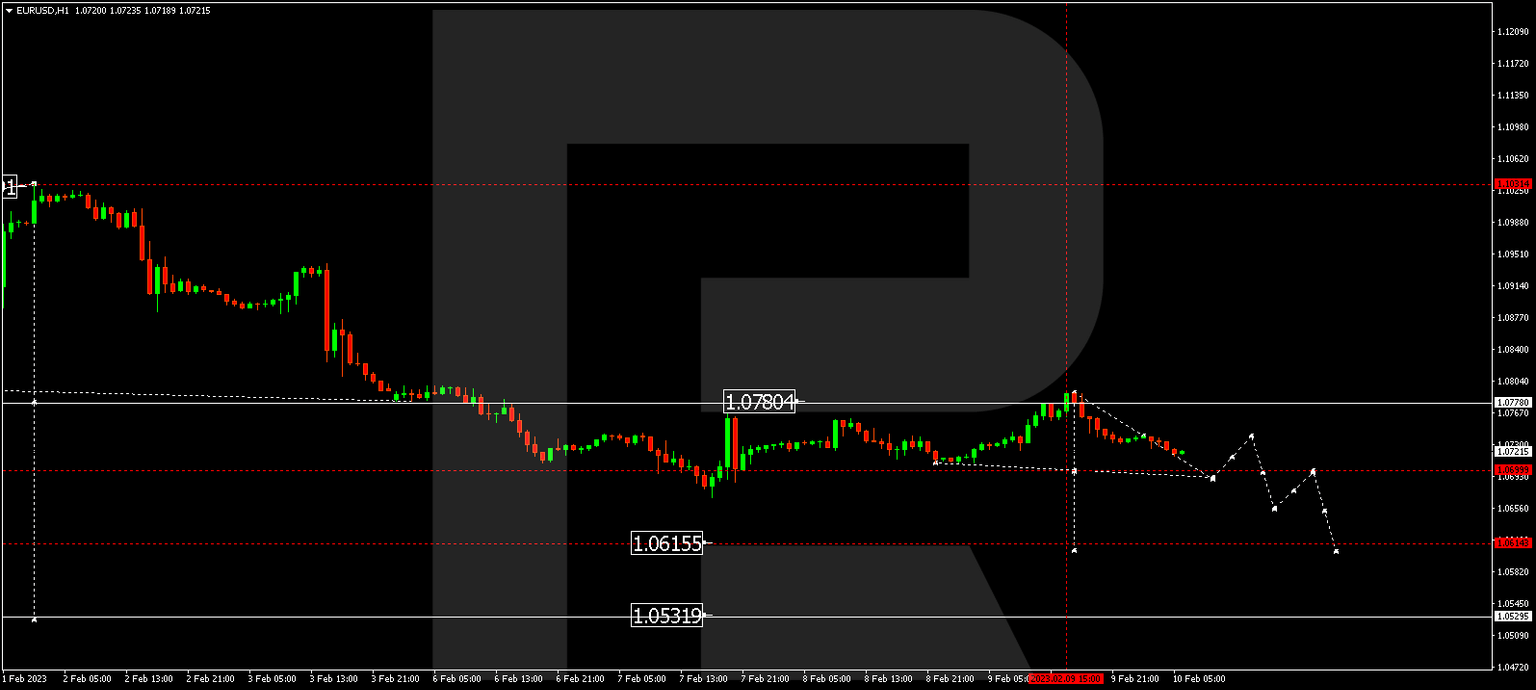

EUR/USD, “Euro vs US Dollar”

The currency pair has completed a correction to 1.0790. Today the market is developing a new structure of decline. A link of decline to 1.0690 is expected, followed by growth to 1.0740 and a decline to 1.0655, from where the wave might extend to 1.0610. The goal is local.

