Forecasting the upcoming week: US inflation data takes center stage

It was a choppy week for the US Dollar (USD) Index (DXY). The Greenback tested six-week lows against a weighted basket of counter-currencies as trade wars, wobbly economic data, and geopolitical headlines weigh on the USD. Greenback bids pushed the DXY back to where it started the week, but the US Dollar remains notably soft through 2025, down nearly 10% from the year’s peaks above 110.00 set in early January.

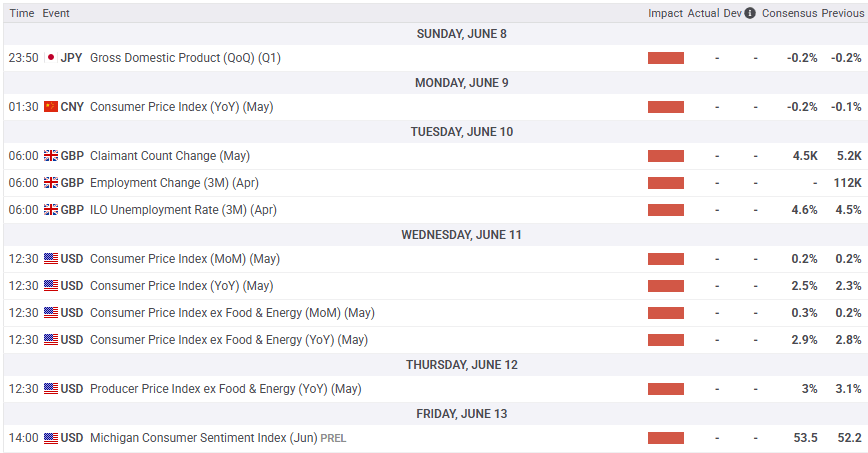

The Greenback heads into a tense week that will prominently feature US Consumer Price Index (CPI) inflation data, and the Dollar Index is struggling to keep its head above the 99.00 handle. Headline CPI inflation figures for May are slated to print next Wednesday. Investors will be pivoting to face the first batch of inflation data, which will include initial price volatility stemming from the Trump administration’s ever-changing tariff moves in April. Annualized headline CPI inflation is expected to rise to 2.5% YoY from 2.3%, and core CPI inflation measures are forecast to tick up to 2.9% from 2.8%.

EUR/USD heads into a quiet week on the European side of the economic data docket; European Central Bank (ECB) President Christine Lagarde continues to beat back rate cut expectations, and Euro-centric economic events are limited through next week. ECB head Lagarde has been known to adjust the rhetoric of policy statements if market reactions leave policymakers dissatisfied, and Lagarde firmly slammed the door on a will-they-won’t-they July rate cut after EU growth clocked in at 0.6%.

GBP/USD continues to drift into the high side. However, Cable bulls remain unable to push the Pound Sterling back above 1.3600 against the US Dollar. UK labor and unemployment figures will be released next Tuesday, and the ILO rolling three-month Unemployment Rate is expected to tick higher to 4.6% from 4.5%, which could introduce a fresh bout of GBP softness as long positioning continues to lean into overextended territory.

AUD/USD continues to settle into a choppy range as bids bump against the ceiling near 0.6500. Australian economic data is strictly mid- to low-tier next week, though Aussie (AUD) traders could be exposed to knock-on effects from an update to Chinese Consumer Price Index (CPI) inflation figures due early next week. China’s May CPI print is expected to deepen a soft contraction, and is forecast to print at -0.2% versus the previous -0.1%.

Key macro events this week:

Economic Indicator

Consumer Price Index ex Food & Energy (YoY)

Inflationary or deflationary tendencies are measured by periodically summing the prices of a basket of representative goods and services and presenting the data as the Consumer Price Index (CPI). CPI data is compiled on a monthly basis and released by the US Department of Labor Statistics. The YoY reading compares the prices of goods in the reference month to the same month a year earlier. The CPI Ex Food & Energy excludes the so-called more volatile food and energy components to give a more accurate measurement of price pressures. Generally speaking, a high reading is bullish for the US Dollar (USD), while a low reading is seen as bearish.

Read more.Next release: Wed Jun 11, 2025 12:30

Frequency: Monthly

Consensus: 2.9%

Previous: 2.8%

Source: US Bureau of Labor Statistics

The US Federal Reserve has a dual mandate of maintaining price stability and maximum employment. According to such mandate, inflation should be at around 2% YoY and has become the weakest pillar of the central bank’s directive ever since the world suffered a pandemic, which extends to these days. Price pressures keep rising amid supply-chain issues and bottlenecks, with the Consumer Price Index (CPI) hanging at multi-decade highs. The Fed has already taken measures to tame inflation and is expected to maintain an aggressive stance in the foreseeable future.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.