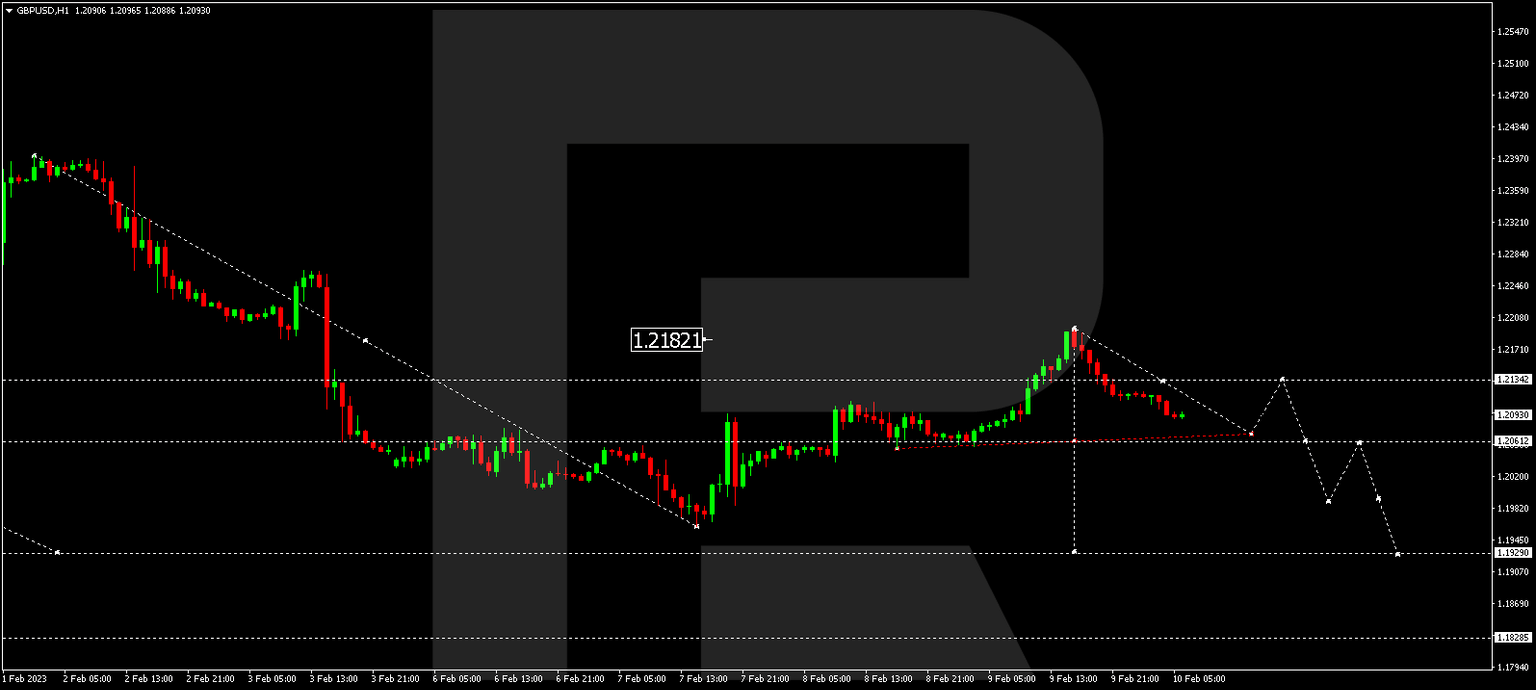

GBP/USD, “Great Britain Pound vs US Dollar”

The currency pair has completed a wave of correction to 1.2193. Today the market continues developing a structure of decline to 1.2062. Then a link of growth to 1.2134 and a decline to 1.1990 should follow, from where the wave might continue to 1.1930. The goal is local.

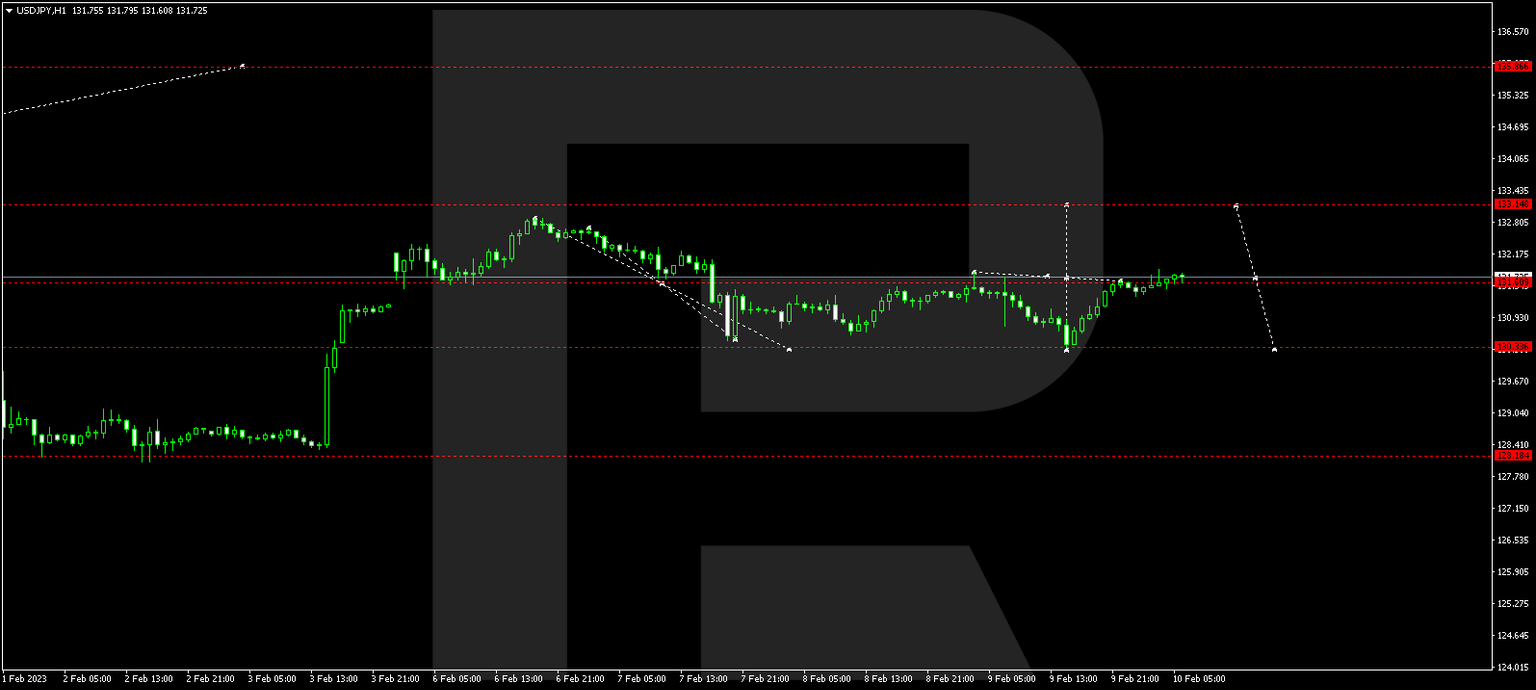

USD/JPY, “US Dollar vs Japanese Yen”

The currency pair has completed a correction at 130.33. Today the market is forming a link of growth to 133.15. After this level is reached, a link of decline to 131.50 should follow.

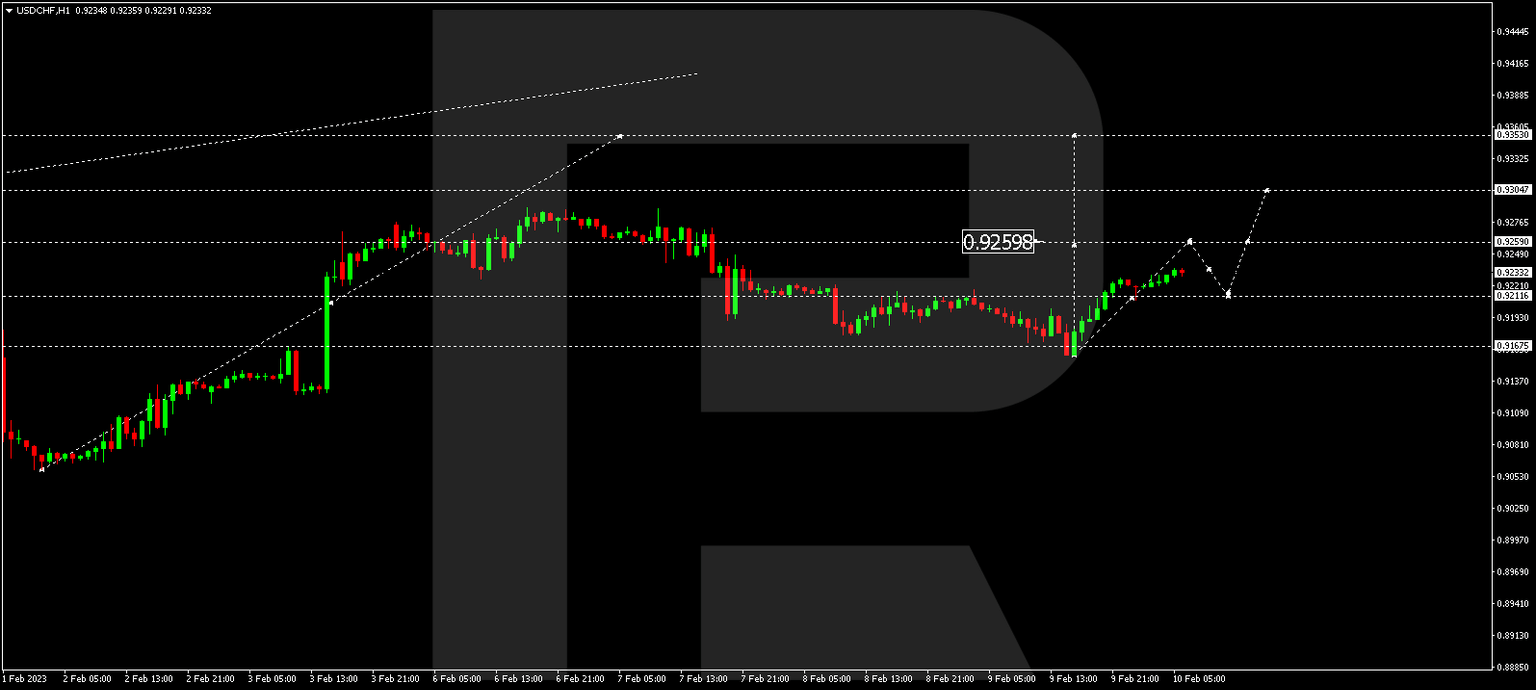

USD/CHF, “US Dollar vs Swiss Franc”

The currency pair has completed a correction at 0.9166. Today a link of growth to 0.9260 is forming. Then a decline to 0.9211 and growth to 0.9305 should follow, from where the wave might extend to 0.9355.

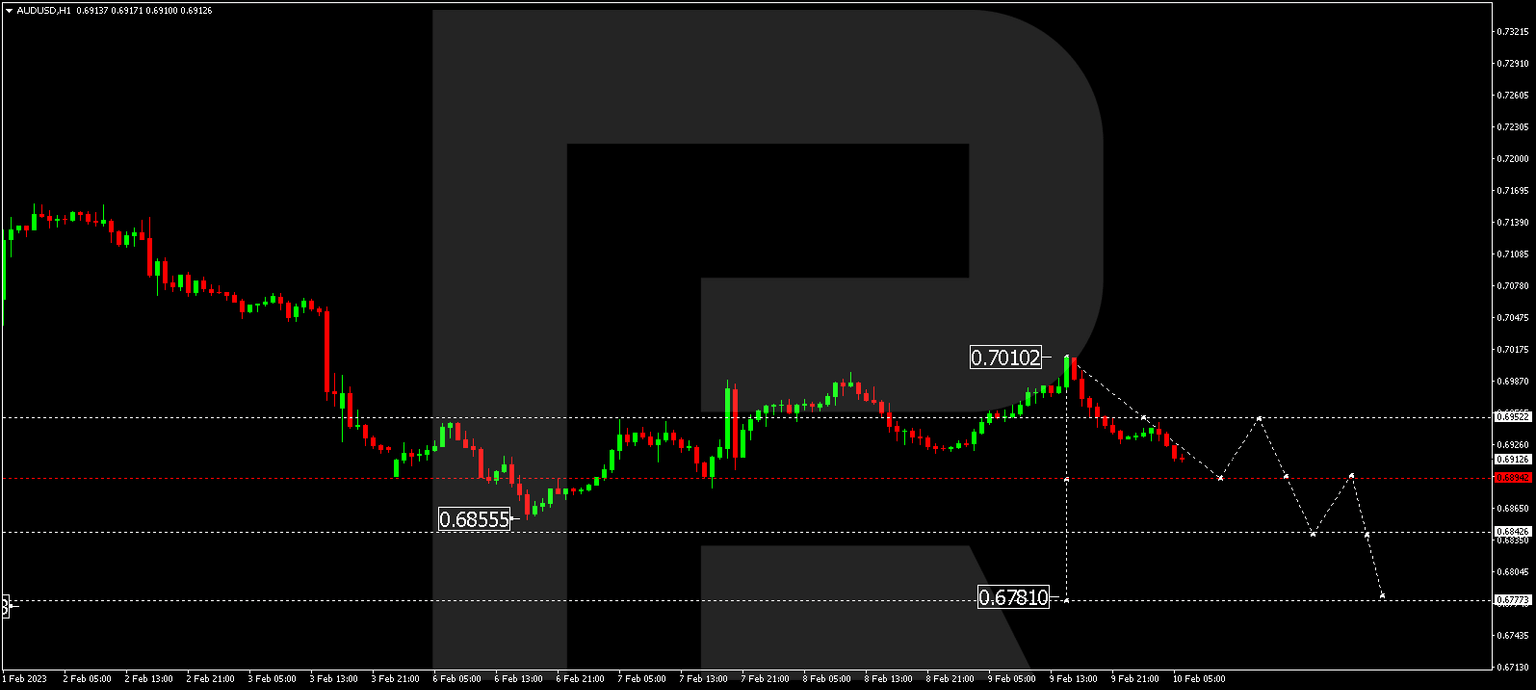

AUD/USD, “Australian Dollar vs US Dollar”

The currency pair has completed a correction to 0.7010. Today a structure of decline to 0.6894 is forming. Then growth to 0.6952 and a decline to 0.6843 should follow, from where the wave might continue to 0.6781.

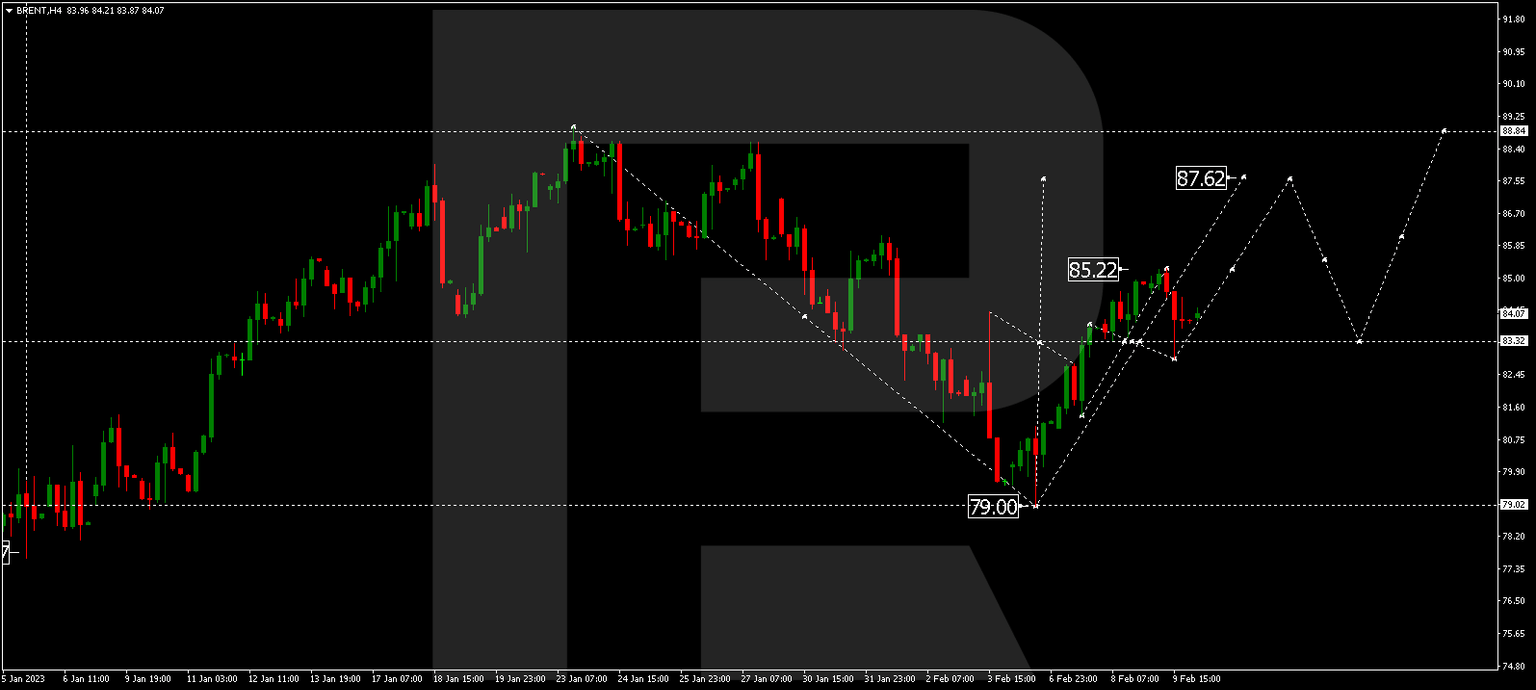

Brent

Brent has completed a link of growth to 85.22 and a link of decline to 83.30. Practically, a new consolidation range has appeared around 83.30. A new structure of growth to 87.62 is expected to develop. The goal is first.

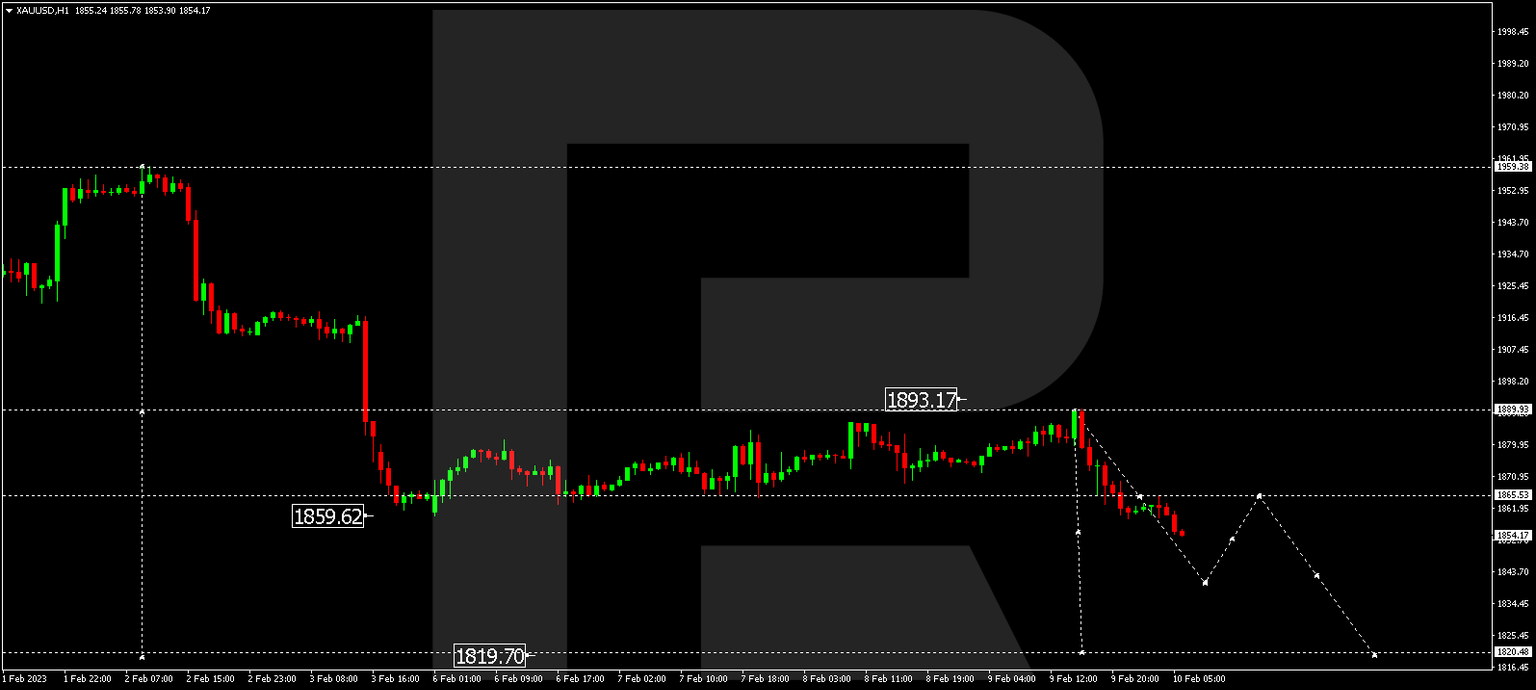

XAU/USD, “Gold vs US Dollar”

Gold has completed a correction at 1889.99. Today the market is forming a link of decline to 1840.80. Then a link of growth to 1865.55 and a decline to 1819.70 should follow.

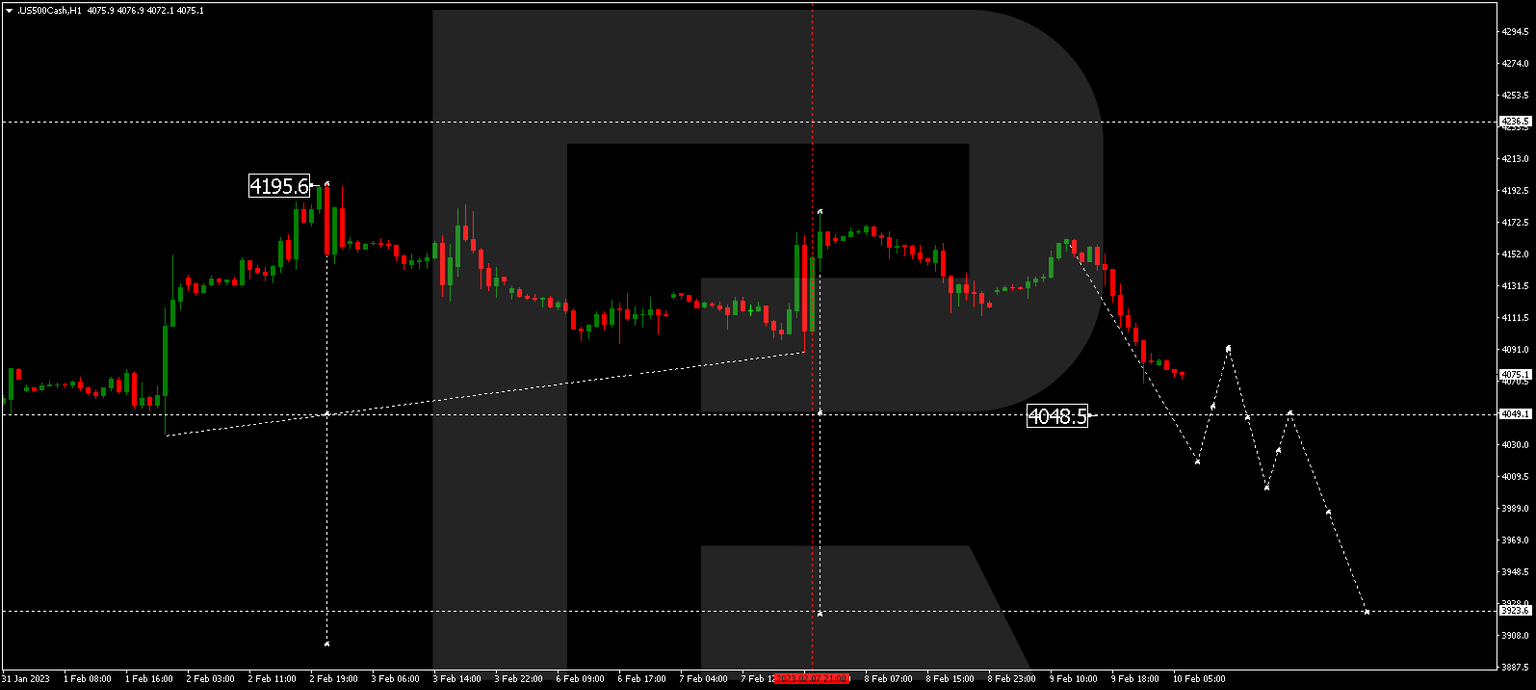

S&P 500

The stock index continues forming a structure of decline to 4050.0. After this level is reached, a new consolidation range should form around this level. With an escape downwards, the wave of decline should continue to 3923.5, from where it might continue to 3903.0. The goal is local.

Author

RoboForex Team

RoboForex

RoboForex Team is a group of professional financial experts with high experience on financial market, whose main purpose is to provide traders with quality and up-to-date market information.